Easier Compliance with Mineral Requirements Including Inflation Reduction Act through Lithium Internalization

Significant Improvement in Cathode Material Performance Expected from Q3

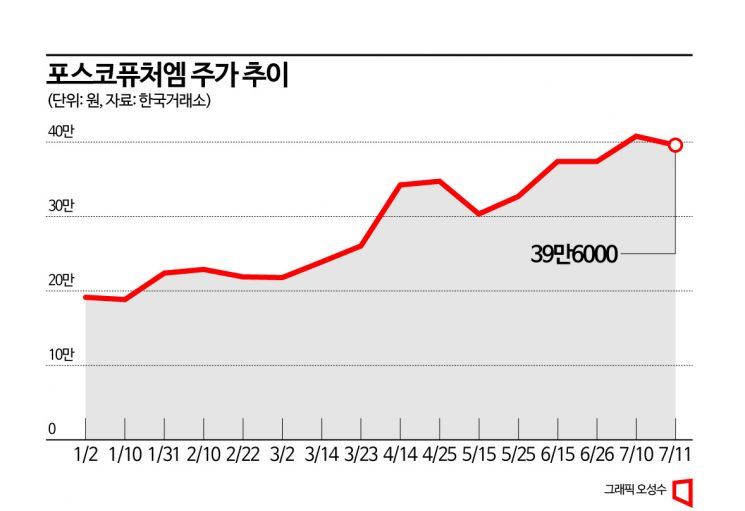

The upward momentum of POSCO Future M is fierce. The stock price surpassed 400,000 KRW based on the closing price the previous day. Fueled by foreign buying inflows triggered by short covering of short selling, EcoPro is eyeing the status of a dominant stock, while POSCO Future M's stock price continues to rise based on order momentum.

According to the Korea Exchange on the 11th, POSCO Future M closed at 396,000 KRW, down 2.94% (12,000 KRW) from the previous day. However, the day before, POSCO Future M touched the 420,000 KRW range during the session, pushing Naver out and rising to 10th place in market capitalization.

Over the past month, foreigners alone have net purchased POSCO Future M worth 134 billion KRW, driving the stock price. Narrowing the period to July, institutions appear to be joining the 'buy' trend. Since the beginning of this month, foreigners and institutions have net purchased 67.1 billion KRW and 48 billion KRW respectively. Individuals alone sold off 120.8 billion KRW. Individuals seem to be realizing profits.

EcoPro surged earlier this year thanks to individual buying, and recently foreigners have also been buying. The financial investment industry estimates that the stock price has risen sharply due to additional short covering buying inflows caused by short selling. Short covering refers to buying stocks to repay when the stock price of a shorted stock rises contrary to expectations.

The potential of POSCO Future M, which attracts attention from foreigners and institutions, lies in the internalization of cathode materials extending to lithium, nickel, and precursors. As the internalization rate increases, POSCO Future M's targeted cathode material production capacity and market share can also increase.

Jung-hwan Kim, a researcher at Korea Investment & Securities, explained, "Lithium internalization makes it easier to comply with mineral requirements such as the Inflation Reduction Act (IRA), and it can receive love calls for secondary battery cells and original equipment manufacturing (OEM)." He added, "Additionally, there are advantages such as stabilizing local lithium supply and procuring raw materials at prices cheaper than the market."

POSCO Future M plans to achieve a lithium internalization rate of over 80% by 2025 by receiving 99,000 tons of lithium through its parent company. This internalization rate is higher than that of EcoPro BM (25%) or L&F (0%).

POSCO Future M has the most stable cathode material value chain in Korea, making it highly preferred by finished car manufacturers. With additional cathode material order contracts in the second half of the year, the scale of growth in 2025 could be even greater. Anna Lee, a researcher at Yuanta Securities, said, "In particular, POSCO Future M produces both cathode and anode materials simultaneously," adding, "From 2024, when anode yield normalization is expected, growth centered on artificial graphite is also anticipated."

According to FnGuide's compilation, POSCO Future M's operating profit for the third quarter is expected to be 101.9 billion KRW, up 24.58% year-on-year, and sales are expected to increase by 48.11% to 1.56 trillion KRW. The expectation that cathode material performance will significantly improve from the third quarter is also interpreted as stimulating foreign investor sentiment.

Chang-hyun Jeon, a researcher at Daishin Securities, forecasted, "Although the additional decline in cathode material prices will continue in the third quarter, sales volume is expected to increase significantly thanks to deferred volumes for Ultium Cells from the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.