As corporate responsibility for ESG (Environmental, Social, and Governance) disclosures is being strengthened, a platform has been launched for the first time in the industry that not only responds to ESG-related regulations and disclosure systems but also helps create corporate management value through financial judgment.

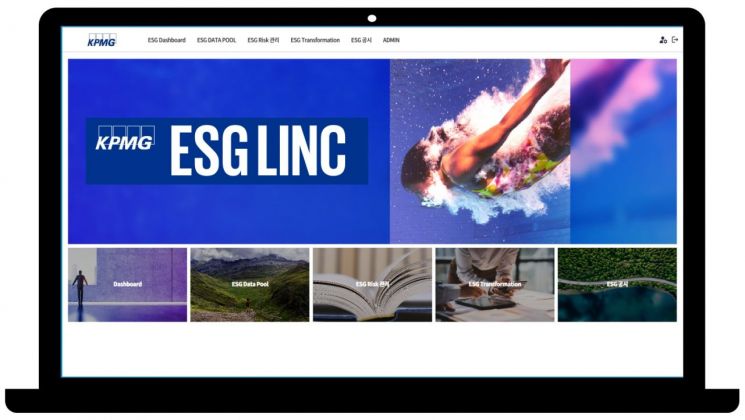

Samjong KPMG announced on the 19th that it has launched 'ESG Link (LINC),' an IT platform that supports unified corporate strategies in response to the mandatory ESG disclosure environment. The name Link (LINC) combines the meaning of connection (Link) and Corporate Sustainability.

Globally standardized and mandatory ESG information disclosures will be reflected from the 2023 fiscal year for companies listed on the U.S. Securities and Exchange Commission (SEC), from the 2025 fiscal year for Korean subsidiaries located in the European Union (EU), and from the 2028 fiscal year for Korean headquarters. The ESG disclosure standards announced by the International Sustainability Standards Board (ISSB) under the International Financial Reporting Standards (IFRS) will be fully applied from the 2025 fiscal year.

Samjong KPMG developed a platform for corporate ESG data management based on global standard indicators in response to the increase in ESG disclosures and related regulations. ESG Link supports the implementation of corporate ESG strategies in ▲ ESG disclosure ▲ ESG risk management ▲ ESG transformation.

First, ESG Link allows management of standard indicators according to disclosure regulations. When new or revised disclosure systems and indicators are announced by domestic and international institutions, and changes occur in ESG indicators, it is possible to continuously manage data and disclosure reports without omission according to the new disclosure indicators based on standard indicators. Additionally, according to the ESG indicator SET, scheduling and data management for data verification and preparation are possible, and reports can be created based on verifiable data through unified ESG indicators.

It also provides financial impact analysis according to climate risks. It identifies climate risk and opportunity factors tailored to corporate characteristics, derives account-specific impacts and changes in financial statements, and utilizes this information for disclosure and management decision-making. Corporate economic activities can be classified and datafied from an eco-friendly activity perspective for quantitative analysis. Through ESG Link, companies can check whether environmental goals are met and understand financial indicators and detailed disclosure requirements related to taxonomy-compliant activities.

ESG Link supports the identification and monitoring of innovative tasks for improving ESG KPIs. It derives specific improvement goals and detailed tasks considering technology maturity, industry suitability, and applicability, focusing on key issues within the company, and continuously monitors KPIs and performance for each task to manage the company’s overall ESG strategy. Companies can analyze the effects by linking the performance of ESG-related tasks with actual quantitative business results and reflect them in management strategies.

Lee Dong-seok, Vice President and Leader of Samjong KPMG ESG Business Group, said, "Unified data management has become important according to standardized global ESG disclosure standards, and ESG-related data must be transformed into an area that derives core values as a survival strategy for companies." He added, "Because ESG disclosure requirements are very detailed and complex for each indicator, integrated strategy preparation and response at the corporate level are necessary."

Meanwhile, Samjong KPMG ESG Business Center was established as the first in the industry in 2008, and over 150 experts provide ESG integrated services to corporate clients, including ESG management strategies, mergers and acquisitions (M&A), certification, and bond issuance. Its ESG information disclosure services offer a one-stop solution from establishing response strategies for each ESG disclosure indicator to IT system and internal process construction related to ESG disclosure operations, including ESG data standardization, and formulating low-carbon advancement strategies to improve actual disclosure performance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.