As secondary battery-related stocks show strong performance, domestic secondary battery-related exchange-traded funds (ETFs) are also rising accordingly.

According to the Korea Exchange on the 19th, as the stock prices of secondary battery-related companies surged, ETFs that include these companies also soared.

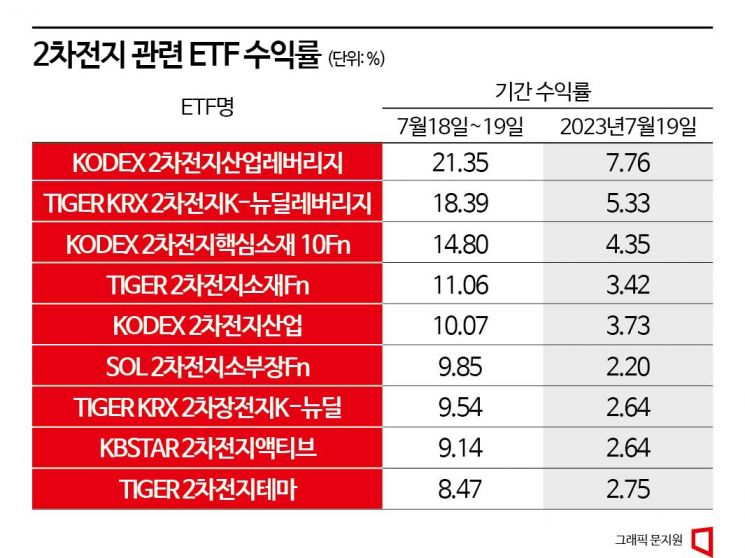

KODEX Secondary Battery Industry Leverage surged 21.35% over two days from the 18th to the 19th. During the same period, TIGER KRX Secondary Battery K-New Deal Leverage rose 18.39%, KODEX Secondary Battery Core Materials 10 Fn increased 14.8%, and TIGER Secondary Battery Materials Fn went up 11.06%.

Following these, KODEX Secondary Battery Industry (10.07%), SOL Secondary Battery Materials Fn (9.85%), TIGER KRX Secondary Battery K-New Deal (9.54%), KBSTAR Secondary Battery Active (9.14%), and TIGER Secondary Battery Theme (8.47%) also showed upward trends.

It is interpreted that the recent market expectations for the secondary battery business have grown, leading to rising stock prices of related stocks and ETFs. EcoPro, the leading secondary battery material stock, surpassed 1.1 million KRW during the trading session, claiming the position of a top-tier stock. Secondary battery theme stocks are rising regardless of whether they are listed on KOSPI or KOSDAQ.

An official from the financial investment industry said, "Related stocks such as LG Energy Solution, POSCO Holdings, and POSCO Future M are showing strong performance, and the strength of U.S. electric vehicle-related stocks has further fueled investor sentiment."

While the order momentum in the first half of the year was centered on cathode materials, the second half is expected to be a period when many materials, including separators as well as cathode materials, will enter into full-scale contracts, leading to expectations that the stock price increase in the secondary battery sector will be greater than in the first half.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.