Legalization Path Opens for Illegal Sticker Token Securities Trading

Obstacles Include Separation of Issuance and Distribution, Investment Limits for General Investors

Subordinate Legislation Expected to Contain Conflicting Interests... Difficulties Anticipated Until Implementation

Legislative amendments to legalize the issuance of 'Security Token Offering (STO),' which is gaining attention as a new growth area in the financial investment industry, are set to be actively pursued. Tokens that were already being traded in the market had previously been labeled as 'illegal,' but now a path to legalization has opened. However, to expedite the passage of the bill, detailed provisions where stakeholders have differing opinions will be included in subordinate legislation, so some difficulties are expected before the system is fully implemented.

According to the office of Yoon Chang-hyun, a member of the National Assembly's Political Affairs Committee from the People Power Party, and the Financial Services Commission, amendments to the Electronic Securities Act and the Capital Markets Act to allow STO are expected to be proposed within this month. This is part of the Yoon Suk-yeol administration's key national agenda item, 'Digital Financial Innovation.' Based on discussions among the government, private sector, and academia, Yoon, who serves as the chairman of the People Power Party's Special Committee on Digital Assets, will be the main proposer. Once the issuance and distribution of security tokens, which operate based on blockchain technology, are permitted, so-called 'fractional investment'?investing by dividing various types of assets much more diversely than traditional stocks (equity securities)?is expected to become legally possible. On the 13th, Yoon hosted a related legislative public hearing and emphasized, "Citibank in the U.S. estimates the STO market size will grow to $5 trillion (about 6,300 trillion KRW) by 2030," adding, "Our country should take a proactive role as a leader, not a follower, by establishing and settling the system so that it becomes an international standard."

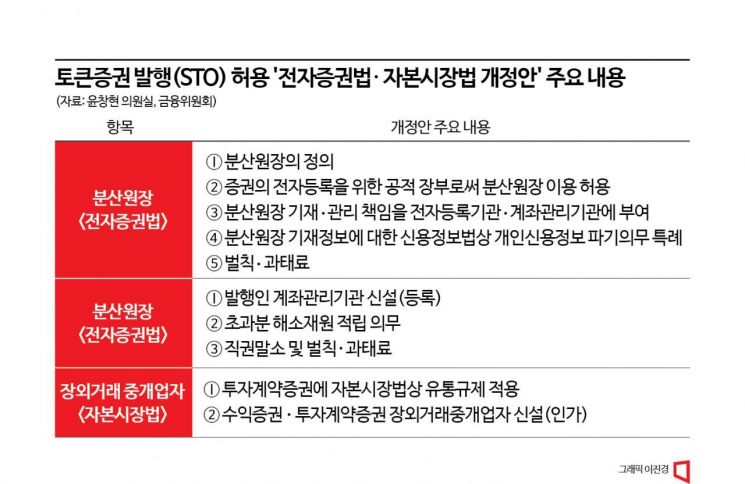

One of the key points of the proposed legal amendments revealed at the public hearing is to explicitly allow the core underlying technology of security tokens, the 'distributed ledger' technology, in the law. This pertains to the method of trading securities. In the past, securities traders received physical certificates (certificated securities) to transfer rights. Only those holding the certificates were recognized as the rights holders. Later, with the transition to electronic securities, an electronic registration ledger recording transaction information became necessary, and currently, financial institutions including securities firms centrally record and manage this ledger. Going forward, even entities other than financial firms will be able to record and manage security token transaction histories on blockchain-based distributed ledgers, which will be legally recognized as valid ledgers.

The amendment to the Electronic Securities Act also includes the establishment of an 'issuer account management institution (registration system)' that allows issuers to directly record and manage information about their self-issued securities on the distributed ledger. This means that security issuers can also manage accounts themselves. For example, currently, shares issued by Samsung Electronics are not managed directly by Samsung Electronics but are traded through securities firm accounts, which manage those accounts. In contrast, security tokens will allow the issuing entity to manage accounts directly. However, unlike general financial institutions, the use of distributed ledgers will be mandatory. To protect investors, separate requirements regarding capital adequacy, human and physical infrastructure, major shareholders, and related registration conditions will be established.

