Domestic Market Size Over 10 Trillion Won

High Pricing Authority Enhances Profitability

PB Already the Trend in US and Europe

High Repurchase Intent and Preference

It is truly the golden age of private brands (PB·PL). PB refers to unique brand products launched by retailers through original equipment manufacturer (OEM) methods. PB has now become a core part of the distribution industry both domestically and internationally. Especially in an era of high inflation, consumers are increasingly seeking cost-effective PB products that rival established brands in quality and price. This is why major retailers such as large supermarkets and convenience stores are eagerly competing in the PB market.

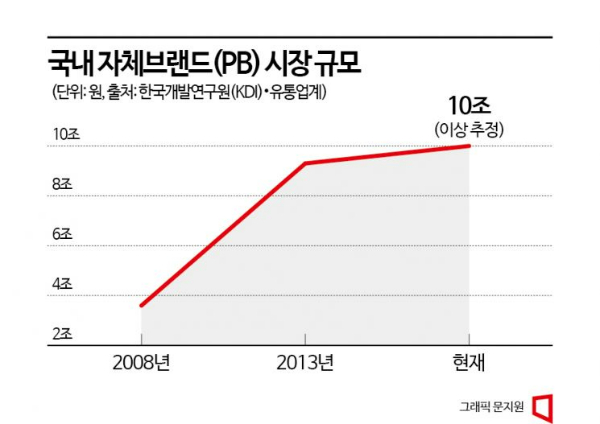

According to the Korea Development Institute (KDI) on the 16th, the domestic PB market has shown steady growth. In 2008, it was approximately 3.6 trillion won, but by 2013, it had surged to about 9.3 trillion won. Currently, PB product sales in large supermarkets have exceeded 5 trillion won, and considering the entire market including food, fashion, and beauty, it is estimated to be over 10 trillion won. This indicates that the popularity and demand for PB products continue to rise.

◆Domestic Market: Large Supermarkets and Convenience Stores ‘Battle for Supremacy’

In Korea, large supermarkets and convenience stores are fiercely competing in the PB market. The product range is gradually diversifying from food items to daily necessities. The focus on PB products is because retailers have freedom in selecting the display shelves and greater authority in pricing, which helps improve profitability. For example, Emart’s PB product sales account for about 20% of its total sales. Its flagship brand, ‘No Brand,’ currently operates around 1,500 products, with sales increasing from 830 billion won in 2019 to 1.27 trillion won last year. ‘Peacock’ sales rose from 250 billion won in 2019 to 420 billion won last year.

Lotte Mart launched its integrated PB brand ‘Oneul Joeun’ earlier this year, while the home meal replacement (HMR) brand ‘Yorihada’ operates separately. Currently, Oneul Joeun offers about 100 items, and Yorihada sells around 650 items. At Lotte Mart, PB product sales accounted for 10% of total sales from January to May this year. At Homeplus, the share of PB products in total sales increased from 4% in 2019 to 9% last year. During the same period, the number of PB products grew from about 900 to 3,000.

Convenience stores have challenged large supermarkets by introducing ultra-low-priced PB products. They aim to break the stereotype that convenience stores are expensive and secure the shopping demand of single- and two-person households. CU operates about 20 types of ultra-low-priced PB products under the ‘Deuktem Series,’ with cumulative sales surpassing 15 million units. GS25 introduced the ultra-low-priced cooperative PB ‘Real Price’ for general merchandise through GS The Fresh. Seven Eleven sells about 20 products under the ultra-low-priced brand ‘Goodmin.’ Emart24 offers around 50 products through its cost-effective line ‘I’m e,’ recording an average annual sales growth rate of 40%.

◆PB ‘Normalization’ in the U.S. and Europe

PB is a familiar concept to retailers worldwide. Especially in the U.S. and Europe, the share of PB products among retailers exceeds 50%. For a long time, they have expanded their product lines by emphasizing cost-effectiveness and high quality, and consumer preference for PB products has accelerated since the COVID-19 pandemic. In the U.S., the share of PB products is notably high at Aldi (82%), Trader Joe’s (58%), Wegmans (52%), and Costco (33%). Amazon holds about 7,000 PB products across apparel, electronics, groceries, and continues to expand its product lines. Kroger, the third-largest supermarket chain, sells over 15,000 products through 29 PB brands and invested $70 million last year to produce its own brand of aseptic milk.

In Europe, the ‘PLMA International Private Label Trade Show’ was held on April 23-24 in Amsterdam, Netherlands. This event is a platform to discover new products and exchange ideas in line with the rapid growth of the PL market worldwide. PL refers to products developed by small to medium-sized manufacturers or custom-made by order of retailers, similar to PB in Korea. This year, over 2,600 global retailers and OEM manufacturers from 125 countries participated. According to market research firm NielsenIQ, PL products significantly increased last year in 17 European countries excluding Switzerland. The PL market share in Germany, the UK, and France was 38.5%, up 1.1% from the previous year. The countries with the largest increase in PL product share were the Czech Republic (3.5%), Portugal (2.9%), Spain (2.2%), and Hungary (2.2%).

People are viewing the PLMA International Private Label Exhibition held in Amsterdam, Netherlands, on the 23rd and 24th of last month. [Image source=PLMA]

People are viewing the PLMA International Private Label Exhibition held in Amsterdam, Netherlands, on the 23rd and 24th of last month. [Image source=PLMA]

Professor Eunhee Lee of Inha University’s Department of Consumer Studies said, “The PB ratio in the U.S. and Europe is higher than in Korea. While high inflation has a short-term impact, advanced countries face a low-growth era. Ultimately, consumers want a certain level of quality at a low price. Recently, retailers have been analyzing data to offer products that meet customer demand at reasonable prices, and collaboration with domestic and international OEM companies has become easier compared to before.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)