Consumer Sentiment Index Surpasses 100

Housing Price Outlook CSI Rises by 8 Points

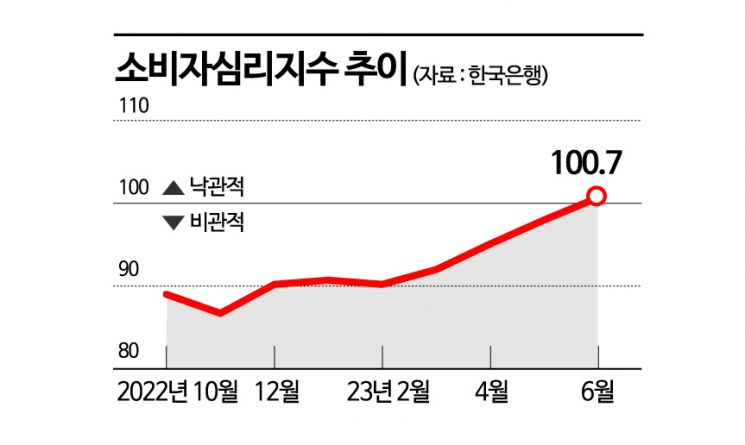

Recently, as the inflation rate has slowed and consumption recovery continues due to the expansion of face-to-face activities, the Consumer Sentiment Index has risen for four consecutive months. The index level also surpassed 100 for the first time in 13 months, indicating that consumer perceptions of the overall economy have turned optimistic.

According to the "June Consumer Sentiment Survey Results" released by the Bank of Korea on the 28th, the Composite Consumer Sentiment Index (CCSI), which comprehensively reflects consumers' economic sentiment, rose by 2.7 points from the previous month to 100.7 this month.

A figure above 100 means that consumer sentiment is optimistic compared to the long-term average (2003?2022), while below 100 indicates pessimism. Last month, the index was 98, below 100, but this month it exceeded 100 for the first time in 13 months since May last year (102.9), showing an upward trend for four consecutive months.

Hwang Hee-jin, head of the Bank of Korea's Statistics and Survey Team, explained the rise in the Consumer Sentiment Index as "due to expectations of easing economic downturn, recovery in consumption from expanded face-to-face activities, and the slowdown in inflation."

Looking in detail, the Current Living Conditions CSI, which shows current living conditions compared to six months ago, was 89, rising for four consecutive months since February. Additionally, the Living Conditions Outlook CSI (93), Household Income Outlook CSI (98), and Consumption Expenditure Outlook CSI (113), which indicate six-month forecasts, all showed upward trends. The Current Economic Conditions CSI (69) and Future Economic Outlook Index (78), which reflect perceptions of the economic situation, rose by 5 points and 4 points respectively from the previous month, and the Employment Opportunity Outlook CSI (81) also increased by 3 points.

In particular, amid the continued slowdown in the nationwide decline of housing prices, the Seoul apartment sales price turned to an increase for the first time in 16 months, causing the Housing Price Outlook CSI (100) to rise by 8 points. This is interpreted as growing expectations of house price increases as the tightening cycle is expected to end. This index fell to 61 in November last year but began to rise sharply from January this year, reaching the baseline of 100.

The Interest Rate Level Outlook CSI (105) plunged by 9 points as the base interest rate was held steady for three consecutive times and the United States also decided to maintain its policy rate target range at the current level (5.00?5.25%).

The Inflation Level Outlook CSI (146) maintained last month's level as the inflation rate slowdown continues due to an expanded decline in petroleum prices, but the perceived inflation remains high due to public utility fees and dining-out services.

Inflation perception fell by 0.1 percentage points to 4.6%, and the expected inflation rate remained unchanged at 3.5%. Expected inflation refers to the anticipated inflation rate one year ahead based on information currently known by economic agents such as businesses and households. The expected inflation rate rose to 4.7% in July last year, then dropped to 3.8% in December. It rose for two consecutive months in January and February, then declined for three consecutive months from March, and has since remained stagnant.

Team leader Hwang said, "Although the consumer price inflation rate fell from 3.7% to 3.3% last month, prices for dining-out services remain high, and future increases in transportation fares such as taxis and subways are also expected. Therefore, consumers still perceive inflation as high, which is why the expected inflation rate has not immediately dropped and remains at the 3% level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.