The price increase trend of the 'leading apartments,' considered a leading indicator of the housing market, continued for two consecutive months. This is due to the revival of the Gangnam area following the government's comprehensive deregulation efforts. However, regions outside the Gangnam 4 districts (Gangnam, Seocho, Songpa, Gangdong) remain in a slump, and the transaction volume within Seoul is still insufficient, leading to forecasts that it will be difficult for the overall market to enter a sustained upward trend.

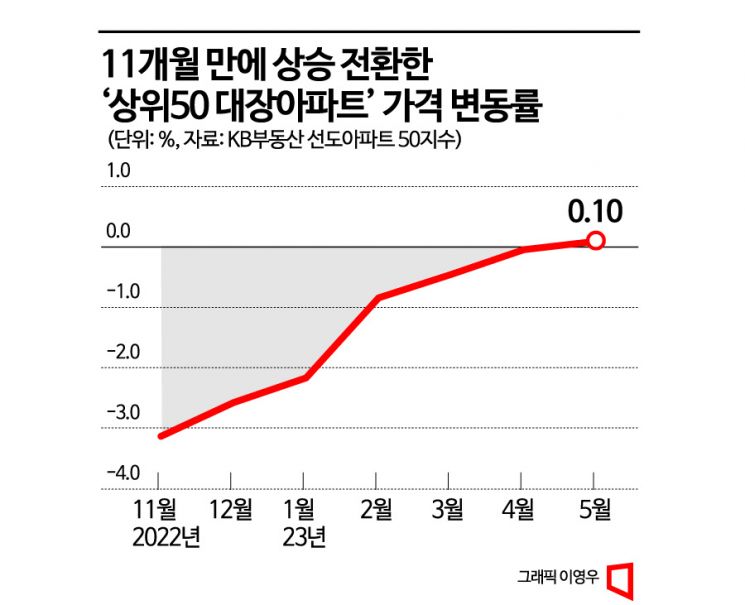

According to the monthly housing trend report released by KB Kookmin Bank on the 27th, the 'KB Leading Apartment 50' index rose by 0.82% compared to the previous month. This index had been declining for 10 consecutive months since turning downward in July last year. In particular, it recorded the largest drop ever in November last year, falling by 3.14%. However, last month it reversed to an upward trend for the first time in 11 months, marking two consecutive months of increase.

The KB Leading Apartment index selects the top 50 apartment complexes nationwide by market capitalization and reflects the rate of change in market capitalization. It is highly sensitive to price fluctuations and is mainly used as a leading indicator to forecast the housing market. Major complexes in the Gangnam area, such as Helio City, Acro River Park, and Eunma Apartments, are included in large numbers.

In particular, the price increase trend appears steep, centered on the Gangnam 4 districts. The top 20 market capitalization indices within Seoul were recorded at 90.6 this month. This is the highest figure so far this year, up 1.4 points from last month. All 20 apartment complexes included in this index belong to the Gangnam 4 districts.

This trend is also reflected in actual transaction prices. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84.95㎡ (exclusive area) unit in Helio City, Garak-dong, Songpa-gu, was sold for 1.99 billion KRW on the 26th of last month, approaching the 2 billion KRW mark. Compared to the transaction price of 1.75 billion KRW at the beginning of this year, the price has risen by 240 million KRW in half a year. The Eunma Apartments in Daechi-dong, Gangnam-gu, known as a 'reconstruction big fish,' was traded for 2.13 billion KRW in February but recovered 340 million KRW to 2.47 billion KRW in a transaction on the 23rd of last month.

This trend was confirmed by other statistics as well. According to the Korea Real Estate Board, the apartment sale price change rate in the southeastern Seoul area, which includes the Gangnam 4 districts, has been on an upward trend for 10 consecutive weeks since turning positive in the third week of April, rising by 1.02% during that period. This contrasts with other Seoul regions (downtown, northeast, northwest, southwest), which all maintained a downward trend during the same period.

However, experts diagnose that it is difficult to conclude that this trend marks the full-scale rise in housing prices. Song Seung-hyun, CEO of City and Economy, said, "Since Gangnam area apartments had fallen sharply before, the recent upward trend seems to be a base effect that makes the rise more noticeable," adding, "It is unlikely that the overall real estate market will revive in a short period while the flood of new supply and unsold inventory issues remain unresolved."

Yeokyunghee, chief researcher at Real Estate R114, explained, "Due to the perception of a bottom, demand is increasing for upgrading to higher-tier areas such as Gangnam or Mapo and Yongsan, creating a recent recovery atmosphere," but added, "However, the apartment transaction volume in Seoul is still around 3,000 units per month, far below the level during the real estate boom, so there is a lack of clear upward momentum." He continued, "In the second half of this year, a large supply of new apartments is expected in various areas such as Eunpyeong-gu, Gangnam, and Dongdaemun," and added, "There is a possibility that downward price pressure will continue for some time due to the impact of new supply."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.