Nearly 900,000 Units Sold Worldwide in First Half

In Korea, Sales Half of Last Year's First Half

'New Car Effect' Absent, Price Cuts, Subsidy Policies

Negatively Impact Demand

Dollar Strength Boosts Supply but Lowers Incentives

Efforts Underway to Overcome with Personnel Renewal and Service Enhancement

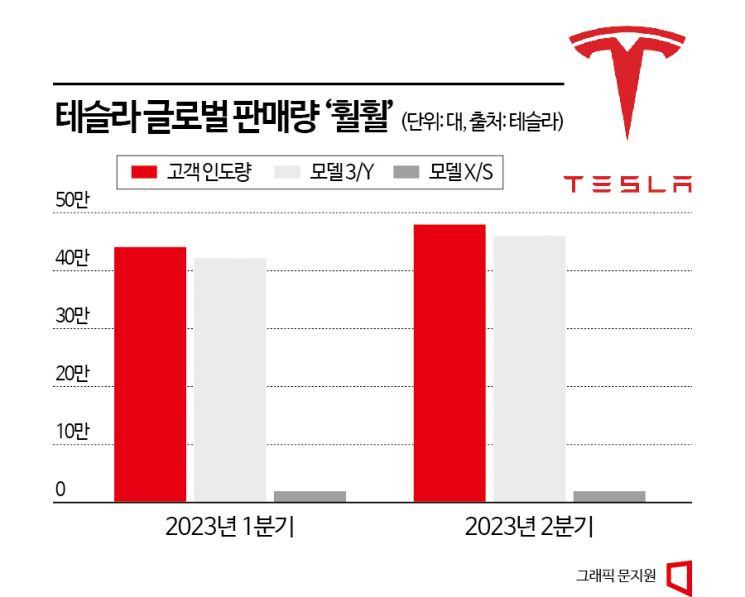

Tesla sold nearly 900,000 vehicles worldwide in the first half of this year. After surpassing 400,000 units in quarterly sales for the first time in the fourth quarter of last year, the company has continued its upward trend this year, exceeding 460,000 units in the second quarter. However, sales in Korea have declined. Domestic sales in Korea during the first half of the year dropped by about half. Analysts attribute this to the absence of new models for 4 to 5 years and price reduction policies negatively impacting demand. As demand has decreased, there are also many reasons for Tesla to reduce supply. Tesla Korea is showing signs of trying to break out of the slump through personnel restructuring and strengthening customer services.

Tesla announced that the number of vehicles delivered to customers in the second quarter (April to June) of this year was 466,140 units. This represents an 83% increase compared to the same period last year and is the highest ever for a second quarter. In the first quarter, 422,875 units were delivered, bringing total sales for the first half of the year to 889,015 units. Looking at sales by model, Model 3 and Model Y led the increase with 859,095 units sold. Model X and Model S sold 29,920 units.

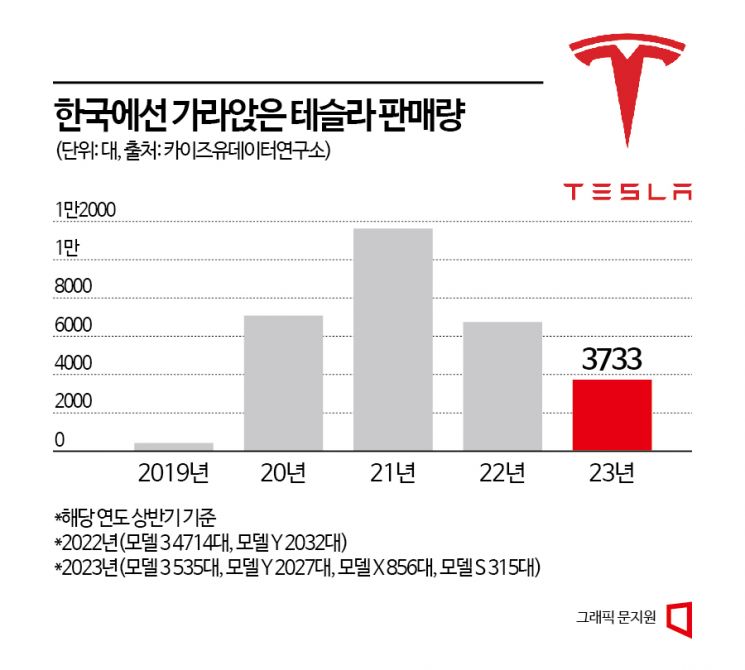

However, Tesla’s sales in Korea continue to struggle. According to data from Kaizyu Data Research Institute, Tesla sold 3,733 units in Korea in the first half of this year (January to June), about half of the 6,746 units sold during the same period last year. This is also the second-lowest figure in the past five years. Specifically, sales of Model 3 plummeted. While 4,714 units of Model 3 were sold in the first half of last year, only 535 units were sold this year.

The reason for the difference in sales between the global market and the Korean market is due to decreased demand in Korea. First, Tesla cannot benefit from the ‘new model effect’ that could boost sales. The best-selling Model 3 was launched in 2019 and has undergone three software updates, known as ‘refreshes,’ which improve vehicle performance (such as driving range). However, Tesla has not implemented the typical annual mid-cycle or model year changes that most automakers do, so the exterior remains unchanged.

Aggressive price reduction policies are also cited as a factor reducing Tesla demand in Korea. Professor Kim Pil-su of Daelim University’s Department of Future Automotive Studies said, “Korean consumers view cars as a form of asset, so when prices drop, used car prices also fall,” adding, “Tesla’s image has shifted more towards a mass-market brand rather than a luxury one, which has affected sales.”

Electric vehicle subsidy policies unfavorable to imported car companies may also impact demand. This year’s subsidy revision added ‘post-management capability evaluation’ as a criterion. The Ministry of Environment explained that this was introduced to address complaints about the lack of post-sale maintenance infrastructure for electric vehicles. Manufacturers operating directly managed service centers receive the highest scores. However, imported car companies do not operate service centers directly in Korea but run them through dealers. This inevitably creates a subsidy gap compared to domestic brands like Hyundai Motor and Kia.

As demand has decreased, there are also reasons for Tesla to reduce supply. The incentive to sell vehicles in Korea is low amid the weak Korean won. Both Model 3 and Model Y sold in Korea are produced in the United States. The two models produced at the Shanghai plant in China are not imported to Korea. Considering logistics costs when shipping vehicles from the U.S. to Korea, it is more advantageous to sell in the U.S. mainland or nearby countries such as Canada and Mexico. However, shipping from nearby China may not be profitable either, as there are automotive tariffs between China and Korea in addition to basic logistics costs, unlike with the U.S.

Feeling a sense of crisis, Tesla recently appointed Yvonne Chan, the Taiwan and Thailand representative, to concurrently serve in place of Kim Kyung-ho, the CEO of Tesla Korea. Tesla also re-established a PR organization, which did not exist under previous headquarters policies. Customer benefits are also increasing. In May, Tesla resumed the Supercharging program, allowing Model S and X buyers to use dedicated charging stations for free. On the 3rd of this month, Tesla launched an Extended Warranty Program (EWI) that provides additional warranty coverage after the original warranty period ends. Korea is the second country worldwide to launch this program after China.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.