Additionally, the Capital Markets Act will be amended to create new over-the-counter (OTC) brokerage businesses for beneficiary certificates and investment contract securities. While OTC trading previously only allowed one-on-one (1:1) bilateral trades, multi-party OTC market brokerage will be permitted going forward. This aims to form diverse distribution markets for non-standard securities. This is regarded as an innovation in the securities issuance and distribution market.

The financial investment industry responded that the main points of the amendment revealed at the public hearing do not significantly deviate from the token securities guidelines announced by the Financial Services Commission in February. The issue lies with the enforcement decree. The ruling party and government plan to push the legislation as quickly as possible and include detailed requirements in the enforcement decree. However, the contents to be included in the enforcement decree have not yet been shared with the industry at all.

The industry has two major concerns. First, the newly established OTC brokerage business will fundamentally prohibit trading securities issued, underwritten, or arranged by the same business operator in the OTC market operated by that operator. This is the so-called 'separation of issuance and distribution principle,' with the financial authorities citing conflict of interest prevention as the main reason. However, a Financial Investment Association official said, "There is an opinion that for cases with low actual conflict of interest risk, separate supplementary measures should be prepared to allow simultaneous issuance and distribution."

Regarding this, Kim Gap-rae, senior researcher at the Korea Capital Market Institute, emphasized, "If conflict of interest issues can be controlled through internal control systems, issuance and distribution can be done simultaneously, but if control is impossible, prohibition is appropriate," adding, "This is a fundamental principle of the capital market." He further noted, "Fractional investments are basically low-priced securities with insufficient investment information. If relaxation of the separation between issuance and distribution is necessary, it should be done stepwise in stages such as issuance, underwriting, and arrangement with low conflict of interest risk. Demanding separation of issuance and distribution from the start does not align with current realities or legal principles."

The second concern is that investment limits for general investors will be imposed (by market and by item) in the OTC market. Although specific figures were not presented at the public hearing, some expect the investment limit to be 10 million KRW. This will also be specified in the enforcement decree. The financial authorities maintain that this is a measure to protect general investors from excessive high-risk investments, but there is criticism that applying limits only to investors while not restricting issuance scale is excessive regulation.

Relatedly, Hwang Hyun-il, a lawyer at Sejong Law Firm, said, "In the past, investment limits were imposed on general investors in online small-amount investment brokerage and peer-to-peer (P2P) trading businesses, but the industry did not activate as a result," suggesting, "To avoid repeating the same mistake, general investors should be allowed sufficient investment limits according to the 'principle of free investment.'"

The financial investment industry also supports expanding investment limits as much as possible for early industry development. Ryu Ji-hae, director of the Digital Asset Task Force at Mirae Asset Securities, said, "Generally, restrictions on investment products differ depending on the product (characteristics), so uniform restrictions are concerning," adding, "More reasonable regulations are needed." The Financial Investment Association is currently collecting opinions from securities firms and plans to submit them to the financial authorities soon.

Moreover, most companies entering the fractional investment business are startups, and the purpose of STO legalization itself is to diversify funding channels for ventures and startups. However, there are complaints that regulations on the newly established issuer account management institutions are excessive. The enforcement decree will specify registration requirements such as capital, personnel and physical facilities, distributed ledger, social credit, major shareholders, executives, and conflict of interest prevention systems for issuer account management institutions, which are considered excessive compared to the initial profitability of the security token business. Additionally, there are many detailed issues to be discussed during the enforcement decree formulation process, including ledger verification responsibilities due to distributed ledger technology adoption, reliability and system stability of multiple account management institutions, and personal information encryption methods.

At least there is consensus among the private sector, government, and academia on the need for swift passage of the bill. Park Sun-young, professor of economics at Dongguk University, said, "This amendment is evaluated as a very prompt response from the perspective of the global capital market and regulation," adding, "Considering that the Basic Virtual Asset Act took over five years to pass the plenary session, speed in the legislative process is important." If the bill is passed within this year at the National Assembly, it will be fully enforced one year after promulgation. Lee Soo-young, director of the Capital Markets Division at the Financial Services Commission, said, "The goal is to formalize the system before the end of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)