Naver Drops from 3rd to 11th in Market Cap Over 2 Years... Kakao Stays at 14th

Growth Stock Image Fades Amid Tech Competition Loss... AI Models and New Business Prospects Uncertain

In the top 10 group by market capitalization (market cap) on the KOSPI, 'Nakao (Naver·Kakao)' has been pushed out. Once a national favorite stock supported by individual investors, it is now experiencing humiliation as a widely disliked stock.

According to the Korea Exchange on the 21st, the market cap rankings of the KOSPI are led by Samsung Electronics (426.2425 trillion KRW), followed by LG Energy Solution (131.274 trillion KRW), SK Hynix (84.5211 trillion KRW), and Samsung Biologics (54.7328 trillion KRW). Hyundai Motor (41.8621 trillion KRW) and Kia (32.847 trillion KRW), which posted record-breaking earnings in the first half of this year, ranked 8th and 9th respectively, with POSCO Holdings (32.6445 trillion KRW) in 10th place. Manufacturing companies in sectors such as semiconductors, secondary batteries, automobiles, and bio are all positioned within the top 10. Naver, which once rose to 3rd place in market cap, slipped to 11th with 32.5637 trillion KRW. Kakao also ranked only 14th with 22.9602 trillion KRW.

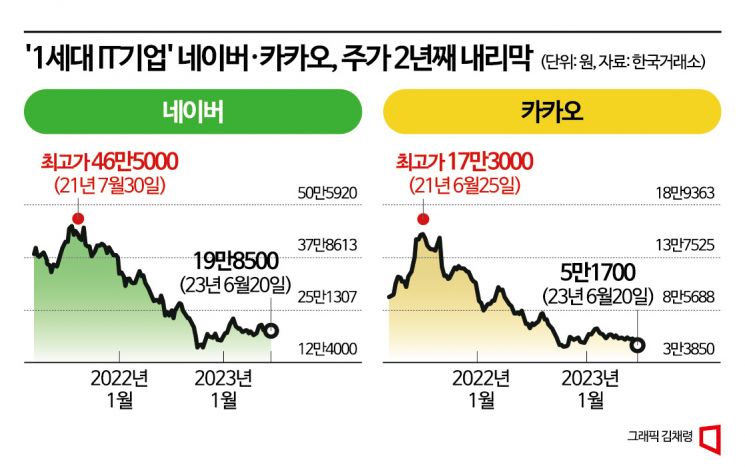

Just a year ago, both Naver and Kakao were within the top 10 by market cap. Around this time two years ago, Kakao even surpassed Naver to reach 3rd place, competing in the 3rd to 4th ranks. However, Naver's stock price has halved from 398,000 KRW (as of June 21, 2021) to 198,500 KRW as of the previous day's closing price. During the same period, Kakao's stock price dropped 67% from 155,000 KRW to 51,700 KRW.

There are multiple reasons behind the stock price slump of these two leading domestic IT companies, but above all, the issue is that their 'growth stock' image is fading as they fall behind in fierce technological competition in the global market, especially in artificial intelligence (AI). The fact that foreign investment funds have drained like a receding tide from both Naver and Kakao over the past two years is evidence of this. Foreign investors have sold a cumulative total of 3.6783 trillion KRW worth of Naver shares over the last two years (June 21, 2021?June 20, 2023). During the same period, 3.1856 trillion KRW of foreign funds exited Kakao. Combined, foreign capital amounting to about 7 trillion KRW has disappeared from the two companies. Consequently, Naver's foreign investor ratio has decreased to 47.79%, while Kakao's is much lower at only 25.62%.

Outlooks for Naver and Kakao in the second half of this year diverge. Naver is expected to have a stronger rebound potential in the latter half, with recent stock price adjustments considered excessive. Heeseok Lim, a researcher at Mirae Asset Securities, said, "The stock price was adjusted due to concerns over a sharp decline in search engine market share, but in reality, it is successfully defending its share," adding, "After the introduction of Search GPT in the second half, the stock price is expected to rebound significantly."

Ji-eun Lee, a researcher at Daishin Securities, also said, "Advertising spending is expected to grow more in the second half compared to the conservative first half," and "there is also potential for additional performance improvement in the commerce sector." However, regarding Naver's upcoming AI 'HyperCLOVA X' to be unveiled next month, she added, "Unless supported by improved earnings, the release of a new AI model alone is insufficient as a direct driver for stock price increases," but noted, "It is positive that they possess such an AI model independently."

In Kakao's case, since investments in new businesses such as generative AI models are still ongoing, the earnings outlook for this year is not very bright. Kakao's annual operating profit decreased from 595 billion KRW in 2021 to 580 billion KRW last year, and this year it is expected to fall further to 495 billion KRW. Jeong E-hoon, a researcher at Eugene Investment & Securities, explained, "Kakao forecasted up to 300 billion KRW in operating losses related to new businesses in its Q1 earnings announcement, so profitability is expected to be negatively impacted this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)