Global increase by 2.7 times, Dongan rises 1.4 times

Share halved from 2.2% to 1.2%

The proportion of Korean unicorn companies has halved over the past five years. Unicorn companies refer to unlisted startups with a corporate value of over $1 billion (approximately 1 trillion KRW).

Perspective view of 'Unicorn101', Tangjeong Knowledge Industry Center, Asan, Chungcheongnam-do.

Perspective view of 'Unicorn101', Tangjeong Knowledge Industry Center, Asan, Chungcheongnam-do. [Photo by Dongseo Construction]

According to the analysis of unicorn companies in major countries released by the Federation of Korean Industries on the 21st, while the number of global unicorn companies increased 2.7 times from 449 to 1,209 between 2019 and 2023, Korea's number only rose 1.4 times from 10 to 14. Korea's share dropped by 1 percentage point from 2.2% to 1.2%. Countries with an increased share in the number of unicorn companies included the United States (48.6→54.2%), India (4.5→5.8%), France (1.1→2.1%), and Israel (1.6→2%). Countries with a decreased share included Korea, China (24.3→14%), the United Kingdom (5.3→4.1%), and Indonesia (1.1→0.6%).

Korea's presence also weakened in terms of corporate value. The global unicorn corporate value increased by 183.9%, from $1.3546 trillion (approximately 1,745 trillion KRW) in 2019 to $3.8451 trillion (approximately 4,952 trillion KRW) this year. Korea's value rose by 12%, from $29 billion (approximately 37 trillion KRW) to $32.5 billion (approximately 42 trillion KRW). Korea's share fell by 1.3 percentage points from 2.1% to 0.8%. The United States increased by 4.6 percentage points (48.8→53.4%), while China decreased by 10.3 percentage points (29.4→19.1%).

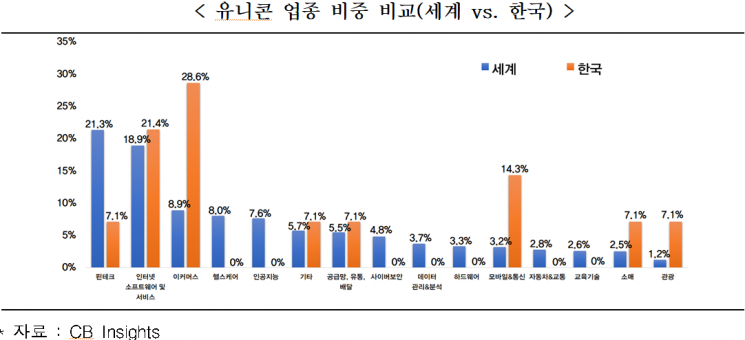

By industry, Korean unicorn companies this year were most numerous in e-commerce (28.6%), internet software and services (21.4%), and mobile and telecommunications (14.3%). Globally, the leading sectors were fintech (21.3%), internet software and services (18.9%), e-commerce (8.9%), healthcare (8%), artificial intelligence (7.6%), supply chain, distribution, and delivery (5.5%), and cybersecurity (4.8%). The Federation of Korean Industries commented, "Korean unicorn companies are concentrated in commerce, telecommunications, and distribution services," adding, "The proportion of data analytics technology-based companies is smaller than in major countries."

Unicorn companies play a positive role in the national economy by promoting innovation, discovering new industries, and expanding employment. Major countries encourage startup creation and provide policy support to help startups grow into unicorn companies. However, Korea's share of unicorn companies is gradually shrinking.

The Federation of Korean Industries stated that regulations on corporate venture capital (CVC) should be eased to facilitate smooth investment necessary for startup growth. They emphasized the need to lift restrictions such as the obligation for holding 100% of CVC shares by holding companies, the 200% debt ratio limit on holding company CVCs, the 40% limit on external funds in CVC-managed funds, and the prohibition on investments in companies owned by the family of the head of affiliated business groups.

Choo Kwang-ho, head of the Economic and Industrial Headquarters at the Federation of Korean Industries, said, "To nurture startups and increase the number of unicorn companies, smooth investment attraction is essential," adding, "To increase investment attraction, CVC regulations should be improved and support for startups' overseas expansion is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.