Sharp Stock Price Drop After Announcement of 1 Trillion Won Fundraising Plan Including Paid-in Capital Increase

Performance Recovery Expected This Year Through Cost Efficiency and Expansion of Special Zones

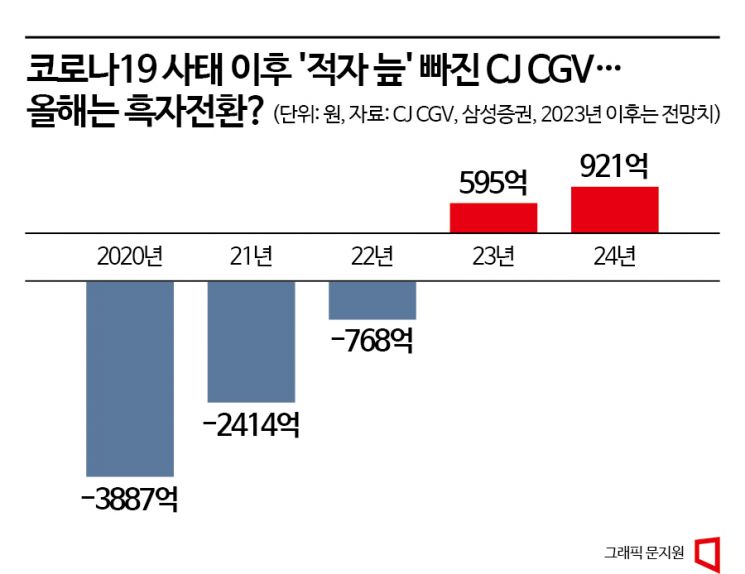

The stock price of CJ CGV, which has represented the domestic movie theater industry, has reverted to levels seen 20 years ago. CGV, which has been struggling with financial pressure due to the rapid deterioration of business conditions following the COVID-19 pandemic, recently announced a fundraising plan totaling 1 trillion won, including a rights offering. As a result, the stock price plummeted for two consecutive days. Although the securities industry expects the financial structure to improve, with a successful return to profitability this year, the ongoing uncertainty in the business environment makes a stock price rebound unlikely.

According to the Korea Exchange on the 23rd, CJ CGV's stock price closed at 10,500 won the previous day. After announcing a 570 billion won rights offering plan on the 20th, the stock price dropped about 30% in two days. The number of new shares to be issued through this shareholder rights offering (74.7 million shares) is about 1.6 times the existing shares outstanding (47,728,537 shares), and the planned issue price (7,630 won) is much lower than the market trading price, leading to concerns over dilution of equity value and causing the stock price to plunge.

The major shareholder CJ is also expected to participate in this rights offering with about 60 billion won. Additionally, CJ plans to contribute about 450 billion won in-kind by transferring its stake in its subsidiary CJ OliveNetworks. Combining the rights offering and in-kind contribution, the total amounts to 1 trillion won, which is about twice the current market capitalization of CJ CGV (501.1 billion won). The plan is to improve the financial structure by repaying borrowings and expanding capital.

Kim Hoe-jae, a researcher at Daishin Securities, described this fundraising plan as "the final decision for normalization," adding, "Although short-term stock price declines and increased volatility are inevitable until the issue price is finalized at the end of next month, now is the right time to improve the financial structure and invest in new businesses."

However, the outlook is not entirely bright. CJ CGV's stock price weakness is not a recent phenomenon, and the rapid expansion of online video streaming services (OTT) such as Netflix has made the growth potential of the movie theater business uncertain. CJ CGV's stock price rose to the 120,000 won range around late 2015 to early 2016 but has been declining for seven years since. The stock price has fallen to about one-tenth of that level, now threatening the 10,000 won mark. Considering that CJ CGV's initial public offering price in December 2004 was 25,000 won, the stock price has actually regressed to about half of the IPO price over more than 20 years.

To overcome this slump, CJ CGV recently announced its 'NEXT CGV' business strategy. The plan is to improve profitability through cost efficiency in existing businesses and provide differentiated experiences that OTT platforms cannot offer. Despite the worsening business environment, the sales proportion of premium theaters such as 4D, IMAX, and ScreenX, which have higher ticket prices than regular theaters, increased from 16% in 2019 to 31% as of May this year. Going forward, CJ CGV plans to expand new premium theaters further and pursue global expansion by increasing technology exports and Hollywood film production.

The financial improvement trend is positive, with CJ CGV expected to turn a slight profit starting this year after years of losses. Ji In-hae, a researcher at Shinhan Investment Corp., said, "There is still market skepticism about the theater business, and the scale of the rights offering is very large, so short-term stock price uncertainty is unavoidable," but added, "The stabilization of the financial structure, which has been considered the biggest risk, should be interpreted positively." He continued, "This is because interest expenses will decrease through capital expansion, dividends from OliveNetworks at about 10 billion won annually, and a gradual turnaround in the core business will significantly improve cash flow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.