Entertainment Big 4 Expected to Achieve Record High Earnings... Institutional and Foreign Investors' Love Calls

Short-Term Surge Faces Downward Pressure... Buy on Dips Considering Growth Potential

The stock trends of major domestic entertainment companies are showing unusual signs. As K-pop continues its unstoppable growth fueled by global popularity, these companies are forecasting record-breaking performance this year, attracting continuous interest from institutional and foreign investors. The investment market is evaluating that it is time to change the perception of the entire entertainment industry. Although stock prices have already risen significantly, considering growth potential, the securities industry diagnoses that there is still investment appeal.

According to the financial investment industry, the combined sales of the Big 4?HYBE, SM, JYP Entertainment (JYP Ent.), and YG Entertainment?in the first quarter of this year reached 890.1 billion KRW, a 48.9% increase compared to the same period last year. Combined operating profit was 149.3 billion KRW, marking a 93.4% increase year-over-year and recording the highest quarterly performance. Seongguk Park, a researcher at Kyobo Securities, analyzed, "The entertainment industry traditionally concentrates events in the second half of the year, making the first quarter an off-season, yet all Big 4 companies recorded earnings surprises. Sales from albums, concerts, and content utilizing artists increased broadly."

This year’s annual performance is also expected to break all-time records. Kyobo Securities forecasts that the combined sales of the Big 4 will reach 4.03 trillion KRW, a 19.8% increase from last year. Operating profit is projected to hit 641.8 billion KRW, setting a new record high. Researcher Park stated, "The combined operating profit of the Big 4 entertainment companies is expected to grow at an average annual rate of 35.0% from 2021 to 2024, significantly surpassing the average growth rates of major industries during the same period. Although there are controversies about overvaluation due to rapid stock price increases in a short period, the upward revision of profit estimates based on clear evidence such as album sales and concert attendance justifies it." He added, "Recently, fandoms of idol groups have been growing not only in Asia but also in the U.S. and Europe, brightening future profit prospects."

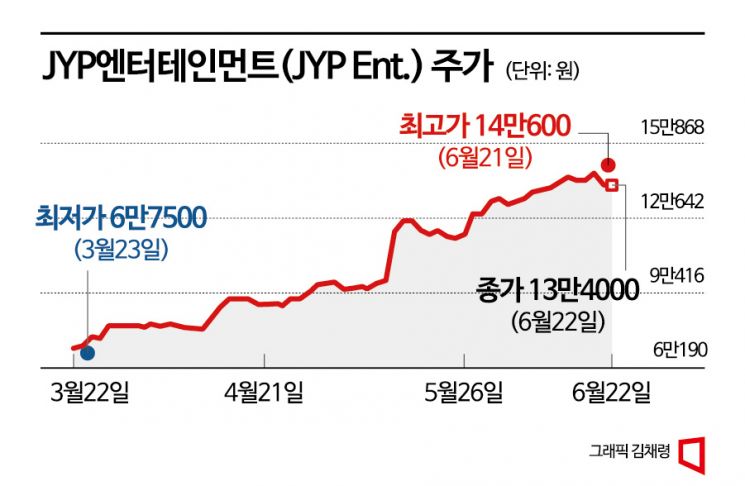

The stock prices of the Big 4 entertainment companies continue to surge. JYP Entertainment is on the verge of surpassing a market capitalization of 5 trillion KRW. The stock price of JYP, which was around 67,800 KRW at the end of last year, has nearly doubled this year. The market cap, which was in the 2 trillion KRW range at the beginning of the year, exceeded 3 trillion KRW for the first time on April 14 and rose to the 4 trillion KRW level on the 16th of last month. As of the close on the 22nd, the market cap recorded 4.7556 trillion KRW. At the beginning of this year, it ranked 10th in market cap among KOSDAQ-listed companies, but it has now risen to 4th place following Ecopro BM, Ecopro, and L&F.

Investor interest continues to grow. Foreign investors have maintained net purchases for seven consecutive trading days since the 14th. During this period, foreign net purchases totaled 34.7 billion KRW. Kyobo Securities expects record-breaking performance to continue from the second to fourth quarters following the first quarter.

HYBE also boasts a remarkable status. As its stock price steadily rises, its market capitalization has settled in the 12 trillion KRW range. On the 22nd, the stock price soared to an intraday high of 312,500 KRW, marking a 52-week high. Institutional investors have been accumulating HYBE shares for 12 consecutive trading days, with net purchases totaling 197 billion KRW during this period. HYBE’s corporate value increase is attributed to the global competitiveness of Korean content such as K-pop. Although the global content industry has grown to a scale comparable to the automobile industry, the media sector’s net profit proportion was only 0.7% and 0.9% of the total last year and this year, respectively. Hyundai Motor Securities forecasts that HYBE’s second-quarter sales will increase by 30.9% year-over-year to 670.3 billion KRW, and operating profit will rise by 13.1% to 99.9 billion KRW, setting a record high.

There are many opinions that entertainment stocks could become new market leaders in the stock market. Donggil Noh, a researcher at Shinhan Investment Corp., evaluated, "The profit expansion potential of entertainment companies is open at the current stage as they begin to target the global market. Although there will be ups and downs, Korea’s position relative to the global market size is still insufficient, so growth potential is large." The media sector’s market capitalization accounts for only 1.7% of the domestic stock market, including KOSPI and KOSDAQ. He added, "It took about 3 to 7 years for new leading sectors such as cosmetics, healthcare, and secondary batteries to fully emerge. Although stock prices surged sharply before and after the first-quarter earnings announcement, increasing price burdens, a strategy to increase weighting from a mid- to long-term perspective during possible future corrections remains valid."

Hwanwook Lee, a researcher at Yuanta Securities, said, "The stock prices of the Big 4 entertainment companies are positioned at the upper end of the historical entertainment sector band (20?30 times), so downward pressure on stock prices is strong. However, when asked whether the current valuation is a range where investment attractiveness declines, the answer is no." He pointed out, "The annual average earnings per share (EPS) growth rate for the next three years is expected to be in the high 30% range at best and at least above 20% (market consensus), so the current stock prices of major entertainment companies are within a reasonable valuation range."

However, there is also advice to be cautious of short-term corrections due to the steep rise in stock prices. Hyunyong Kim, a researcher at Hyundai Motor Securities, said, "JYP Entertainment’s stock price is somewhat burdensome as it is overvalued compared to SM and YG Entertainment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.