Bank of Korea Financial Stability Report

Year-end Overall Self-Employed Delinquency Risk Rate at 3.1%

Economic Downturn, Commercial Real Estate Decline, Loan Interest Burden

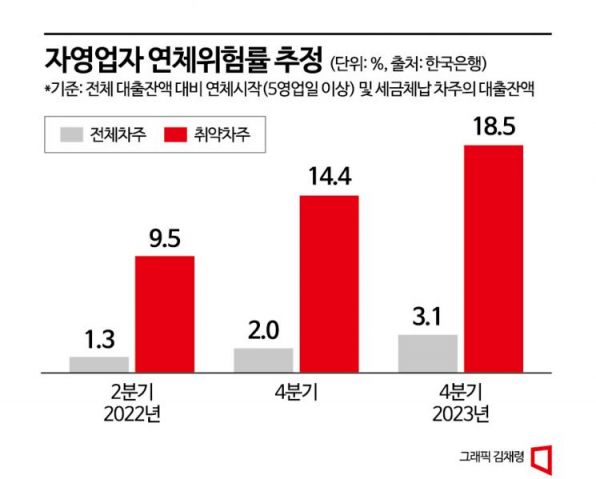

The Bank of Korea forecasted that the delinquency risk rate for all self-employed individuals will rise by 3.1% by the end of this year. Among them, the delinquency risk rate for vulnerable borrowers is expected to increase up to 18.5%. The Bank of Korea warned that if the economic recovery is delayed more than expected and commercial real estate prices decline while the burden of loan interest rates remains, the scale of delinquencies will expand, especially among vulnerable self-employed borrowers.

On the 21st, the Bank of Korea announced the results of its estimation of the delinquency risk rate for self-employed loans at the end of this year through its Financial Stability Report. To capture delinquency risk more broadly than existing delinquency rate indicators, loans held by self-employed individuals who have either started delinquency (over 5 days) or have not paid taxes were considered delinquency risk loans.

Comparing the estimates from the second quarter of last year to the fourth quarter of this year, the delinquency risk rate for all self-employed individuals rises from 1.3% to 3.1%. For vulnerable borrowers, it increases from 9.5% to 18.5%. The reason for expecting such an increase in the delinquency risk rate among self-employed individuals is that, compared to non-self-employed individuals, they are more vulnerable to declines in real estate prices, have a higher burden of principal and interest repayments, and possess a debt structure centered on short-term loans and lump-sum repayments.

At the end of the first quarter of this year, the proportion of non-residential real estate collateral loans among self-employed loans was 58.6%, which was higher than that of non-self-employed individuals (15.1%). The repayment burden of principal and interest for self-employed individuals was also significant. The loan size per self-employed individual (3.3 trillion KRW) in the first quarter of this year was 3.7 times that of non-self-employed individuals (900 billion KRW). Additionally, the proportions of lump-sum repayment loans and short-term loans among self-employed loans were 44.2% and 73.2%, respectively, which were higher than those of non-self-employed individuals (37.7% and 37.6%, respectively).

Despite these circumstances, the income of self-employed individuals remains at 92.2% of the level at the end of 2019, before COVID-19, due to rising loan interest rates and raw material prices. Meanwhile, the outstanding loan balance for self-employed individuals at the end of the first quarter of this year was 1,033.7 trillion KRW, an increase of 7.6% compared to the same period last year.

The report stated, "Debt has increased mainly among vulnerable borrowers, non-bank sectors, and face-to-face service industries, worsening the overall debt quality," and suggested, "To manage the delinquency risk of loans with high potential default risk among self-employed loans, it is necessary in the short term to promote debt restructuring measures such as the New Start Fund for vulnerable borrowers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.