KRW/JPY Exchange Rate Drops About 10% in Just Two Months

KRW/USD Exchange Rate and Gold Also in Adjustment Phase

The prices of safe-haven assets such as the US dollar, Japanese yen, and gold continue to decline. This is due to growing expectations both inside and outside the market that the interest rate hike cycles of central banks around the world are entering their final stages.

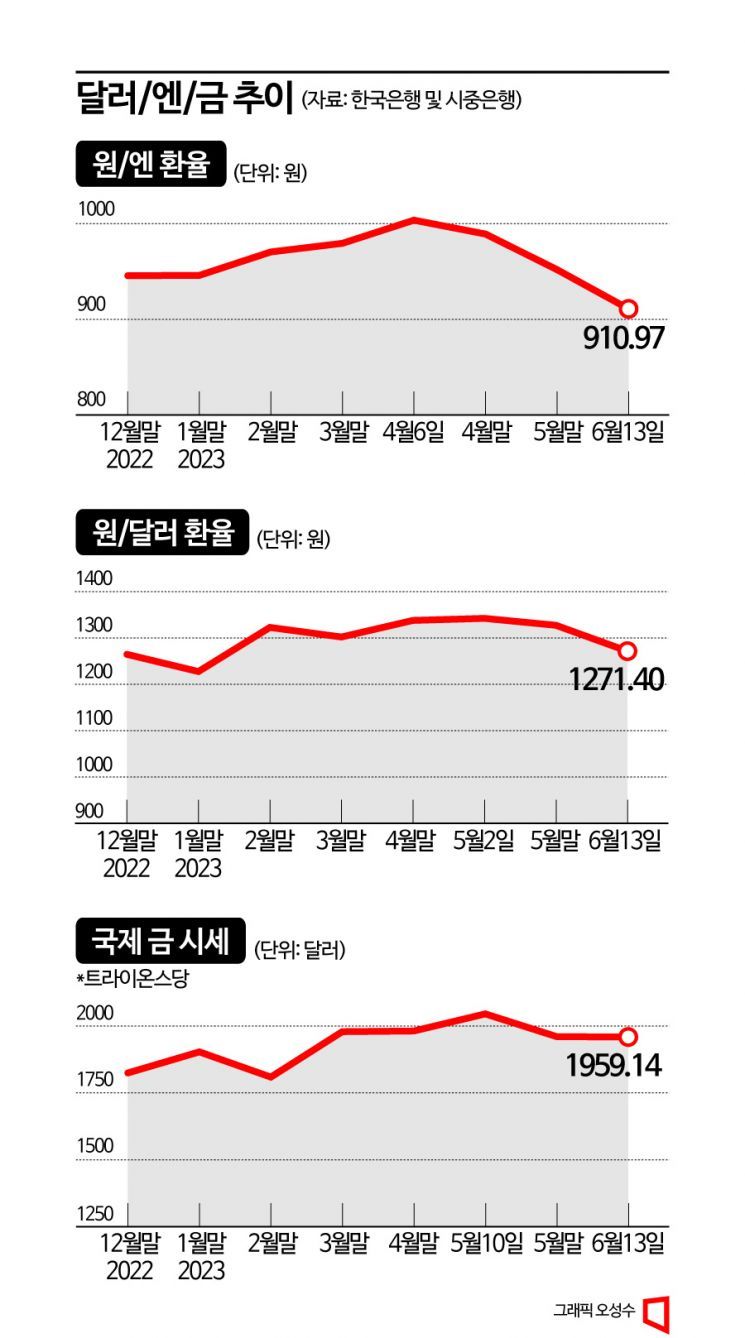

According to the Bank of Korea on the 16th, the won-dollar exchange rate was 1,271.40 won as of the 13th. The won-dollar exchange rate, which had remained in the 1,300 won range until last week, fell for three consecutive days and dropped into the 1,200 won range. The won-dollar exchange rate, which had declined to 1,227.40 won at the end of January, rose to 1,322.60 won at the end of February, 1,301.90 won at the end of March, and 1,337.70 won at the end of April, and even reached 1,342.10 won in early May. However, it has since trended downward, falling about 5.1% from its peak as of the 13th.

This trend is also seen in the yen. As of the 13th, the won-yen exchange rate closed at 910.97 won per 100 yen, marking the lowest point this year. This represents a 9.2% decline from the yearly high of 1,003.61 won on April 6. In just two and a half months, the exchange rate has dropped by more than 10%. The won-yen exchange rate had been rising steadily since recording 945.98 won at the end of January, reaching 970.40 won at the end of February and 979.42 won at the end of March, peaking at 1,003.61 won in early April before continuing its downward trend. It is now lower than the levels seen in November last year (931.44?968.77 won), when there was a yen 'hoarding' phenomenon.

Gold prices, which typically move inversely to the dollar, are also on a downward trend. According to Shinhan Bank, as of the 13th, the international gold price was $1,959.14 per troy ounce (T.oz = 31.1g). This is about 4.2% lower than the peak of $2,045.58 on May 10.

The reason for the decline in the won-dollar exchange rate is attributed to growing market expectations that the interest rate hike cycle is coming to an end. The US Federal Reserve (Fed) also held its benchmark interest rate steady at 5.00?5.25% during the Federal Open Market Committee (FOMC) regular meeting held on the 14th (local time), skipping a rate hike for the first time in 15 months. Expectations that the semiconductor market may recover in the second half of the year are also influencing this trend.

The weakening of the won-yen exchange rate is also related to this. While the won is showing relative strength, the Bank of Japan (BOJ) continues its accommodative monetary policy, causing the yen to weaken against the dollar, which in turn is pushing the won-yen exchange rate downward. Some expect the won-yen exchange rate could temporarily reach the 800 won range.

Gold prices, which had been rising due to the collapse of Silicon Valley Bank (SVB) in the US in March and the increase in gold reserves by central banks worldwide, briefly surpassed $2,000 per troy ounce in May but have recently entered a correction phase. The Bank of Korea responded to calls for increasing gold reserves by stating, "Considering that gold prices are already close to previous highs, the potential for further increases is uncertain," and added, "A strong dollar can emerge anytime depending on the global economic situation, and the fact that real interest rates, which represent the opportunity cost of holding gold, have turned positive is also a limiting factor for price increases."

Experts believe that safe-haven assets are likely to remain weak for the time being. A financial sector official said, "As the Fed begins to moderate the pace of tightening, market expectations for interest rate cuts are growing, so safe-haven assets are likely to continue to weaken for the time being," adding, "Investors are also turning their attention to domestic stocks and long-term bonds as investment assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.