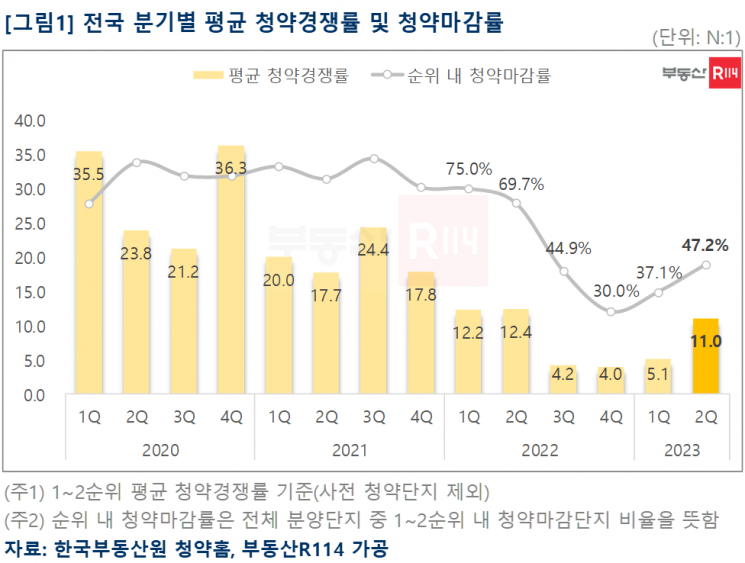

The nationwide average subscription competition rate recovered to double digits in the second quarter of this year. However, the polarization by region seems to continue.

According to Real Estate R114 on the 17th, the average subscription competition rate in the second quarter of this year recorded 11 to 1, more than doubling compared to the first quarter. The proportion of complexes that successfully closed subscriptions within the first and second priority among nationwide sale complexes was also 47.2% (25 out of 53 complexes closed), the highest since the second quarter of last year.

The rise in subscription competition rates is due to the expansion of subscription demand groups such as low-score and homeowners, influenced by regulatory easing following the 1st and 3rd measures. Additionally, as the possibility of a soft landing in the real estate market centered on the metropolitan area increased, buying sentiment in the sales market also improved. Moreover, with the prospect that the upward trend in sale prices will continue for some time due to rising labor and material costs, the perception of rushing to secure subscription opportunities spread, driving up competition rates.

However, even in the second quarter, there was a clear difference in subscription temperature by region and complex. Seoul recorded the highest average subscription competition rate nationwide at 49.5 to 1. Although the competition rate (57 to 1 in the first quarter) slightly declined due to an increase in supply dispersing demand, the concentration in Seoul continued as many subscription waiters flocked to supply complexes in redevelopment projects with favorable locations and reasonable prices. In Chungbuk, the subscription performance of the Techno Polis sale complex in Cheongju City’s public housing site was good, and in Gyeonggi and Incheon, complexes with transportation benefits such as metropolitan road plans and new GTX lines, which are expected to improve access to Seoul, had high competition rates.

On the other hand, the sales market in local areas continues to be sluggish. When looking at the subscription competition rates by housing area for sale complexes supplied in ▲Gangwon (1,152 units) ▲Daegu (34 units) ▲Ulsan (193 units) ▲Jeju (136 units) ▲Gyeongnam (45 units), the competition rates did not reach 1 to 1. The supply volume was only 1,560 units combined across the five provinces, but buying demand has not recovered.

The localized warm breeze in the subscription market is expected to continue for some time. A Real Estate R114 official said, "In the regulated areas of the Gangnam 3 districts and Yongsan district, the price ceiling system is applied, and since April, a lottery system for general supply under 85㎡ exclusive area has been implemented, so interest in the Seoul subscription market will be further concentrated." He added, "On the other hand, except for some cities supported by development benefits and demand, other local cities are not accelerating the resolution of accumulated unsold units, and as the risk of real estate PF loan defaults and delinquency rates increase and prolong, negative effects on the third quarter sales market are inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.