Started first work since 2005

Attempts at bank acquisition and listing

Declining life insurance industry... Pushed for 'survival'

"Necessary for business diversification and long-term strategy development"

Kyobo Life Insurance is putting all its efforts into the transition to a financial holding company, aiming to launch in the second half of next year. To diversify the holding company's business structure, it recently revealed plans to enter the non-life insurance sector, demonstrating its determination to realize the long-cherished goal of transitioning to a holding company after 18 years.

According to the insurance industry on the 12th, Kyobo Life Insurance announced its plan to establish a holding company last February and has been focusing on business expansion and diversification. A representative example is the incorporation of Kyobo AIM Asset Management in April. This is interpreted as a strategy to further enhance the group's capabilities in alternative investments such as real estate and infrastructure. Recently, it is reported that Kyobo Life is carefully considering various options to strengthen its non-life insurance business, including investing in Kakao Pay Non-Life Insurance shares and acquiring MG Non-Life Insurance.

Transition to a Holding Company, an 18-Year-Long Aspiration

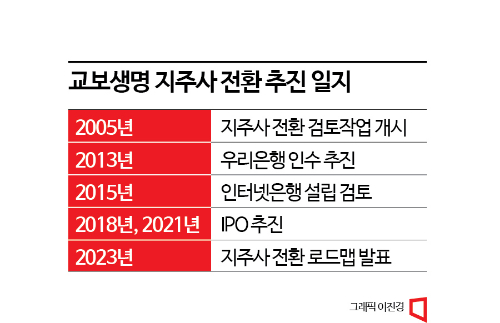

This is not Kyobo Life Insurance's first attempt to transition to a holding company. Rather, it has been a long-standing goal for about 18 years. When several financial holding companies were launched in the banking sector in 2001, Kyobo Life began reviewing the transition to a holding company from 2005. At that time, Chairman Shin Chang-jae of Kyobo Life mentioned the transition to a holding company as a key task and stated, "We are actively reviewing whether the transition to a financial holding company will benefit the company." That year, Kyobo Life started estimating the financial impact according to the method of transition to a holding company and steadily laid out the blueprint for launching a holding company by 2007 to enhance corporate value.

The first major public move was in the 2010s. Kyobo Life attempted to launch a holding company system by entering the banking business. In 2013, Kyobo Life formed a consortium on the premise of launching a holding company and attempted to acquire a 30% stake in Woori Bank, but the bid failed, and the deal did not materialize.

Attempting to establish an internet-only bank was also preparation for the holding company system. Earlier, in 2015, Kyobo Life formed a consortium with KT and Woori Bank to consider establishing an internet bank. However, due to disagreements over the shareholding ratio with KT, they decided not to participate in the internet bank establishment.

The listing efforts pursued in 2018 and 2021 are also interpreted as intermediate steps toward becoming a financial holding company. Kyobo Life has been promoting an initial public offering (IPO) to diversify capital procurement methods in preparation for the newly introduced accounting standard 'IFRS17' and the new solvency regime (K-ICS) this year, and to lay the foundation for the holding company transition in the long term. However, the listing process has been continuously delayed due to ongoing litigation with the Affinity Consortium, which opposes it. As a result, Kyobo Life has shifted to prioritizing the holding company transition first.

Stagnant Life Insurance Industry... Transition to a Holding Company for 'Survival'

Kyobo Life Insurance views the transition to a financial holding company as a breakthrough amid the stagnation of the life insurance industry. It judged that the current life insurance-centered governance structure has limitations in establishing and implementing the group's long-term growth strategy due to various regulatory constraints.

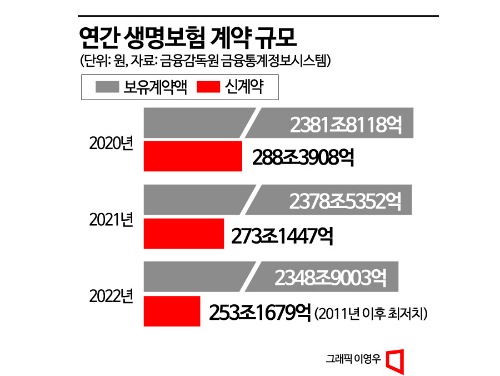

In fact, the life insurance industry's business conditions are worsening. According to disclosures by the Life Insurance Association, as of the end of last year, the total amount of contracts held by life insurers was KRW 2,348.9003 trillion (general account basis), a decrease of KRW 29.6349 trillion (1.2%) over one year. This marks the third consecutive year of decline since 2020. The number of new life insurance subscribers is also decreasing. Last year's new contract amount was KRW 253.1679 trillion, a sharp drop of KRW 19.9768 trillion (7.3%) compared to the previous year. This is the second consecutive year of decline. The annual new contract amount has shrunk to the lowest level since 2010 (KRW 233.5986 trillion). This is why voices calling for life insurers to fundamentally improve their structure and urgently find new growth engines are growing louder.

For Kyobo Life Insurance, the transition to a holding company is considered the biggest task to increase corporate value, but many hurdles remain. In particular, obtaining the consent of the Affinity Consortium, which holds a 24% stake in Kyobo Life, is essential. It is known that Kyobo Life is currently negotiating with the Affinity side behind the scenes. There is cautious speculation that a positive response from the Affinity side may come. If Kyobo Life's corporate value rises by securing a diverse business portfolio through the holding company transition, financial investors (FIs) will also be able to recover their investment at a higher price.

A Kyobo Life Insurance official said, "There is a need for a new corporate governance structure that can establish and implement group growth strategies from a long-term perspective, moving away from the current life-centered governance structure," adding, "We will expand the business base from the existing life insurance focus to various non-insurance areas and lay the foundation for the group's sustainable growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.