Expansion of Inspections to Eradicate Circular Practices in Bond-type Wraps and Trusts

"Long-term Bond Demand Absorption and Yield Improvement Effects... Compensation for Investment Losses Is Problematic"

Financial Supervisory Service Holds Meeting with Securities CEOs on the Afternoon of the 5th

The Financial Supervisory Service (FSS) will hold a meeting with securities company CEOs today (the 5th) at 3 p.m., chaired by Deputy Governor Ham Yong-il. This is based on the judgment that practices such as passing investment losses to other clients or compensating for them through bond rollovers in wrap and trust accounts are clearly illegal. Initially, the FSS planned to discuss improvements to the securities companies' report-writing practices, which had been focused solely on 'buy' recommendations. However, after it was revealed that some securities firms compensated investors for losses in bond-type wrap and trust products, the discussion topics were expanded.

The FSS will particularly expand its inspections to include Yuanta Securities, Korea Investment & Securities, Eugene Investment & Securities, and SK Securities to eradicate the practice of 'rollover' in bond-type wrap accounts and specific money trusts. This is the second round of inspections following KB Securities, Hana Securities, and others.

Including Long-Term Bonds in Short-Term Products to Boost Returns

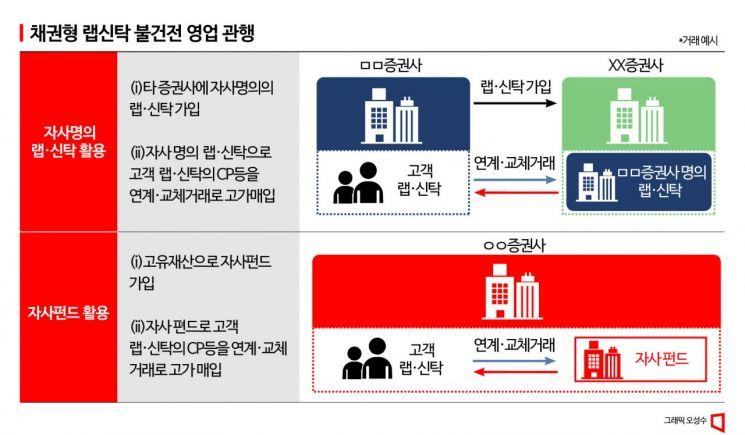

The contract period for wrap and trust products is typically short, ranging from 3 to 6 months. These products are mainly subscribed to by corporations and institutional investors to manage short-term funds. Therefore, they should be managed with short-term bonds, commercial paper (CP), and other short-maturity products. However, to increase returns, it has been customary to include less liquid long-term CPs and similar assets. This mismatch between the contract period of wrap and trust accounts and the remaining maturity of the included assets results in a 'maturity mismatch' in management.

Securities companies have traditionally operated this way. Wrap and trust accounts serve as a demand outlet for long-term bonds and are one of the management methods that can also increase returns. Usually, when the wrap or trust account matures, the securities company sells the included assets in the market to pay redemption proceeds. If asset sales are difficult, the principle is to negotiate with clients to extend the maturity or terminate the contract and return the funds.

The problem is that during periods of rising interest rates, the possibility of losses in wrap and trust accounts increases. As benchmark interest rates rise, bond yield volatility expands, leading to greater valuation losses on long-term bonds included in wrap and trust accounts. Therefore, during periods of rising interest rates, risk management such as switching from long-term to short-term bonds in advance is necessary.

Losses Increase During Interest Rate Hikes, Leading to Compensation for Investors

