Statistics Korea May Industrial Activity Trends

Production 1.3%, Consumption 0.4%, Investment 3.5%

Semiconductor Production Down 16.7% Year-on-Year

"No Signal of Export Increase, No Clear Rebound"

Last month, production, consumption, and investment all increased simultaneously for the first time in three months, signaling a positive turn in the economy. The economic indices that reflect the current and future economic conditions also show signs of improvement. However, the recovery in the semiconductor sector remains slow, making a clear rebound difficult to expect.

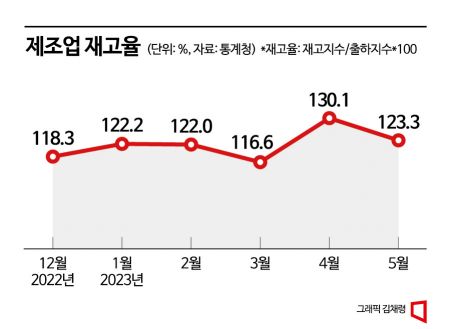

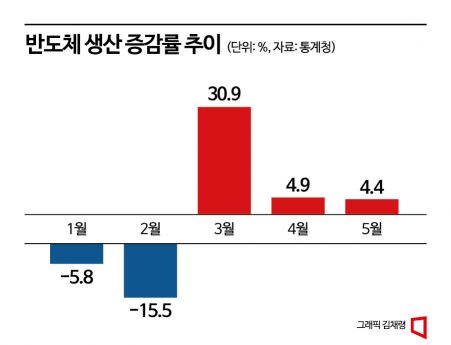

According to the industrial activity trends released by Statistics Korea on the 30th, total industrial production in May rose by 1.3% compared to the previous month, marking the largest increase in 14 months since March last year (1.9%). The growth was led by the manufacturing sector. Manufacturing production increased by 3.2% month-on-month, supported by automobiles (8.7%) and semiconductors (4.4%), despite a 16.9% decline in telecommunications and broadcasting equipment production. The overall inventory ratio also fell by 6.8 percentage points from 130.1% in April to 123.3% last month, mainly due to the automobile and machinery equipment sectors.

Retail sales also rose by 0.4% compared to the previous month. Durable goods such as home appliances (0.5%), semi-durable goods like shoes and bags (0.6%), and non-durable goods including food and beverages (0.2%) all showed increases. This rise is attributed to an earlier-than-usual heatwave compared to the average year and an increase in apartment move-ins. However, the service sector declined by 0.1% month-on-month as decreases in finance, insurance, accommodation, and food services offset a 3.2% increase in professional, scientific, and technical services.

Facility investment also grew by 3.5%. Investments increased in machinery such as general industrial machines (2.6%) and transportation equipment including aircraft (6.2%). Construction performance rose by 0.5% compared to the previous month, with building construction up by 0.7% despite a 0.1% decline in civil engineering.

The composite economic index is gradually showing improvement. The coincident composite index, which reflects the current economic situation, rose by 0.1 points month-on-month, marking four consecutive months of increase. The leading composite index, which forecasts future economic conditions, ended a six-month decline since October last year and remained steady compared to the previous month.

"Manufacturing recovery is insufficient... No clear signs of economic rebound"

The problem lies in the semiconductor sector, which has not clearly revived. Semiconductor production increased by 4.4% last month, slightly slowing from the 4.9% growth in the previous month. Compared to the same month last year, it decreased by 16.7%. Overall inventory increased by 2.7% month-on-month and by 84.7% year-on-year.

Kim Bo-kyung, Economic Trend Statistics Officer at Statistics Korea, explained, “Although the manufacturing sector was affected by fewer working days, the recovery remains insufficient. Semiconductor shipments have increased, but there are no strong signals of a significant rise in exports, a leading indicator, so it is difficult to say the rebound is clear.”

According to the ‘May ICT Export-Import Trends’ released by the Ministry of Science and ICT, semiconductor exports last month amounted to $7.84 billion, down 35.7% from the same month last year. This decline is due to the sluggish semiconductor market and falling prices. Memory semiconductor exports dropped 53.1% year-on-year to $3.64 billion, while system semiconductor exports shrank by 4.9% to $3.64 billion.

There had been expectations that production cuts by semiconductor companies would lead to price recovery, but this was not reflected in the recent statistics. Typically, semiconductor production takes 3 to 4 months, so the effects do not appear immediately.

Statistics Korea also stated that the economy has not yet entered a full recovery phase. Officer Kim said, “Although some improvement trends have been observed, manufacturing production remains sluggish compared to a year ago due to IT sector contraction and delayed effects of China’s reopening of economic activities. Uncertainty may increase depending on the timing and extent of IT sector recovery and economic trends in major countries.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.