"The Infamous Poor Borrower Industry" Self-Deprecation of Self-Employed

Deteriorating Debt Quality, Rising Delinquency Rates... Loan Barriers Increasing

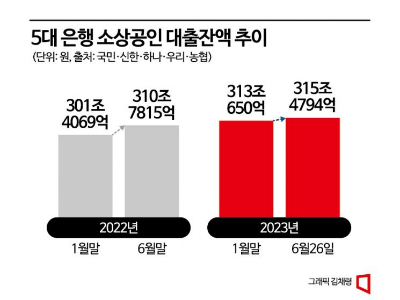

Small Business Loan Growth Significantly Slows Down

"These days, first-tier banks often refuse to provide loans for the food service industry altogether. Since self-employment is currently one of the most problematic sectors with high default risks, even visiting multiple banks doesn't help in getting a loan. I found one bank branch that said they would lend, but the interest rates and limits were outrageous. I can't even think about borrowing."

Kim Dohyeon (33), who started a delivery restaurant three years ago, is unable to borrow money for operating expenses. Although he has a 30 million KRW loan from the Credit Guarantee Foundation, he has no bank loans, and last year's sales were about 180 million KRW. Kim said, "My credit score is relatively high, so I don't understand why my loan applications keep getting rejected," expressing his frustration.

As the quality of self-employed debt deteriorates and delinquency rates rise, the growth rate of self-employment loans has noticeably slowed. Interest rates remain high, and banks have raised the loan thresholds considering the risks associated with self-employment loans.

According to the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup), the outstanding balance of loans to small business owners increased by 2.4144 trillion KRW (from 313.065 trillion KRW to 315.4794 trillion KRW) from January to June this year (as of the 26th). This is only about a quarter of the increase of 9.3746 trillion KRW (from 301.4069 trillion KRW to 310.7815 trillion KRW) recorded from January to June last year.

The financial distress of small business owners carrying debt can be understood from the Financial Stability Report released by the Bank of Korea. The report stated, "Last year, self-employed debt increased mainly among vulnerable borrowers (multiple debtors with low income or low credit), non-bank sectors, and face-to-face service industries." The overall quality of debt has worsened.

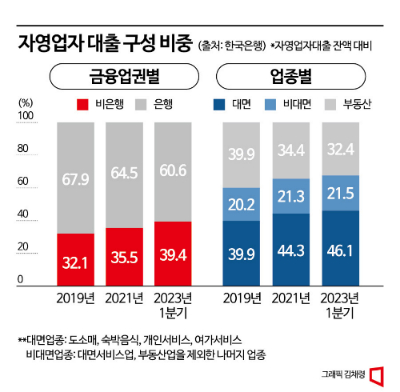

The proportion of face-to-face service loans, which are sensitive to economic conditions and mainly involve small-scale businesses, increased from 44.3% at the end of 2021 to 46.1% in the first quarter of this year relative to the total self-employed loan balance. The share of second-tier financial institution loans, which have relatively higher interest rates, also rose from 35.5% to 39.4% during the same period. The proportion of vulnerable borrowers, who are multiple debtors with low income or low credit, increased from 9.0% to 10.1%.

Delinquency rates rose in parallel. The report noted, "When calculating delinquency rates based on self-employed borrowers who have missed principal and interest payments for over a month, the increase in delinquency rates was largest in the face-to-face service sector," adding, "Non-bank sectors and vulnerable borrowers showed similar trends." From the end of June last year to the end of March this year, the delinquency rate in the face-to-face service sector rose by 0.38 percentage points (from 0.22% to 0.60%), which was higher than the increase in the non-face-to-face sector (0.18 percentage points, from 0.19% to 0.37%).

By financial sector, the delinquency rate in first-tier financial institutions rose by 0.21 percentage points (from 0.16% to 0.37%), while in second-tier institutions it increased by 1.25 percentage points (from 1.27% to 2.52%).

A representative from a commercial bank said, "Since the delinquency rate among self-employed borrowers is rising, we have had to be conservative with lending this year for risk management reasons," adding, "Loan screening has become stricter than last year." The Bank of Korea also expressed concern, stating, "Self-employed individuals are vulnerable to real estate price declines and have high principal and interest repayment burdens, and with the delay in economic recovery, there is a risk of an expansion in delinquency amounts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.