The government recently halted the reduction of the individual consumption tax on automobiles after five years, increasing the likelihood of gradually abolishing the comprehensive real estate tax fair market value ratio normalization and the fuel tax reduction. This is to restore the temporarily reduced taxes during the COVID-19 situation to their original state in preparation for tax revenue shortfalls.

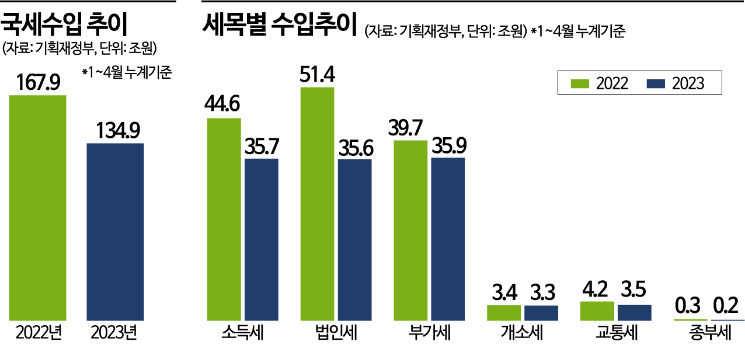

According to the Ministry of Economy and Finance on the 18th, the cumulative tax revenue reduction up to April this year compared to the same period last year amounts to 33.9 trillion won. Among the tax items, income tax, corporate tax, and value-added tax, which account for the largest shares, decreased by 8.9 trillion won, 15.8 trillion won, and 3.8 trillion won respectively compared to the same period last year.

The problem is that the tax revenues from these three major sectors are unlikely to increase significantly in the second half of this year. Some predict that if the tax revenue shortfall continues monthly, the total shortfall by the end of the year could reach up to 50 trillion won.

The government plans to efficiently execute the budget by utilizing surplus funds and reserves without preparing a supplementary budget, but this is expected to be insufficient to cover the tax revenue shortfall. This strengthens the possibility of stopping tax support to secure revenue.

The prevailing view is that the termination of the individual consumption tax reduction signals the start of this trend. The expected increase in tax revenue from this is estimated to be around 500 billion won. Following the individual consumption tax reduction, the restoration of the comprehensive real estate tax fair market value ratio from 60% back to 80% is also being discussed. This plan would revert the fair market value ratio for the comprehensive real estate tax, which was lowered to the minimum legal limit of 60%, back to 80%. The official assessed value rate can be determined by enforcement decree without legislation by the National Assembly. The previous administration raised the official assessed value rate to 95%, but the Yoon Seok-yeol administration lowered it to 60%.

There is also talk of advancing the end date of the fuel tax reduction, which was extended until the end of August. In April, the government extended the reduction of fuel tax by 25% for gasoline and 37% for diesel and LPG butane. However, with international oil prices stabilizing in the low $70 per barrel range, the feared price surge seems to have been alleviated for the time being. The tax revenue lost due to the fuel tax reduction over the past year amounts to about 5.5 trillion won, and stopping the reduction could secure that amount in related tax revenue. However, the government draws a line on linking the termination of the automobile individual consumption tax reduction with the normalization of the comprehensive real estate tax official assessed value rate or the fuel tax reduction.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.