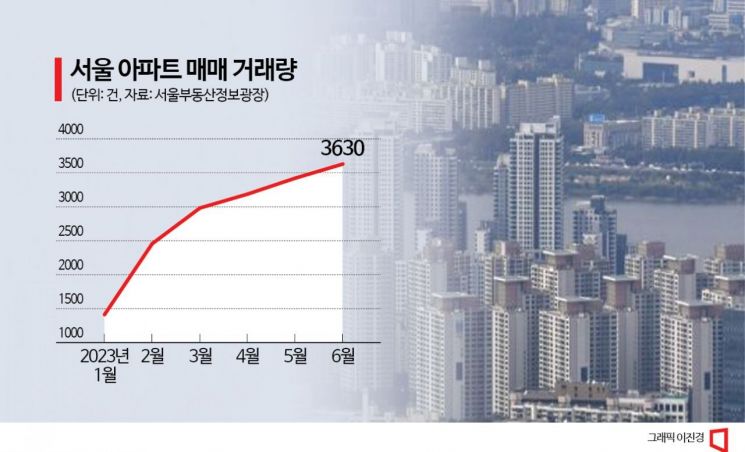

36,30 Cases in June... Surpassing 3,000 Cases for 3 Consecutive Months

Bottoming Theory of House Prices, Buying Sentiment Rises with Subscription Boom

"Possibility of Loan Interest Rate Increase... Difficult for Transaction Volume to Explode"

The volume of apartment transactions in Seoul in June is on track to surpass 4,000 units for the first time in 1 year and 10 months. As the 'house price bottom theory' spreads mainly in the Gangnam area and the subscription market thrives despite high pre-sale prices, buyer sentiment is stirring. The atmosphere is such that record-high prices exceeding those of 2021, when the real estate market was hot, are emerging one after another.

According to the Seoul Real Estate Information Plaza on the 20th, the volume of apartment sales transactions in Seoul in June is recorded at 3,630 units. This marks over 3,000 units for three consecutive months following ▲3,187 units in April and ▲3,422 units in May. Since the reporting deadline for June transactions is until the end of July, with more than ten days remaining, surpassing 4,000 units also seems possible. The last time monthly transaction volume exceeded 4,000 units was in August 2021 (4,065 units).

Even in the first quarter of this year, when the transaction cliff was gradually resolving, few experts anticipated such a rapid turnaround. Many expected that once low-priced, high-quality urgent sales were exhausted, transactions might decline again. However, as transaction volume steadily increased and rebound transactions surged mainly in the Gangnam area, the house price bottom theory is gaining traction. Moreover, with the subscription market becoming more competitive, buyer sentiment is fluctuating, driving the increase in transaction volume.

Evidence supporting the Seoul house price bottom theory is also reflected in statistical figures. According to the Korea Real Estate Board, the Seoul apartment actual transaction price index in May rose by 1.43% compared to one month earlier, marking five consecutive months of increase. An increase in the actual transaction price index means that the number of transactions sold at prices higher than the most recent previous transactions has increased.

In particular, the southeastern area, which includes Gangnam, Seocho, Songpa, and Gangdong districts, has led the turnaround by recording a 2% range fluctuation rate for four consecutive months. In fact, in this area, record-high prices occasionally exceed those of 2021, when the real estate market was hot, especially for large-sized units. A 164.97㎡ (exclusive area) unit in Tower Palace, Dogok-dong, Gangnam-gu, Seoul, was traded last month at 4.85 billion KRW, setting a new record. This is 650 million KRW higher than the 4.2 billion KRW recorded in September 2021 and 400 million KRW higher than the previous transaction price of 4.45 billion KRW in April. In the nearby Dogok Rexle, a 134.9㎡ unit was also sold this month at 4.35 billion KRW, matching the record price set in 2021. Similarly, a 117.12㎡ unit in Raemian Prestige, Banpo-dong, Seocho-gu, Seoul, was traded last month at 5.05 billion KRW, the highest price ever recorded. This is 800 million KRW higher than the 4.25 billion KRW recorded in November 2021.

Yeokyung Hee, Senior Researcher at Real Estate R114, said, "Seoul has abundant housing demand waiting in the wings, and as the perception that prices have bottomed out expands and subscription market conditions improve, transaction volume is increasing. Especially in the Gangnam area, financially capable buyers are entering large-sized units and setting new record prices." However, she added, "Since there is still room for interest rate hikes on loans, it seems difficult for Seoul's transaction volume to increase explosively."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.