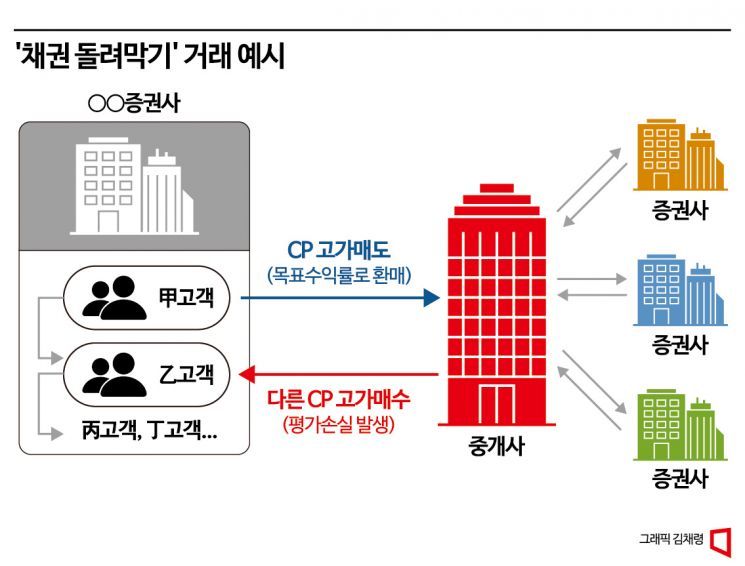

However, it has been revealed this time that instead of selling the included assets as per principle, losses were passed on to other accounts or compensated for. SK Securities, unable to properly respond to redemption requests and facing signs of escalation into legal disputes, compensated investors approximately 10 billion KRW as a settlement (compensation) for investment losses. Some securities firms, including KB Securities, purchased customer assets at high prices using their own funds when it became difficult to achieve target returns at maturity.

Securities companies argue that such rollover practices are somewhat unavoidable. A securities company official said, "While securities firms sometimes offer principal protection or certain returns to corporations or institutions, they are often the ones first requested to do so," adding, "Since securities firms are in a subordinate position, if they refuse such requests, they fear disadvantages in other businesses such as IB advisory or retirement pensions, so they engage in rollover."

The FSS takes the stance of "no longer tolerating illegal acts." An FSS official pointed out, "If there are institutions demanding principal protection, it means there are securities firms accepting it," and added, "There is a widespread perception that if losses occur in wrap and trust products but profits are made in other products, it is not a problem." He explained, "The meeting is held to collectively examine whether the failure to comply with the law in product sales, management, and post-management procedures is due to inability or unwillingness, and to respond jointly."

This is not the first time the FSS has taken action. In 2014, Macquarie Investment Trust Management (then IGN Investment Trust Management) and seven bond brokerage securities firms were sanctioned by the FSS. When bond volatility increased due to the tapering of quantitative easing in the U.S. in 2013, Macquarie Investment Trust Management compensated investors for losses caused by parking transactions. This was done by passing losses onto other funds and securities firms. At that time, Macquarie Investment Trust Management received severe disciplinary action.

FSS: "Manage Risks Instead of Compensating Losses"

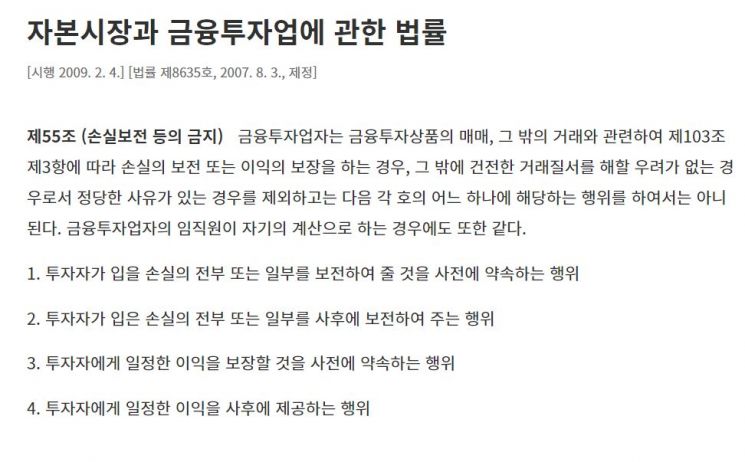

The FSS raises two major issues. First, there is a high possibility of violating the 'investor self-responsibility principle.' According to Article 55 of the Capital Markets Act (Prohibition of Loss Compensation, etc.), except for justifiable reasons, it is prohibited to △promise in advance to compensate all or part of the losses an investor may incur △compensate all or part of the losses an investor has incurred afterward △promise in advance to guarantee certain profits to investors △provide certain profits to investors afterward.

Second, there has been a failure to manage risks and a lack of proper internal controls. The FSS acknowledges that maturity mismatch management is realistically unavoidable to some extent. However, it insists that active risk management should be conducted rather than passing losses to other accounts during management.

An FSS official pointed out, "In a situation where a 3-month maturity account included a 1-year bond to increase returns but incurred losses," adding, "Licensed securities firms should at least manage risks by selling the 1-year bond and switching to short-term bonds before maturity as per the principle."

The industry also views compensating investment losses as problematic. A securities company CEO said, "The issue of wrap and trust circular transactions has repeatedly occurred during periods of rising interest rates," and criticized, "When losses occur in customer accounts, practices such as averaging down with other funds and arbitrary asset transfers continued, and compensating losses with proprietary accounts is a very serious problem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.