BGF, Full Support After Acquiring Eco Materials in 2021

Plans 100% Participation in Paid-in Capital Increase... Expects Growth in Specialty Gases

Engineering plastics manufacturer BGF Eco Materials is expanding its business areas backed by full support from its parent company BGF. It is raising funds for the acquisition of semiconductor specialty gas producer KNW through a rights offering.

According to the Financial Supervisory Service's electronic disclosure system, BGF Eco Materials will issue 13.5 million new shares to existing shareholders to raise 67.5 billion KRW. The initial issue price is 5,000 KRW per share, and the final issue price will be confirmed on the 2nd of next month.

All the raised funds will be used for the acquisition of KNW. Earlier, on May 25, BGF Eco Materials announced that it would acquire 5.19 million existing shares of KNW for 63.5 billion KRW. Additionally, it decided to participate in KNW's paid-in capital increase to acquire an additional 3.92 million new shares. Upon completion of the capital increase, it will secure a 56.7% stake in KNW. BGF Eco Materials plans to raise 113.5 billion KRW for acquiring KNW shares by combining its existing cash of 85.8 billion KRW with the funds raised through the capital increase.

KNW is a manufacturer of semiconductor and secondary battery materials. Through its affiliate Fluorin Korea, it produces specialty gases for semiconductor processes. Last year, it recorded sales of 99.6 billion KRW and operating profit of 15.3 billion KRW. Compared to the previous year, sales increased by 38.6% and operating profit grew by 98.0%.

The fluorine (F2) gas mainly produced by Fluorin Korea is difficult to handle and has high entry barriers due to regulatory impacts. As semiconductor fine process advancement progresses, the scope of its application is gradually expanding, leading to rapid market growth.

The synergy effect is expected from BGF Group's network and Fluorin Korea's technological capabilities. The aggressive mergers and acquisitions (M&A) by BGF Eco Materials are anticipated to improve consolidated financial performance. A financial investment industry insider said, "Demand for specialty gases in semiconductor production is increasing," adding, "Compared to the eco-friendly plastics sector, which requires more time, the specialty gas sector is expected to grow faster."

Since December 2021, when BGF became the largest shareholder, BGF Eco Materials has been actively expanding its business areas, thanks to large-scale financial support from BGF. BGF participated in BGF Eco Materials' rights offering by investing 30.9 billion KRW. Additionally, BGF Eco Materials issued bonds with warrants (BW) and convertible bonds (CB) to BGF, raising 66.9 billion KRW.

BGF is reorganizing its material business affiliates within the group through BGF Eco Materials. BGF Eco Materials absorbed and merged eco-friendly packaging manufacturer BGF Eco Bio. Previously, BGF Eco Bio issued new shares to BGF and Hong Jeong-hyeok, CEO of BGF Eco Materials, acquiring 100% of BGF Eco Bio's shares. Earlier this year, it participated in a rights offering of J-Eco Cycle, where CEO Hong Jeong-hyeok is the largest shareholder, investing 20 billion KRW. J-Eco Cycle is a waste recycling and plastic waste collection and processing company.

After completing the reorganization of material business affiliates within the group, it expanded its domain into semiconductor materials by acquiring KNW. BGF will acquire all shares allocated to it in BGF Eco Materials' rights offering. Two years after investing 250 billion KRW to acquire BGF Eco Materials in 2021, BGF will invest an additional 44.4 billion KRW.

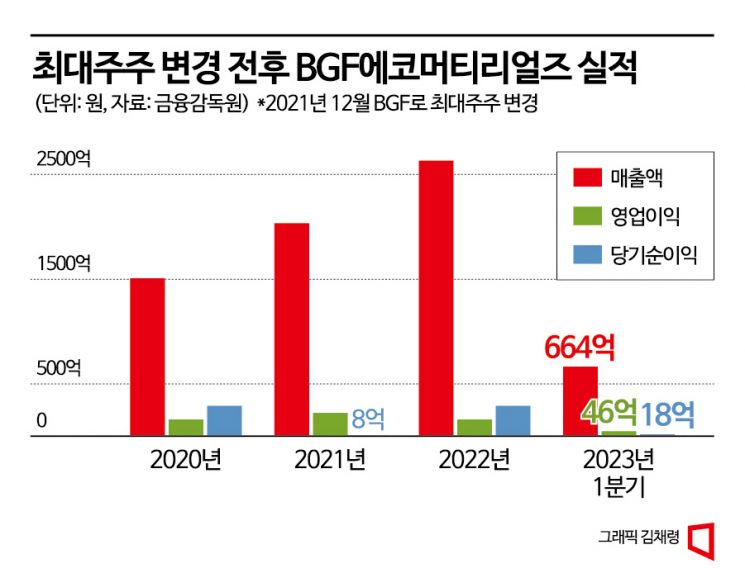

BGF Eco Materials, supported by BGF, is growing in scale. Last year, it recorded sales of 263.3 billion KRW and operating profit of 15.9 billion KRW. Sales increased by 29.4% compared to the previous year, but operating profit decreased by 28.5%. The company has grown through mergers and equity investments, and it appears that time will be needed to improve profitability going forward.

However, the stock price remains stagnant. BGF holds 26.3 million shares of BGF Eco Materials. The average acquisition price per share is 10,394 KRW, which is higher than the current price of 5,700 KRW. Although the number of shares held increases and the average purchase price decreases through participation in the capital increase, the investment return rate remains negative.

As of the end of March, the largest shareholder group holds 69.7% of BGF's shares, while general shareholders hold 30%. This structure allows most agenda items to pass at shareholder meetings even if minority shareholders do not agree. Considering BGF's cash-generating ability, it has sufficient capacity to make large-scale investments in BGF Eco Materials and wait for results.

Jong-ryeol Park, a researcher at Heungkuk Securities, explained, "BGF Eco Materials is expanding its business areas centered on automotive engineering plastics, lightweight products, and eco-friendly materials," adding, "With an expanded customer base and efficient cost control, BGF Eco Materials is expected to sustain performance improvements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)