CJ CGV Raises Over 1 Trillion Won Through Paid-in Capital Increase

Lotte Culture Continues Rolling Over Hybrid Bonds

Megabox Joongang Endures with Commercial Paper and Convertible Bonds

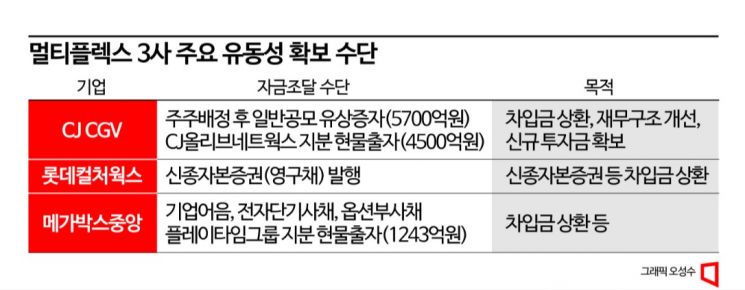

As CJ CGV is pushing forward with a 1 trillion won rights offering, the three major multiplex operators in South Korea, including Lotte Cultureworks and Megabox Joongang, are struggling to secure liquidity. Lotte Cultureworks has been issuing perpetual bonds (hybrid bonds) consecutively to secure funds for repaying borrowings, while Megabox Joongang is holding on with ultra-short-term commercial papers (CPs, including electronic short-term bonds) and bonds with options.

According to the investment banking (IB) industry, Lotte Cultureworks privately placed 30 billion won worth of perpetual bonds on the 29th, with Samsung Securities as the lead manager. In April of this year, it also issued 40 billion won worth of perpetual bonds with Korea Investment & Securities as the lead manager to secure liquidity. In total, it issued 70 billion won worth of perpetual bonds over three months. The raised funds were used to repay maturing bonds and to early redeem previously issued perpetual bonds.

Perpetual bonds are recognized as equity in accounting, so companies mainly issue them to lower their debt ratios. As multiplex operations became difficult due to COVID-19, CJ CGV and Lotte Cultureworks managed their debt ratios by utilizing large-scale perpetual bonds. CJ CGV, which recently decided to conduct a 1 trillion won rights offering, barely got through the tough times by issuing perpetual bonds exceeding 1 trillion won.

The problem is that the early redemption (call option exercise) periods for these perpetual bonds are coming up one after another. The perpetual bonds issued by Lotte Cultureworks allow the company to exercise call options annually starting two years after issuance to redeem principal and interest early. If the call option is not exercised, the bonds have a step-up structure where the interest rate increases significantly each year. In December, the call option exercise period for 10 billion won worth of perpetual bonds arrives, followed by 3 billion won worth in February next year.

An IB industry insider said, "Lotte Cultureworks’ debt ratio stood at 3500% as of the end of last year," adding, "Considering that most of the capital consists of hybrid bonds, it is effectively in a state of complete capital erosion." The insider also noted, "There are few investors willing to invest in Lotte Cultureworks’ hybrid bonds, so the company is barely managing to absorb them in the market through securitization and other means."

Megabox Joongang, facing difficulties in issuing corporate bonds, is securing liquidity by issuing ultra-short-term commercial papers (CPs, including electronic short-term bonds) with a three-month maturity and bonds with options. Recently, it newly issued 20 billion won worth of CPs with investors such as Heungkuk Securities and Woori Comprehensive Financial, increasing the CP balance to 110 billion won. Megabox Joongang’s CP balance decreased to 34.5 billion won in September last year but increased by nearly 80 billion won over about nine months as it issued more CPs to repay borrowings. Earlier in April and June, it consecutively issued 52.5 billion won worth of bonds with options, which are effectively repayable after six months, to secure funds.

As of the end of the first quarter this year, Megabox Joongang’s debt ratio was 1380%, showing a significant deterioration in financial structure since COVID-19. However, its parent company, Contents Joongang, extinguished the urgent situation by contributing 100% of Playtime Group’s shares in kind to Megabox Joongang. An IB industry insider said, "Although performance is improving after the end of COVID-19, the increased borrowing scale is huge, and the short-term repayment burden has become quite heavy," adding, "For the time being, the pattern of repaying maturing borrowings with CPs and bonds with options will continue, further intensifying the shortening of debt maturity."

CJ CGV is expected to see a significant improvement in its financial structure by injecting 1 trillion won through an in-kind contribution of CJ OliveNetworks shares and a rights offering. However, concerns have also been raised that it may become difficult to secure sufficient funds as shareholders’ opposition to dilution of shares causes the stock price to fall continuously.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.