Industry "High Demand for Used Equipment Requires Tax Benefits"

Government "Difficult to Verify Contribution to Production Capacity," Reluctant

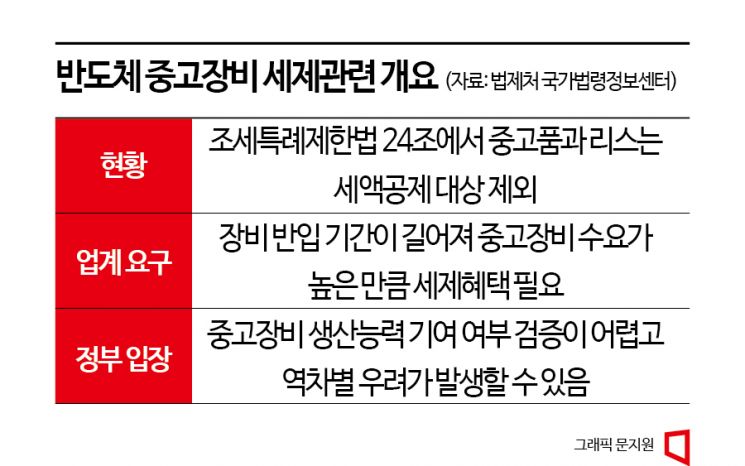

There is growing demand from the industry to amend the Restriction of Special Taxation Act (commonly known as the 'K-Chips Act') to include used semiconductor equipment as eligible for tax credits. Due to the extended lead time for semiconductor equipment (the time from order to delivery), there is a need to introduce used equipment, but since it is excluded from the tax credit scope, companies are hesitant to expand their investments.

On the 3rd, the semiconductor industry expressed hope that not only new equipment but also used equipment would be included in the tax credit scope to enable 'timely investment.' A semiconductor industry official said, "The equipment lead time has lengthened due to the semiconductor supply crisis and has yet to recover," adding, "For new equipment, 8-inch (200mm) wafers take 24 months, and deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography equipment take 18 months each." He added, "Even if we invest immediately, the equipment would only be delivered by 2025, and when we tried to purchase used equipment, it was excluded from the tax credit under the Restriction of Special Taxation Act, which places a heavy burden on companies."

The industry believes that the production volume of new 8-inch wafers and DUV/EUV lithography equipment used for power semiconductors, display driver ICs (DDI), and automotive semiconductors cannot keep up with industry demand. Lithography equipment is necessary for drawing circuits on substrates. The lead time for 8-inch wafers has increased from the previous 10 months to 24 months recently. The lead time for lithography equipment has also lengthened from 6 months to 18 months (1 year and 6 months).

As equipment delivery deadlines extend, semiconductor companies inevitably face setbacks in product development and mass production. With delays in new equipment delivery, companies are forced to purchase used equipment, which costs about 80% of new equipment. However, even if used equipment can be purchased immediately, it is not eligible for tax credits, which places a heavy burden on companies. During the legislative process of the K-Chips Act, which passed the National Assembly in March, tax-saving provisions for used equipment were not even discussed. Article 24, Paragraph 1 of the law explicitly states, "Investments in used goods and leases are excluded from tax credits."

The industry argues that if equipment delivery remains difficult as it is now, investment sentiment in the semiconductor sector could shrink, so used equipment should be included in the tax credit scope to support companies in timely importing equipment and producing products. They also claim that the sunset clause for tax credits on new equipment under the Restriction of Special Taxation Act, which expires at the end of next year, should be extended or completely removed.

However, the government is showing a passive stance toward including used semiconductor equipment in the tax credit scope. A Ministry of Economy and Finance official said, "Facility investment tax credits should be applied to products that clearly increase national economic production capacity and gross domestic product (GDP), but used equipment is a resale of existing domestic products, so there is no guarantee that granting tax credit benefits will increase national production capacity or added value." The official also pointed out that it is unclear how to define the scope of used products, there are concerns about overlapping tax benefits between new and used products, and there could be controversies over unfair treatment of industries outside semiconductors, all of which make tax credits difficult to apply.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.