Growing from a Local Junk Shop to a Resource Circulation Center

Mastern Investment Management Weighs Entry into Waste Upstream Market

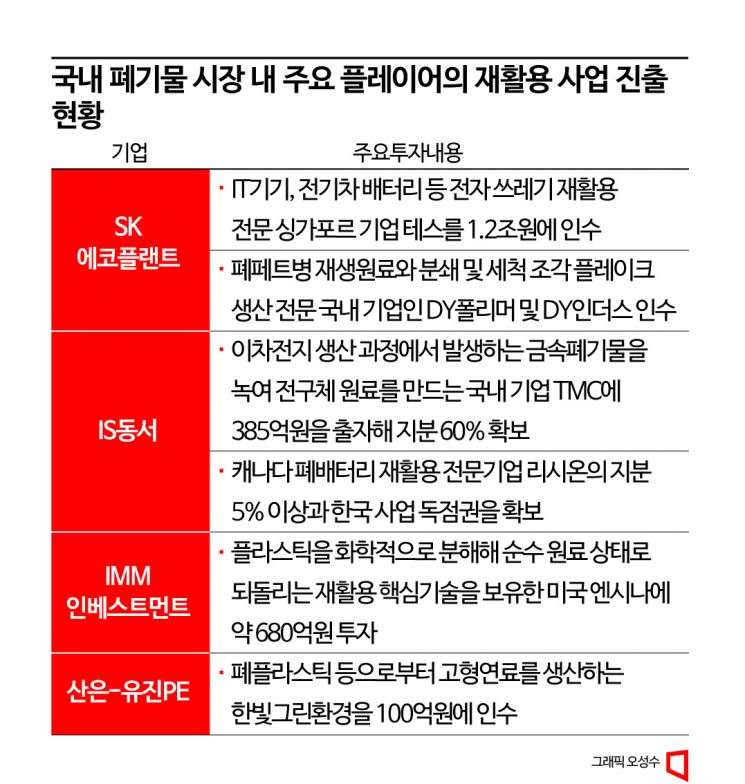

Major Corporations and Private Equity Funds Acquire or Invest in Small Waste Companies

Recently, alternative investment and private equity firms have been actively developing investment strategies for waste infrastructure. In the domestic waste market, where the major trend is shifting from landfill and incineration to recycling, key players are moving swiftly. After a period when investments in small and micro waste treatment companies were mainly led by foreign infrastructure funds and some domestic large corporations, various investment firms have begun to focus on investing in the entire upstream and downstream waste value chain, from collection and disposal to recycling.

Moving into the Waste Upstream Market... Spotlight on Recycling Business Potential

According to the financial investment industry, alternative investment specialist asset management firm Maston Investment Management is considering entering the waste upstream market. They are focusing on the potential of the recycling business beyond the downstream sector centered on incineration and landfill.

A representative from Maston Investment Management explained, "Waste treatment companies, often called junkyards, are gaining attention as new investment destinations under the name of resource circulation centers due to the growth of the recycling business linked to the climate crisis," adding, "Small-scale companies are gradually expanding in size and transforming into large-scale resource circulation centers."

Aegis Asset Management has also been reviewing investments related to waste treatment and resource circulation infrastructure since last year. These investment firms, which have mainly focused on office and commercial real estate investments, are now eyeing this sector as their next growth engine.

The waste industry is a representative licensed industry with high entry barriers. The domestic waste market became active mainly around domestic and foreign private equity (PE) firms such as Macquarie Private Equity, Apalma Capital, and E&F PE, starting with JP Morgan's acquisition of small and micro waste treatment companies scattered nationwide in 2010 to establish EMK.

PE firms have focused on the fact that most domestic waste treatment companies are small-scale and lack systematic systems, making bolt-on investments?acquiring similar or related companies to achieve economies of scale?highly effective in enhancing corporate value and improving profitability.

The waste industry has actively pursued mergers and acquisitions (M&A) because it can achieve economies of scale through vertical integration that completes the value chain from waste generation to final disposal.

After the COVID-19 pandemic, general domestic companies also began showing interest in the waste market. Strategic investments are being made based on the judgment that the linear economy of "manufacturing-consumption-disposal" can no longer be maintained amid resource wars triggered by supply instability due to rising raw material prices.

In recent years, the domestic market has expanded from the downstream industry, which mainly handles waste disposal such as incineration and landfill, to the upstream market that connects to recycling.

