Unlike Last Year, Decoupling More Pronounced This Year

Bitcoin Price Increase Limited Due to Coin Market Regulations

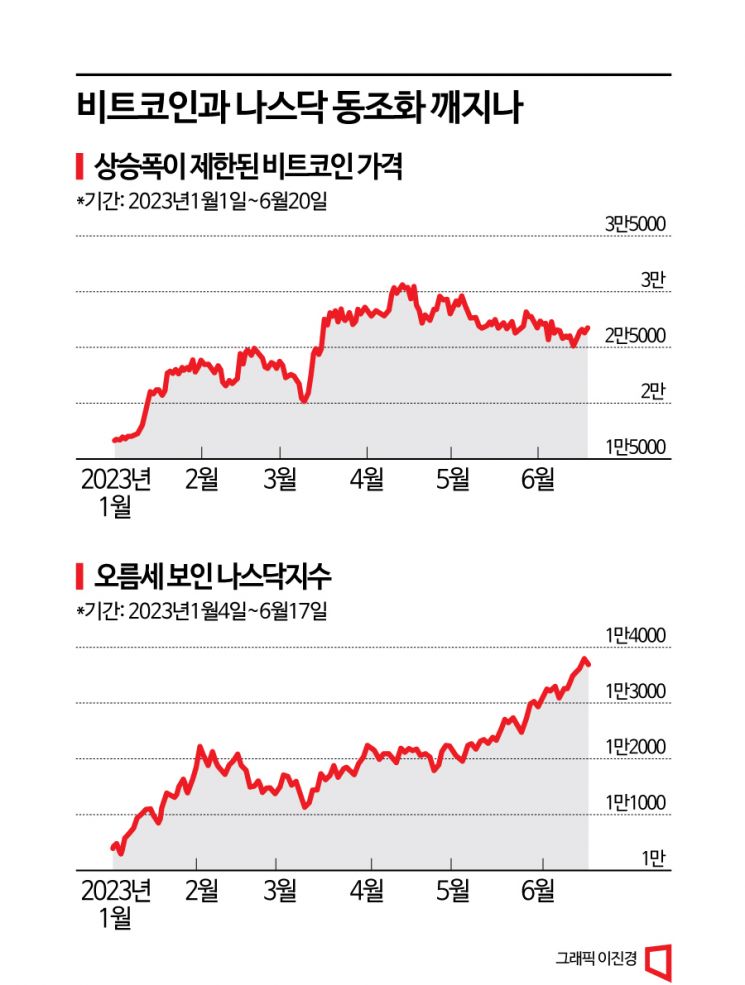

The decoupling phenomenon continues between Bitcoin prices, which have shown synchronization, and the US Nasdaq index, centered on technology stocks. Analysts suggest that the decoupling is occurring due to adverse factors in the virtual asset market.

According to the industry on the 20th, as of 2:15 PM that day, the price of Bitcoin was recorded at $26,975 (approximately 34.54 million KRW), up 0.56% from the previous day. This represents a 62.45% increase compared to the beginning of this year. Bitcoin prices, which recorded $16,605 on January 1, steadily rose and even surpassed $30,000 on April 18. However, after exceeding $30,000, the price has trended downward and is currently moving in the $26,000 range.

The Nasdaq index, which had shown synchronization with Bitcoin prices, also recorded a rise of over 30% compared to the beginning of the year. On the 17th, the Nasdaq index closed at 13,689.57, down 93.25 points (0.68%) from the previous session. Compared to 10,386.99 at the start of the year, this is a 31.80% increase. Although the index gave back the gains from the previous month in March, it has generally trended upward, showing a different trajectory from Bitcoin prices.

Previously, Bitcoin prices and the Nasdaq index moved in similar directions. This synchronization was especially prominent last year. Due to the impact of interest rate hikes and a weak US stock market, along with the arrival of the 'crypto winter' in the virtual asset market, a high positive correlation coefficient of over 0.90 was observed, sometimes approaching 1. The closer the absolute value of the coefficient is to 1, the higher the correlation. A positive correlation coefficient means that different assets move in the same direction. Last year, the Nasdaq index started at 15,832.80 at the beginning of the year and fell to 10,466.48 by the end of the year. During the same period, Bitcoin prices also dropped from the $46,300 range to the $16,600 range, showing similar patterns. Additionally, both recovered losses in March, declined afterward, and then experienced an uptrend in August.

Bitcoin has been regarded as a hedge whenever the stock market showed weakness, earning the nickname "digital gold." However, as investor sentiment worsened and preference for safe assets increased, the value of traditional safe assets like the dollar and gold rose, while Bitcoin gradually came to be seen as a risky asset. This led to a high correlation between Bitcoin prices and the Nasdaq index last year.

The breakdown of the synchronized relationship between Bitcoin prices and the Nasdaq index is interpreted as being due to adverse events within the virtual asset market causing a downturn in the coin market. The decoupling phenomenon began to be detected after the global virtual asset exchange FTX's bankruptcy in November last year. Following FTX's bankruptcy, Bitcoin prices fell, whereas the Nasdaq index slightly rose or remained stable, signaling decoupling. However, in May last year, the Terra-Luna incident caused internal adverse effects in the coin market, and during that period, the Nasdaq index also showed weakness, displaying similar movements.

Earlier this year, expectations that interest rate hikes would end led to simultaneous rises in Bitcoin prices and the Nasdaq index, showing synchronization. However, as the US Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and the European Union (EU) began imposing regulations on the virtual asset market in earnest in April, decoupling appeared. The SEC and CFTC filed lawsuits against the global virtual asset exchange Binance. In particular, the SEC is increasing regulatory pressure by claiming that 19 specific virtual assets have securities characteristics. On April 20 (local time), the EU Parliament passed the virtual asset regulatory package "MiCA," which defines the scope and types of virtual assets and includes investor protection measures. Bitcoin prices, which had been moving in the $30,000 range, fell to the $27,000 range.

An industry insider said, "Regulatory issues in the virtual asset market have continued through the second quarter, with the SEC at the center. Due to the impact of SEC regulations, the virtual asset market has not recovered from the downturn, and until regulations are eased or issues regarding the securities nature of virtual assets are resolved, the decoupling phenomenon between Bitcoin prices and the Nasdaq index is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)