Despite Consecutive Hawkish Remarks, Expectations for Rate Cuts

Challenge to Bridge the Gap Between Market and Monetary Policy

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Committee meeting held on the 25th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Committee meeting held on the 25th at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

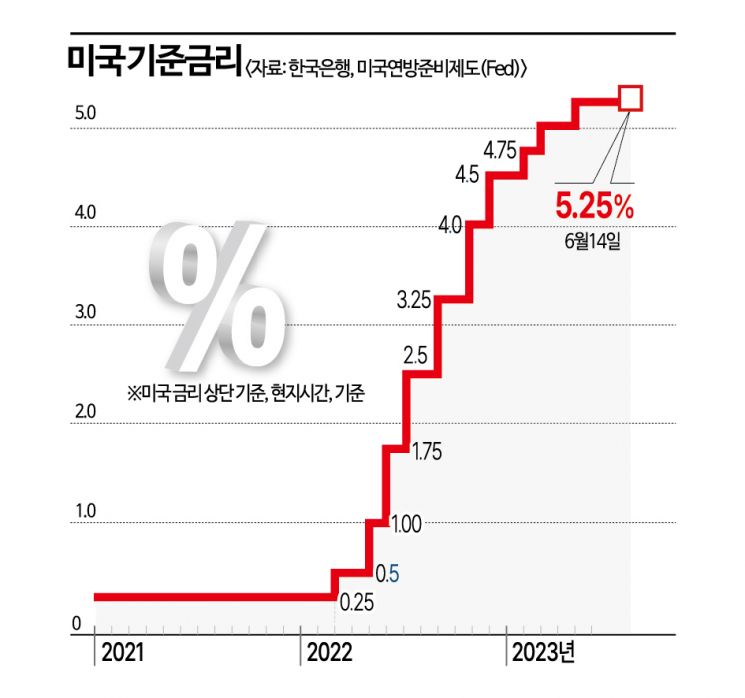

The U.S. Federal Open Market Committee (FOMC) kept the benchmark interest rate unchanged as expected, but strongly hinted at additional hikes within the year, which is expected to pose a variable for the Bank of Korea's monetary policy. If the U.S. Federal Reserve (Fed) raises rates again next month, the interest rate gap between Korea and the U.S. could widen to a historic high, potentially increasing exchange rate volatility due to foreign capital outflows. However, despite hawkish remarks from central bank heads including the U.S., market expectations for rate cuts have not diminished, making it a major challenge for central banks to bridge the gap between the market and monetary policy.

On the morning of the 15th, the Bank of Korea held a 'Market Situation Review Meeting' chaired by Deputy Governor Lee Seung-heon, stating that expectations for monetary policy could change depending on future economic indicators. Deputy Governor Lee said, "It is necessary to note that the recent FOMC raised the year-end policy rate outlook on the dot plot and that Fed Chair Jerome Powell’s press conference remarks suggested the possibility of additional rate hikes while denying the possibility of rate cuts within the year," adding, "The monetary policy stance of major central banks is strengthening, as seen with Australia and Canada resuming rate hikes."

At this FOMC meeting, the U.S. policy rate was held steady at 5.00?5.25% as the market expected. Despite the Fed’s hawkish stance on future policy direction, the market expects that additional rate hikes may be limited to one. Consequently, U.S. Treasury yields fell and the U.S. dollar closed weaker. Deputy Governor Lee emphasized, "The market’s reaction shows some gap from this monetary policy stance, and as expectations for monetary policy may change depending on major economic indicators to be released, volatility in domestic and international financial markets could increase. We will closely monitor related market conditions."

The Bank of Korea breathed a sigh of relief as the Fed held its benchmark rate steady, but concerns are deepening as the possibility of rate hikes in the second half of the year remains alive. If the Fed realizes two additional hikes within the year, the gap with Korea’s current benchmark rate of 3.5% could widen to as much as 2.25 percentage points. Such a rate differential could accelerate foreign capital outflows and spur a rebound in the won-dollar exchange rate, which has recently shown a stable trend.

Lowering excessive market expectations for rate cuts is also a challenge for the Bank of Korea. Governor Lee Chang-yong poured cold water on the market’s hopes by saying right after last month’s monetary policy meeting, "The market’s expectation that the benchmark rate will be cut within the year is excessive." The Reserve Bank of Australia surprised by raising its benchmark rate last month and continued its hike path this month. The Bank of Canada, which had declared a pause in rate hikes, also surprised with a rate increase this month after three months.

Monetary Policy Board members have also emphasized the need for tightening for a considerable period. According to the minutes of last month’s Monetary Policy Board meeting released on the 13th, one board member expressed the view that maintaining tightening through a hold is not enough and that additional rate hikes should be considered if necessary. This member said, "If convergence to the inflation target is judged to be significantly delayed, we must actively respond through additional rate hikes, etc."

Joo Won, head of economic research at Hyundai Research Institute, said, "Although U.S. consumer prices have slowed, excluding oil prices the slowdown is slower, so there is a possibility that the U.S. will raise rates once more depending on indicators," and added, "Going forward, central banks will face the market’s expectations for rate cuts and the key issue will be how much longer they maintain rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)