Despite the decline in housing prices, the sale prices of privately sold apartments are soaring to unprecedented levels. This is attributed to the combined effects of interest rate hikes, increased construction costs, and the easing of price regulations. As prices surged, the proportion of low- to mid-priced apartments priced below 600 million KRW also decreased by about 18% over the past two years.

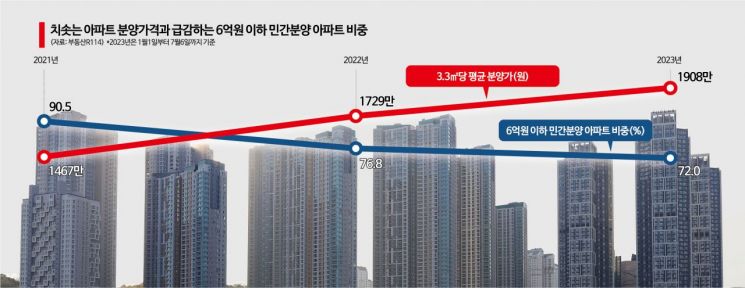

According to a survey by Real Estate R114 on the prices of privately sold apartments from the beginning of this year until the 6th, the average sale price per 3.3㎡ (based on general supply units) was recorded at 19.08 million KRW. This is nearly 2 million KRW higher than last year's 17.29 million KRW. Compared to two years ago in 2021 (14.67 million KRW), the price has surged by a whopping 30%.

In particular, as of July 4th, the nationwide average apartment sale price was 21.01 million KRW per 3.3㎡, a sharp increase of 38.3% compared to last year's average of 15.19 million KRW. Looking at the trend of average apartment sale prices nationwide this year, it fluctuated between 16 million and 18 million KRW: 17.18 million KRW in January, 17.75 million KRW in February, 16.19 million KRW in March, 16.39 million KRW in April, 18.40 million KRW in May, and 16.89 million KRW in June, marking the first time it exceeded 20 million KRW.

The most significant increase was observed in the price range of over 900 million KRW to 1.5 billion KRW. The average sale price per 3.3㎡ in this range rose by 2.77 million KRW compared to the previous year (from 26.51 million KRW to 29.28 million KRW). Following this, the price range over 1.5 billion KRW increased by 1.65 million KRW (29.89 million KRW to 31.54 million KRW), the range over 600 million KRW to 900 million KRW rose by 1.62 million KRW (21.59 million KRW to 23.21 million KRW), and the range below 600 million KRW increased by 530,000 KRW (14.23 million KRW to 14.76 million KRW).

As sale prices soared, the proportion of low- to mid-priced apartments priced below 600 million KRW also significantly declined. Until 2021, apartments priced below 600 million KRW accounted for 90.5% of all privately sold apartments, but this year, it sharply dropped to 72%.

The rise in sale prices despite the downward trend in transaction prices since last year is attributed to the lifting of the price ceiling system and increases in raw material and construction costs. The consecutive base interest rate hikes have increased financial costs, and the Russia-Ukraine war last year caused a sharp rise in prices of key materials such as rebar and cement. The Ministry of Land, Infrastructure and Transport also raised the basic construction cost under the price ceiling system by 2.64% in March compared to September last year, reflecting changes in construction material prices and labor costs.

Additionally, the easing of regulations in most areas except the Gangnam 3 districts (Gangnam, Seocho, and Songpa) due to the 1st and 3rd policy measures earlier this year has allowed for more flexible pricing, which is believed to have driven up sale prices.

Yeokyunghee, Senior Researcher at Real Estate R114, said, “As the price burden increases, selective subscription is expected to become more prominent, and interest in public sales and pre-subscription is likely to rise, especially among younger generations.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.