Subscription Rate for Warrants at 100.3%... Raised 96.3 Billion KRW

Successful Fundraising for Power Semiconductor Facility... Overhang Concerns Ahead of New Stock Listing

KEC raised funds for power semiconductor facility investment through a rights offering to existing shareholders. While KEC secured funds to establish new growth engines by achieving a 100% subscription rate from existing shareholders, shareholders are expected to continue deliberating until the new shares are listed due to the sluggish stock price.

According to the Financial Supervisory Service on the 27th, KEC recorded a subscription rate of 100.26% after receiving subscriptions from holders of new share warrants from the 21st to the 22nd. While issuing 56 million new shares, the number of subscribed shares reached 56.15 million. The issue price per new share is 1,719 KRW, raising 96.3 billion KRW through the rights offering.

The raised funds will be used for 65 billion KRW in investment for power semiconductor production facilities and 25 billion KRW for expanding production capacity. Demand for power semiconductors has recently increased in the electric vehicle and energy storage system (ESS) sectors. KEC successfully completed a national project titled "Development of 1200V-grade Silicon Carbide (SiC) MOSFET Devices for Electric Vehicles and Renewable Energy," implemented by the Ministry of Trade, Industry and Energy. It received an evaluation from the Korea Institute for Advancement of Technology that the devices can be commercialized for electric vehicles and renewable energy. Given the high import dependency of power semiconductors, KEC judged that domestic production would enable performance improvement. This is the reason for the large-scale investment decision.

By raising the planned funds through the rights offering, KEC has laid the groundwork to grow by responding to the increasing demand for power semiconductors driven by the electric vehicle market growth. However, considering that facility investments must continue until 2025, sales are expected to increase substantially only after one to two years.

KEC recorded sales of 267.5 billion KRW and 256.2 billion KRW in 2021 and 2022, respectively. Operating profits during the same period were 26.5 billion KRW and 18 billion KRW. It was a time when new growth drivers were needed. While KEC breathed a sigh of relief by securing funds to invest in new growth engines through the rights offering, shareholders who participated in the offering are likely to be sensitive to stock price movements until the new shares are listed. The scheduled listing date for the new shares is the 14th of next month.

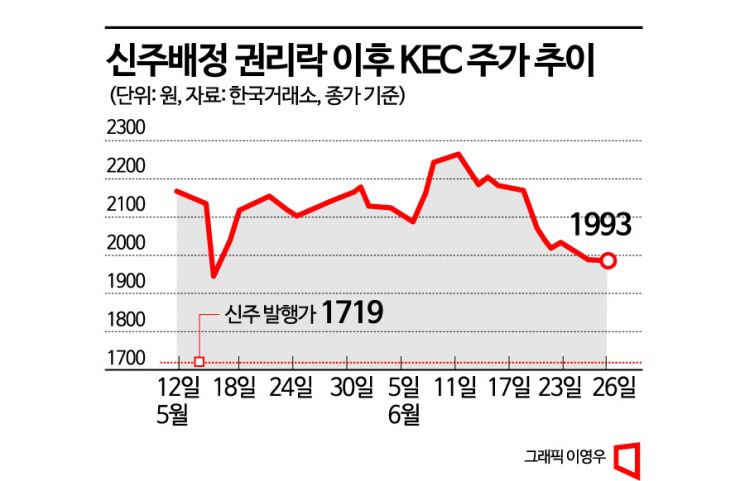

The current stock price is 1,993 KRW, approximately 15.9% higher than the new share issue price of 1,719 KRW. Selling the new shares at the current stock price level would yield investment returns. However, since the new shares issued through the rights offering account for 38.7% of the current number of shares, concerns about overhang (potential large-scale selling pressure) may increase as the period to sell the new shares approaches.

KEC’s stock price has fluctuated between 1,900 KRW and 2,300 KRW since the rights to subscribe to new shares disappeared on the 12th of last month. Even after news that the company would raise funds as planned following the subscription rate exceeding 100%, the stock price showed little reaction. The largest shareholder, Korea Electronics Holdings, decided to subscribe to only about 60% of the allocated new shares. The major shareholder’s stake will slightly decrease from 32.84% to 29.18% after the rights offering. The proportion of freely tradable shares will increase further with the listing of the new shares.

If investors who are scheduled to acquire the new shares decide to sell them to each other, a stock price decline is inevitable. At this point, just before the large-scale new share listing, there is little incentive for new investors to rush to acquire shares. It is highly likely that investors will judge that it is not too late to invest after the overhang issue is resolved. A financial investment industry official explained, "KEC, which is currently experiencing profitability deterioration, can find a breakthrough through the rights offering," adding, "Investors who participated in the offering should evaluate growth potential from a long-term perspective and decide whether to hold their shares."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)