GS25 Ranks 2nd with Kim Hyeja Dosirak

CU Enters Top Ranks with Pepsi Zero

Yearly Hit Products Reflect the Era

Popular convenience store products serve as indicators that allow us to grasp the social landscape and trends of the year at a glance. In the past, convenience stores were merely places selling simple snacks like triangular kimbap and cup noodles, but now they have firmly established themselves as the closest distribution channel to home, with their status rising day by day.

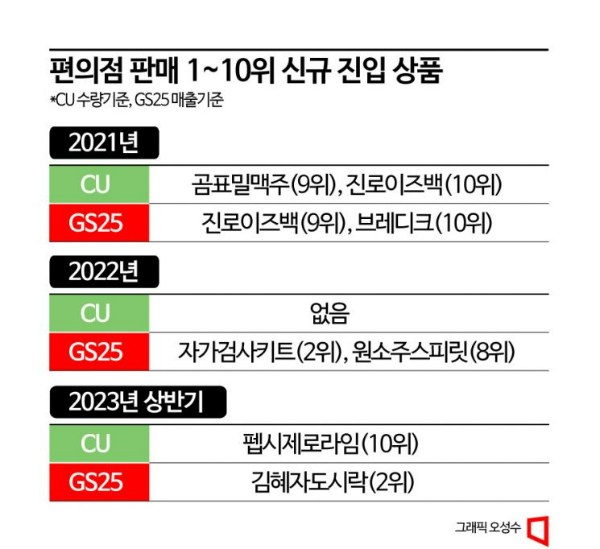

According to the convenience store industry on the 16th, the keywords for convenience stores in the first half of this year are ‘high inflation’ and ‘zero calories.’ Analyzing the top 1 to 10 popular products at GS25 from January to June this year (based on sales), Kim Hyeja Dosirak ranked 2nd. Last year, no lunchbox products were in the top 10, but this year the ranking surged. This is analyzed to be because as the burden of lunch costs increased due to the ongoing high inflation, office workers and students sought convenience store lunchboxes more. In fact, Kim Hyeja Dosirak has been practically sold out since its launch, surpassing 8 million units sold cumulatively.

At CU, Pepsi Zero Sugar Lime newly entered the top 10 at 10th place in the first half of this year. This product is receiving explosive reactions among Generation Z for its clean aftertaste and the unique freshness of lime. As a result, Pepsi, which was perceived as the perennial second place in the cola market, lowered Coca-Cola’s market share from over 90% to the 50% range by promoting Zero Sugar Lime. Originally, zero-calorie cola was evaluated to have a worse taste than existing products, but recently, the trend has changed due to advances in alternative sweeteners. Additionally, the spread of healthy pleasure, which seeks enjoyment while taking care of health, also contributed to the growth of the zero beverage market.

Professor Eunhee Lee of Inha University’s Department of Consumer Studies said, “The fact that lunchboxes and zero-calorie beverages sold well this year has social symbolic meaning. Consumers are saving on meal costs and are highly interested in dieting,” adding, “Convenience stores are attracting customers based on the convenience of location and are now recognized as places where affordable and high-quality products can be purchased, unlike in the past.”

Last year, ‘COVID-19’ and ‘distilled soju’ struck Korean society hard. At GS25, sales of self-test kits increased 500 times compared to the previous year, unusually ranking 2nd in overall sales. It seems that during the spread of COVID-19, purchases were made at convenience stores late at night or when self-test kits were urgently needed. GS25 operates various products such as Rapigen, OHC, PCL, and Wells Bio, and currently sells them at about 12,000 stores that have obtained medical device approval.

Won Soju Spirit ranked 8th, becoming a hit product. This was the first time that differentiated alcoholic beverages ranked in the top 10 sales at GS25. This product is a premium soju fermented and distilled from Totomi rice from Wonju, Gangwon Province, released in limited quantities, causing open-run sales, and is a follow-up product to Won Soju. Since its first launch, it has become a sold-out item and achieved record-breaking sales, with cumulative sales of Won Soju Spirit exceeding 5 million bottles to date.

In 2021, ‘low-alcohol beverages,’ ‘craft beer,’ and ‘premium bread’ enjoyed their heyday. In particular, Jinro Is Back ranked high at both CU and GS25, reflecting the preference for low-alcohol beverages. At that time, Hite Jinro lowered the alcohol content from the existing 16.9 degrees to 16.5 degrees. Jinro Is Back is a soju that reinterprets the Jinro soju launched in 1970 with a modern sensibility, gaining popularity by creating the new cocktail term “Tejina” (Terra + Jinro Is Back). In January this year, Jinro Is Back was revamped as Zero Sugar.

At CU, Gom Pyo Wheat Beer, which sparked the craft beer craze in convenience stores, ranked 9th. Due to the nature of craft beer produced in small-scale breweries at the initial launch, supply sometimes could not keep up with demand. At GS25, the premium bakery brand Breadique ranked 10th. This reflects the spread of a culture among young people of replacing meals with bread. Currently, Breadique operates about 30 products, with cumulative sales exceeding 45 million units.

A convenience store industry official said, “Looking at the hit products by year, we can see various trends and social conditions that were popular each year,” adding, “We will quickly respond to new trends through accumulated data on product changes, volume, and size.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)