11 Insurance Companies Show Strong Overseas Performance

Net Profit Increases While Assets Decrease

"Aggressively Targeting Emerging Markets"

Last year, insurance companies' net profits from overseas branches nearly reached 160 billion KRW. This is attributed to increased sales due to the easing of COVID-19 and improved performance in real estate leasing businesses.

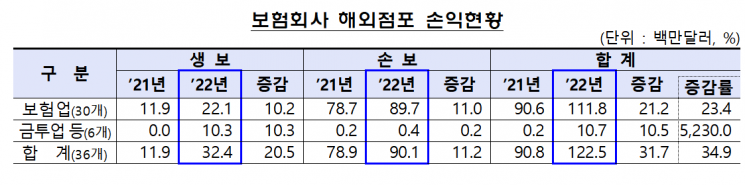

According to the Financial Supervisory Service's announcement on the 11th, 11 insurance companies (4 life insurers and 7 non-life insurers) operating 39 overseas branches in 11 countries recorded a net profit of 123 million USD (approximately 158.2 billion KRW) last year. This represents a 34.9% (31.7 million USD) increase compared to the previous year-end.

This is interpreted as a result of increased sales in the Asian region and reduced losses in the European region as the COVID-19 situation eased in the insurance industry. They earned 112 million USD in profit from insurance operations alone, and thanks to improved performance of real estate leasing corporations, they also gained 10.7 million USD in financial investment operations. Notably, this is an increase of 10.5 million USD compared to the previous year.

However, assets decreased by about 3.5% (23 million USD) from 6.56 billion USD at the end of the previous year to 6.33 billion USD (approximately 8 trillion KRW). Liabilities alone stood at 3.78 billion USD, exceeding the capital size of 2.55 billion USD. The available capital decreased by 18 million USD (4.5%) due to the exclusion of Samsung Fire & Marine Insurance's accident law corporation's reserve of 570 million USD, and despite realizing net income last year, the capital of Samsung Fire & Marine Insurance's accident law corporation was excluded, resulting in a decrease of 5 million USD.

Overall, overseas branches of insurance companies grew compared to the previous year, mainly in the Asian and European markets. Life insurers saw improved performance due to better business conditions following the easing of COVID-19 and increased profits from local corporations engaged in real estate leasing.

Non-life insurers improved their performance through expanded sales to domestic companies entering the Asian market. It is expected that the trend of new entries into emerging markets such as Vietnam and the expansion of overseas insurance recruitment will continue.

A Financial Supervisory Service official stated, "While monitoring the financial soundness of overseas branches and the progress of new market entries, we will actively support resolving operational and medical difficulties of overseas branches and new overseas market entries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)