Strategic and Financial Investors Focus on Expanding the Value Chain

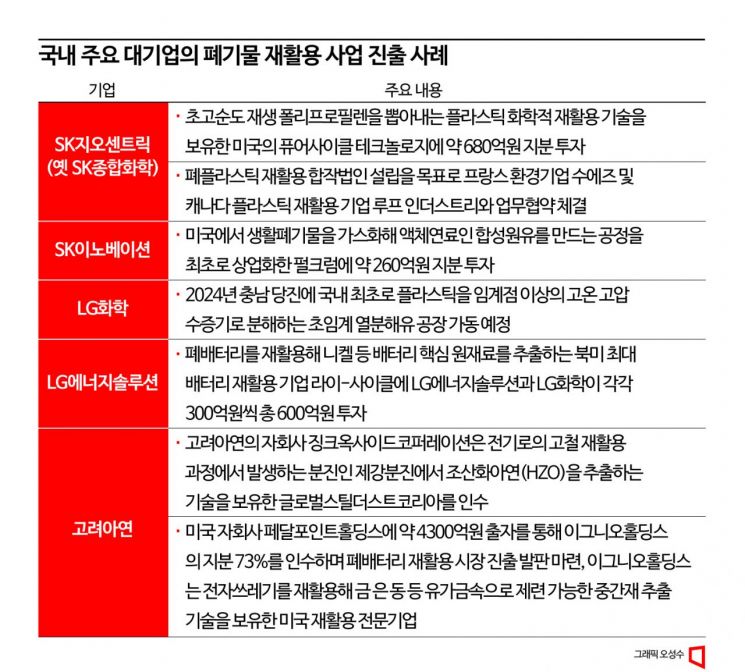

Strategic and financial investors who first entered the waste market focusing on the downstream business are now expanding their scope to recycling businesses with an emphasis on value chain expansion. Among domestic large corporations, there are also signs of attempts to enter the recycling market directly by investing in global advanced recycling specialist companies.

SK Ecoplant, which quickly acquired many domestic waste treatment companies, made a full-scale entry into the recycling market centered on global IT devices and electric vehicle batteries by acquiring TES, a Singapore-based electric and electronic waste disposal and recycling specialist, in February last year. In August of the same year, it acquired DY Polymer and DY Indus, domestic companies specializing in recycled raw materials for plastic waste, reducing dependence on imported raw materials and advancing the recycling business to secure competitiveness.

IS Dongseo entered the market by acquiring waste disposal companies such as Inseon ENT and Koentec. In April 2021, it invested in TMC, a metal waste recycling specialist, and in January 2022, secured more than 5% of shares in Lithion, a Canadian secondary battery recycling specialist, obtaining exclusive rights for the Korean business. In July of the same year, it successfully issued a green bond, one of the ESG bonds, for the purpose of recycling company M&A, investing an additional 20 billion KRW. IS Dongseo also started construction of a domestic waste battery recycling facility through its subsidiary IS SBM Solution.

Domestic PE firms are also expanding their investment scope to the entire waste treatment value chain. IMM Investment, which operated EMK, a major player in the waste M&A market in the first half of last year, invested about 68 billion KRW in Encina, a U.S. recycling company with core technology for chemical recycling of plastics.

The San-eun-Yujin PE consortium, which has focused on investing in waste disposal businesses such as medical waste treatment company DDS and liquid waste treatment company CS Eco, diversified its business by acquiring 100% of the shares of Hanbit Green Environment, a waste recycling specialist, in April last year. Hanbit Green Environment produces energy sources for steam and power generation using waste plastics and shows strengths in recycling.

Domestic Large Corporations like SK and LG Actively Enter the Recycling Market

Meanwhile, major domestic conglomerates are pursuing market entry strategies by investing in global recycling companies to secure technology or exclusive business rights. SK Geocentric invested about 68 billion KRW in PureCycle Technologies, a U.S. plastic recycling company, in March last year to expand its recycling business. SK Geocentric and PureCycle plan to establish a joint venture in Korea and build a plastic waste recycling production facility in Ulsan by the end of 2024. SK Geocentric is also collaborating with global environmental specialists such as Suez, Loop Industries, and Veolia to secure recycling technology and is pursuing various strategies to expand recycling businesses domestically and internationally, including factory establishment.

SK Innovation, focusing on the growth of the waste-to-energy market, invested 26 billion KRW in Fulcrum BioEnergy, a U.S. company, in July last year. Fulcrum is the first company in the U.S. to commercialize a process that hydrolyzes municipal solid waste to produce synthetic crude oil.

LG Chem has selected plastic recycling as a future growth engine and is advancing its business. In October two years ago, it invested in Mura Technology, a UK company with proprietary supercritical pyrolysis technology that decomposes plastics using superheated steam at high temperature and pressure beyond the critical point. Last year, it obtained the first domestic permit for a supercritical pyrolysis oil plant. Aiming to operate the plant in 2024, LG Chem recently completed a technical feasibility review with KBR, a U.S.-based global engineering and services company holding the technology license for Mura, and signed process license and engineering contracts for basic plant design. Additionally, LG Chem and LG Energy Solution each invested 30 billion KRW, totaling 60 billion KRW, in Li-Cycle, North America's largest battery recycling company, two years ago.

Korea Zinc, a non-ferrous metal smelting specialist, is focusing on securing new growth engines including resource circulation. Through its subsidiary Zinc Oxide Corporation (ZOC), which extracts zinc oxide (HZO) containing valuable metals from steelmaking dust and other steel industry waste and supplies it as raw material, it acquired Global Steel Dust Korea (GSDK), a steelmaking dust recycling specialist, in 2022. In the same year, it invested 430 billion KRW in its U.S. subsidiary Pedal Point Holdings to secure a 73% stake in Ignio Holdings, a U.S. electronic waste recycling specialist.

Looking at the status of domestic recycling companies, as of 2020, there were 6,535 companies licensed or registered for waste recycling in Korea. More than half of these are companies with five or fewer employees. Only 1.5% of companies have more than 100 employees. There are forecasts that the market will be reorganized around a very small number of large companies in the future.

Park Dohwi, senior researcher at Samjong KPMG Economic Research Institute, said, "While recycling demand is increasing day by day, many recycling companies continue to be small-scale," adding, "The domestic recycling market has just begun to emerge, and future strategies to prepare for the upcoming heyday must be actively established and implemented."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)