Moves to Compete with Netflix

Judging Survival Difficult Through Each for Themselves

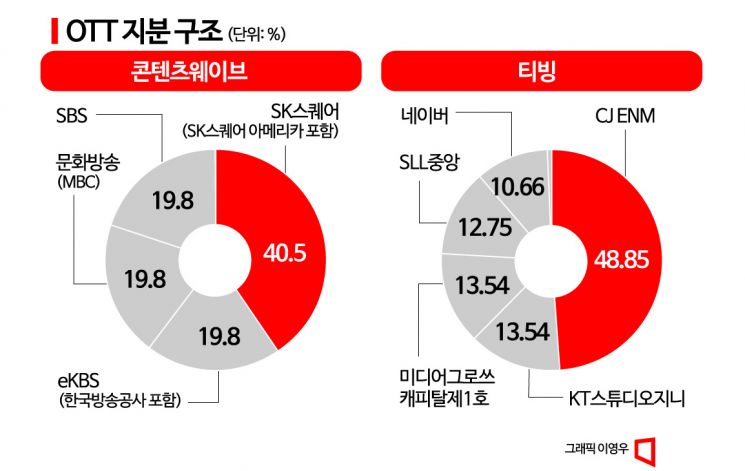

SK Square and CJ ENM have begun the merger process of the native online video services (OTT) Wave and TVING. This move aims to counter the 'Goliath' Netflix with scale and financial power.

SK's top executives announced on the 4th, "We are in discussions for the merger of Wave and TVING." It is known that Yoo Young-sang, CEO of SK Telecom, Park Sung-ha, CEO of SK Square, and Koo Chang-geun, CEO of CJ ENM, are leading efforts to explore the synergies from the merger. The main issue is the merger ratio. Although some shareholders have differing opinions on the valuation, internally it is said that the merger is inevitable. Both companies have settled on signing a memorandum of understanding (MOU) within this month. Initially, they plan to generate synergy through content partnerships.

The merger rumors between Wave and TVING first surfaced in July 2020. At that time, Yoo Young-sang (then head of SKT MNO division) surprised attendees at an event by proposing, "Wave wants to merge with TVING." Since a joint venture was being prepared, TVING's response was lukewarm. The quiet merger rumors resurfaced this year as CJ ENM, previously indifferent to the merger, changed its stance and joined the negotiation table. CJ ENM's profitability worsened due to the acquisition and merger (M&A) of the U.S. entertainment company Fifth Season (formerly Endeavor Content) and the weakening media content market. CJ ENM decided to sell non-core assets.

The merger between Wave and TVING gained momentum because there was a consensus that survival would be difficult through going it alone. Native OTTs are diagnosed to be in crisis. Providing content through fragmented OTTs by company faces limits in competing with Netflix. Last year, TVING and Wave posted losses of 119.1 billion KRW and 121.6 billion KRW, respectively. The effect of partnerships with overseas OTTs was also minimal. Wave, which exclusively aired HBO dramas, failed to secure the hit show "The Last of Us" in the first half of this year. Instead of expensive new releases, it brought in outdated, cheaper content.

Netflix is rapidly encroaching on the domestic media market with its massive capital. Industry views hold that the domestic media market is effectively a Netflix domain. According to the May OTT monthly active users (MAU) data released by the analytics service Mobile Index, Netflix leads with 11.53 million users. It is followed by TVING (5.14 million), Coupang Play (4.31 million), and Wave (3.91 million).

After the merger, Wave and TVING's combined MAU will exceed 9 million, enabling a direct showdown with Netflix. The Korea Communications Commission has also advocated for 'OTT integration' as a way to strengthen competitiveness. Last year, the commission submitted a plan for an 'OTT integrated platform' to the Presidential Transition Committee as a strategy for the overseas expansion of K-content. A media industry insider explained, "If cooperation is strengthened through content partnerships and capabilities are consolidated, there is a chance to compete with Netflix," adding, "Exporting Korean content as an integrated K-OTT could also increase competitiveness overseas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.