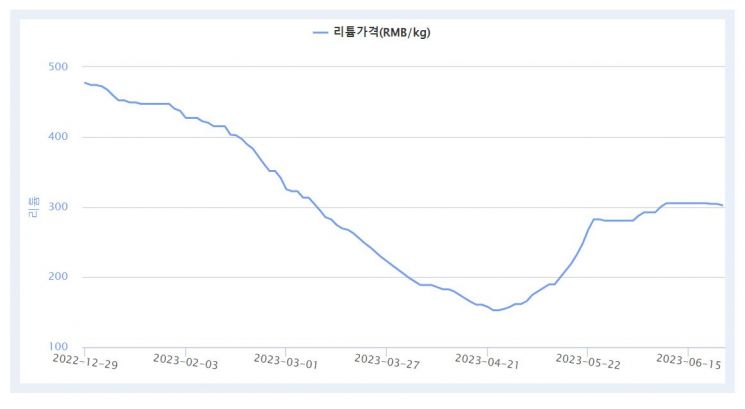

Lithium Carbonate Price at 304.5 Yuan per kg as of 26th

Doubled in Two Months from 152.5 Yuan Level on April 24 This Year

Governments and Companies Worldwide Say "We Want Lithium"

Survey and Design Take 2 Years, Mine and Salt Lake Development Up to 7 Years

Demand Rises Sharply but Supply Remains 'Inelastic'

"Prices Fluctuate Repeatedly Amid Unstable Demand and Subtle Market Changes"

Lithium phosphate produced from Argentina's Hombre Muerto salt lake developed by POSCO Holdings. Photo by Jeong Donghoon

Lithium phosphate produced from Argentina's Hombre Muerto salt lake developed by POSCO Holdings. Photo by Jeong Donghoon

The price of lithium, a key raw material for batteries, is fluctuating once again. Although many countries and companies are eager to enter the lithium business, which has emerged as a protagonist in the electric vehicle era, price instability continues.

As of the 26th of this month, the price of lithium carbonate stands at 304.5 yuan per kilogram (approximately 54,810 KRW), about double the lowest price recorded in April (152.5 yuan, approximately 27,450 KRW). The price of lithium has seen dramatic ups and downs over the past three years. It became a 'ten bagger' in the mineral market?a stock that yields tenfold returns for investors?before dropping to about half of its peak price. In January 2020, lithium was priced at 39.5 yuan per kilogram (approximately 7,110 KRW), rising to a peak of 252 yuan (approximately 45,360 KRW) in 2021. Following the outbreak of the Russia-Ukraine war and the ensuing supply chain crisis, prices soared to an all-time high of 581.5 yuan per kilogram (approximately 104,670 KRW). (Data from Korea Resources Information Service)

Since then, lithium prices have stabilized. Although the Russia-Ukraine war has prolonged, concerns over supply chain disruptions have eased, and governments worldwide have entered lithium mining and processing. However, prices have started to fluctuate again over the past two months.

Lithium is one of the lightest metals in the world. Because it is lightweight, batteries made with this metal are light and have very high energy density. Due to its color and high value, it is called 'white petroleum.' Lithium accounts for 40-50% of the cost of battery cathode materials and 20-30% of the total battery cost. Battery prices fluctuate according to lithium prices.

Everyone is rushing into the 'profitable' lithium business. ExxonMobil, the world's largest oil company, has purchased lithium deposits, and Tesla broke ground last month on the first lithium refining plant in the U.S. automotive industry in Corpus Christi, Texas. Countries in the 'Lithium Triangle'?Bolivia, Chile, and Argentina?where 60% of the world's lithium reserves are concentrated, are considering forming a coalition to control market prices. In South Korea, some listed companies' stock prices surged simply by announcing lithium development projects, creating 'lithium theme stocks.'

The reason lithium prices fluctuate wildly is due to supply and demand instability. Demand changes flexibly with economic fluctuations such as electric vehicle sales, but supply is difficult to increase or decrease quickly. It takes 1-2 years just to confirm lithium deposits and plan projects, and 4-7 years to develop mines and salt lakes. For example, POSCO Holdings acquired the Hombre Muerto lithium salt lake in Argentina in 2018 and will produce lithium hydroxide six years later, next year. This was possible due to their expertise in developing and operating iron ore mines overseas, including Brazil.

The battery industry expects this lithium supply instability to continue for a long time. Albemarle, the world's largest lithium producer, forecasts that global lithium demand will exceed supply by about 500,000 tons by 2030. Until last year, there were 45 lithium mines worldwide. This year, 11 new mines are scheduled to open, and 7 more next year. (Data from Fastmarkets) Amid prolonged supply instability, lithium prices are expected to continue to fluctuate sharply with subtle market changes such as electric vehicle sales. A battery industry official said, "The recent surge in lithium prices is due to a sharp increase in lithium demand as electric vehicle sales have grown significantly worldwide," adding, "The Chinese government’s restrictions on domestic companies that mined and produced lithium illegally without permits also contributed to the supply shortage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.