Ants' Investment Sentiment Shifts to Bonds Amid Peak Base Rate Theory

Record 20 Trillion Won Last Year, Net Buying in Half a Year This Year

Possibility of Rate Hike Not Ruled Out...Advice to Be Cautious with Bond Investments

This year, the momentum of the 'bond ants' remains unstoppable. The record for the largest net bond purchases set last year has nearly been reached within just six months of this year. This is interpreted as investors focusing on bond investments, aiming for a twofold benefit of interest income and capital gains when interest rates fall, while anticipating the peak of interest rates. However, there is also advice to approach bond investments cautiously, as the U.S. Federal Reserve (Fed) is expected to implement additional rate hikes.

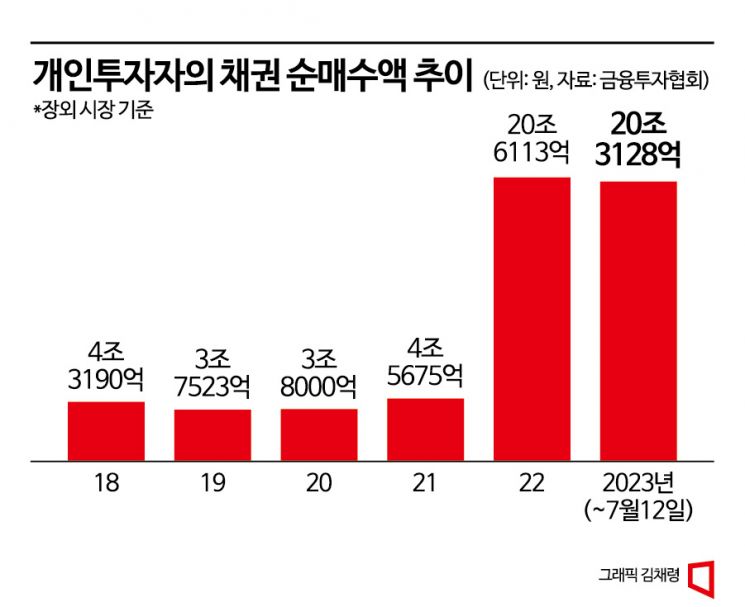

According to the Korea Financial Investment Association, as of the 12th of this month, individual investors' net bond purchases (over-the-counter basis) this year have totaled 20.3128 trillion won. This is close to last year's record high net purchase amount of 20.6113 trillion won. In effect, it is almost as if the entire net purchase amount of last year has been achieved in just half a year.

Last year, amid the U.S.-originated high interest rate trend, interest rates surged sharply and the stock market entered a slump, sparking a bond investment boom. Investors expected capital gains by purchasing bonds at lower prices due to rising interest rates and then benefiting from price increases as rate hikes concluded. The fact that bonds are considered safe assets during economic downturns also attracted individual investors. Consequently, last year recorded the largest net purchase amount ever at 20.6113 trillion won. This represents a staggering 351.26% increase compared to the total net purchases in 2021, which were 4.5675 trillion won. Previously, individual bond purchases were not significant, with amounts around 4.319 trillion won in 2018, 3.7523 trillion won in 2019, and 3.8 trillion won in 2020.

There is a consensus that the era of popularization of the domestic bond market has begun. An industry insider stated, "Bond investment, which used to be exclusive to high-net-worth individuals, became popular starting last year as interest rates rose sharply," adding, "If interest rates peak and then decline, bond investors can gain trading profits, and even when held to maturity, relatively stable returns can be earned, making bonds an attractive financial tool among individual investors."

Oh Hyun-seok, Head of Digital Asset Management at Samsung Securities, analyzed, "Bond investment has become popular among general investors from high-net-worth individuals, creating a 'snowball effect.' Individuals who started investing in bonds last year amid high interest rates are clearly reinvesting or expanding their investments this year." He added, "The baby boomer generation in their 50s and 60s is enjoying tax benefits by investing retirement funds in bonds with higher interest rates than deposits, while the 30s and 40s generation is expanding tax-saving bond investments as bond trading becomes possible in brokerage-type Individual Savings Accounts (ISA)."

This year, the safest government bonds were the most purchased by individuals, with net purchases totaling 7.3725 trillion won. Following that, corporate bonds with attractive interest rates ranked high with net purchases of 5.1412 trillion won.

Concerns Over Bond Interest Rate Volatility... Purchase Strategy Remains Valid

However, there is also advice to approach cautiously. Although the Fed held the benchmark interest rate steady for the first time in 15 months, it recently left open the possibility of additional rate hikes. Ji-young Han, a researcher at Kiwoom Securities, explained, "Market participants seem to accept a 0.25 percentage point rate hike in July as a given," adding, "Both the European Central Bank (ECB) and the Bank of England (BOE) governors have indicated they will continue hawkish policies over a long time horizon, which will pressure the Fed not to hastily stop tightening."

The Fed strongly signaled a hawkish stance to raise rates further in the second half of this year to stabilize prices, effectively forecasting additional tightening measures. Fed Chair Jerome Powell said at a press conference, "Inflationary pressures remain high," adding, "Almost all (FOMC) members believe additional rate hikes will be appropriate this year," and "No members expect rate cuts this year, and it would be inappropriate to cut rates within the year."

Nonetheless, there is no disagreement that bonds remain an attractive investment from a medium- to long-term perspective. There is also advice to use the current rising interest rate phase as an opportunity to secure high-interest bonds. Baek Yoon-min, a researcher at Kyobo Securities, predicted, "Unless external variables expand significantly, it is difficult for market interest rates to rise sharply beyond current levels," and "Although the market may feel constrained in setting direction for a while, the expectation that market interest rates will stabilize downward in the mid-term remains valid."

Ultimately, even if bond interest rate volatility increases for the time being, the strategy of buying during corrections remains valid. Gong Dong-rak, a researcher at Daishin Securities, diagnosed, "Due to the hawkish rate hold and Chair Powell's repeated intention to raise rates, bond market volatility has increased, and market interest rates have approached the upper bound of the previously maintained range," adding, "However, considering recent bond interest rate trends, the market has sufficiently absorbed the factors for additional tightening, and the strategy of buying during corrections should be maintained."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)