Inflection AI Joins Unicorn Companies

Suleiman's Wealth Increases by Hundreds of Millions of Dollars

Jensen Huang's Net Worth Rises by $2.4 Billion

Ellison Becomes One of the World's Top 4 Billionaires

Recently, the AI boom, sparked by generative artificial intelligence (AI) such as Chat GPT, has swept the market, propelling founders of related companies into the ranks of billionaires.

On the 25th (local time), Bloomberg reported that Mustafa Suleyman, co-founder of AI startup Inflection AI, has amassed hundreds of millions of dollars in assets through fundraising.

Inflection AI, founded by Suleyman, co-founder of Google DeepMind, and Reid Hoffman, founder of LinkedIn, successfully secured $225 million in investment last year, joining the ranks of unicorn companies. A unicorn company refers to a private startup valued at over $1 billion. Although Inflection AI declined to disclose specific details, Bloomberg predicted that the company's valuation has soared to several billion dollars.

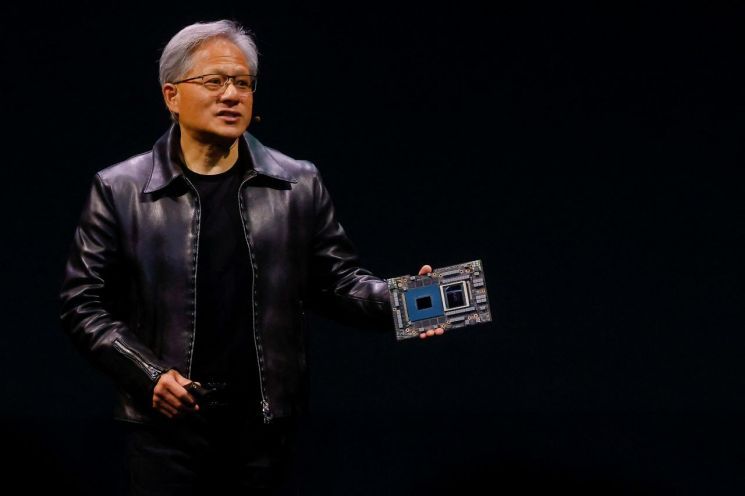

Founders in the semiconductor and software industries are also reaping significant benefits from the AI boom. Nvidia's stock price has surged 188.83% this year, and its market capitalization surpassed $1 trillion on the 30th of last month. Nvidia designs graphics processing units (GPUs), which are crucial for running various games. Fueled by expectations that the demand for high-performance GPUs will skyrocket with AI technology development, the stock price has recently soared.

Nvidia founder Jensen Huang's net worth increased by approximately $2.4 billion compared to the previous year due to the stock price rise. According to Bloomberg's billionaire ranking statistics on that day, Huang's net worth was estimated at $37.8 billion (49.4272 trillion KRW).

Larry Ellison, founder of Oracle, which focuses on software and cloud services, also saw a significant increase in his net worth for similar reasons. Oracle's stock price reached an all-time high of $127.54 on the 15th amid expectations that the spread of generative AI, which demands overwhelming computing power, will boost cloud service demand.

Thanks to Oracle's stock price surge, Ellison surpassed Microsoft chairman Bill Gates earlier this month to become the world's fourth-richest person. Last week, Ellison exercised stock options on 5.25 million Oracle shares, earning profits worth billions of won. Between the 20th and 22nd, he purchased Oracle shares at a conversion price of $30.11 per share and then sold the 5.25 million shares acquired through stock options at an average price of $122 per share, securing a capital gain of $482 million.

The assets of AI industry founders are expected to continue growing, fueled by market expansion. Starting with OpenAI, which launched the generative AI ChatGPT in January and raised $10 billion from Microsoft, the investment frenzy toward the AI industry is ongoing.

James Penny, Chief Investment Officer at UK asset management firm TAM, stated, "AI startups are capital-intensive businesses, and founders need to actively raise funds," adding, "The current investment enthusiasm for AI companies reminds me of the early days of the dot-com bubble in the 2000s, which wiped out 70% of the Nasdaq."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)