Won-Yen Exchange Rate Falls Below 900 Won for the First Time in 8 Years

In the Past, Weak Yen Negatively Affected Korean Exports

Hyundai Motor Group Ranks 4th in US Sales in First Half of This Year

Toyota US Sales Decline, Honda and Nissan Fall Outside Top 5

Korean Product Competitiveness Rises, Exchange Rate Impact Minimal

There is an analysis that South Korea's automobile exports have become free from the influence of the 'Yen depreciation (円低, weak yen)'. In the past, the weak yen was a negative factor for automobile exports. However, as Korean cars compete in export markets based on quality rather than price, the impact of exchange rates has become minimal.

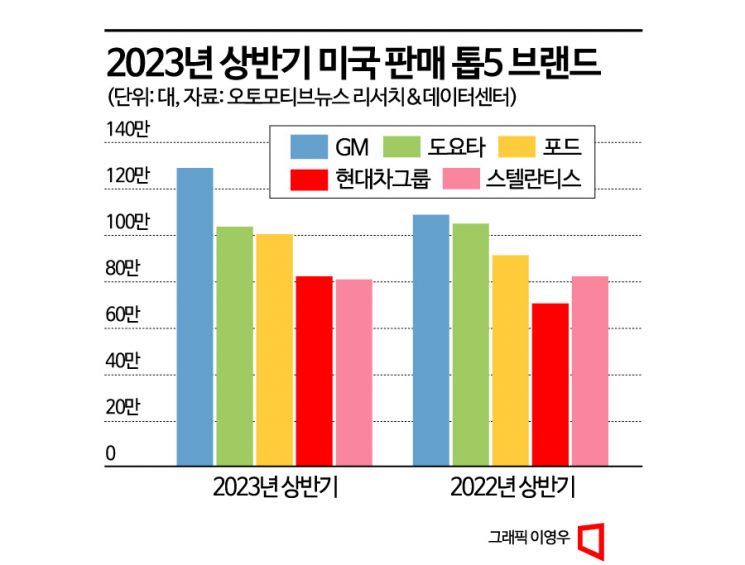

According to data released by each company on the 11th, Hyundai Motor Company and Kia sold 820,180 units in the United States in the first half of this year, a 17% increase compared to the previous year. This marks the first time they have ranked 4th in the first half of the year. If this trend continues, it is expected that they could achieve the 4th place for the entire year for the first time in history.

During the same period, Toyota sold 1,038,520 units, a 0.7% decrease, losing the top spot in first-half sales rankings in the U.S. to GM for the second consecutive year. If Toyota fails to recover sales in the second half, it may not be able to continue its record of '11 consecutive years as the top annual seller' in the U.S.

In the past, it was widely believed that when the yen's value dropped, domestic car exports also decreased. During the peak of the rapid yen depreciation caused by Abenomics in 2013, there was an analysis that a 1% drop in the yen's value led to a 0.96% (10,000 units) decrease in Hyundai's exports.

In the first half of this year, the average won-yen fiscal exchange rate was 961.47 won per 100 yen, marking the lowest level in eight years since the second half of 2015 (954.92 won). On the 5th, the daily closing rate fell below 900 won for the first time in eight years, reaching 897.29 won.

However, domestic car exports remain robust. Hyundai and Kia achieved double-digit sales growth in the U.S. market, where they directly compete with Japanese brands, in the first half of this year. Among the top five companies in the U.S. market, the only imported car brands are Toyota and Hyundai-Kia. GM and Ford are American brands, and Stellantis also includes some American brands under its umbrella.

Between 2012 and 2015, when the effects of Abenomics were fully realized, the sharp decline in the yen's value had some impact on the export market. During the first half of those years, Hyundai and Kia were blocked by Japanese brands such as Honda and Nissan and failed to enter the top five in the U.S. market.

However, this year the situation is different. Even during the same 'weak yen' period, the product quality and brand value of Korean cars have improved. Especially in the electric vehicle market, they are overwhelming Japanese cars. In the first half of this year, Hyundai's Ioniq 5 and Kia's EV6 were included in the top 10 best-selling electric vehicles in the U.S. Among brands with two or more models in the top 10, Hyundai Motor Group is the only one besides Tesla. There are no Japanese cars in the top 10.

Experts view the impact of yen depreciation on South Korea's exports as limited. Moreover, between 2012 and 2015, while the yen weakened against the dollar, the won was strong, causing the won-yen exchange rate to drop more steeply (yen depreciation against the won). Recently, both the yen and won have weakened against the dollar simultaneously, leading to analyses that the impact of yen depreciation is not as significant as before.

Also, looking at the dollar-denominated export price index, South Korea has a competitive advantage over Japan. The dollar-denominated export price index reflects the actual price perceived by U.S. buyers when purchasing imported products in the U.S. Since 2022, South Korea's export price index has declined more steeply than Japan's. Although Japan tried to lower export prices by weakening the yen, Korean products of equivalent quality were sold at lower prices in overseas markets.

Aluminum, a major raw material for automobiles, was priced at $2,703 per ton in 2022, rising 58% over the past two years. During the same period, the yen depreciated 28% against the dollar, while the won fell only 16%. From the perspective of Japanese companies, raw material prices increased by 1.5 times, and the payment currency, the dollar, also became more expensive. Consequently, they had no choice but to reflect this in export prices, raising the price of vehicles exported to the U.S. Korean companies were also affected by rising raw material prices but experienced less impact from exchange rates than Japan. This is why Korean companies were able to keep export prices lower than Japan over the past two years.

Kang Min-seok, a researcher at Kyobo Securities, said, "The era when Japanese companies gained price competitiveness due to the weak yen is over. Moreover, since the export target markets and consumer bases of Korean and Japanese automakers differ, the impact of yen depreciation on exports is even more limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)