Differentiation from Entry-Level Brands to High-End Lines

Strategy to Recover Demand Shrunk by Smartwatches

Japanese watch brands Citizen and Seiko, known for their entry-level watches, are further strengthening their premiumization strategies. As the number of smartwatch users rapidly increases and the analog watch market shrinks, they are differentiating themselves with high-end lines.

On the 15th, Asahi Shimbun reported that Citizen recently announced a new product in its premium brand line, "The Citizen." This new model was launched at 880,000 yen (8 million KRW). This is quite different from Citizen's usual approach, which typically offered mid-to-low price lines ranging from 400,000 to 1 million KRW. The limited edition, with only 200 units available, is priced at 1,045,000 yen (9.56 million KRW).

Citizen has set a policy to continue focusing on automatic watches, expecting stable demand and market growth. In particular, it plans to target overseas markets starting next year by promoting its high-end line, The Citizen.

Citizen is recently putting effort into its high-priced lines, which cost several million won. In addition to The Citizen, it has also released the "Campanola," which displays real-time constellations on the dial, and the ultra-thin wristwatch "Eco-Drive One," with a watch movement thickness of only 0.3 mm.

Citizen revised its strategy because its series launched in the so-called "affordable price range" of 50,000 to 200,000 yen (450,000 to 1.82 million KRW) struggled. Consumer sentiment was once dampened by COVID-19, and the perception that "if it's the same price, people buy smartwatches" further hurt sales. As a result, by raising the average unit price and focusing on premiumization to enhance brand value, Citizen's high-end line sales increased by more than 30% compared to the previous year.

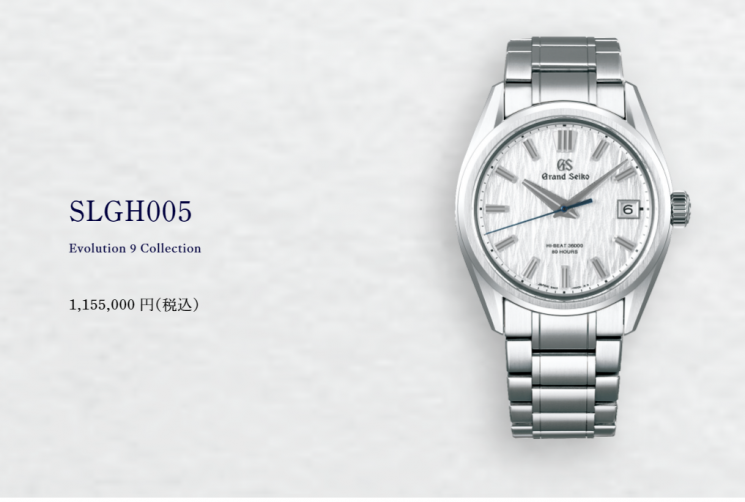

Seiko is following a similar path. Through its high-end brand "Grand Seiko," Seiko is differentiating itself ahead of Citizen. Depending on the series, Grand Seiko watches are generally available for 3 to 7 million KRW. However, over the past four years, Grand Seiko has been releasing watches priced between 20 million and 30 million yen (182.15 million to 273.23 million KRW) annually. Especially notable is the Shirakaba series, known in Korea as the "Birch Tree Watch," designed to resemble birch wood, which costs over 1 million yen (9.1 million KRW).

Grand Seiko Shirakaba watch from Japan. The price is 10.51 million KRW. (Photo by Grand Seiko official website)

Grand Seiko Shirakaba watch from Japan. The price is 10.51 million KRW. (Photo by Grand Seiko official website)

Earlier, in October last year, Seiko released the "Kodo," which took 10 years to develop. The name "Kodo" means "heartbeat" in Japanese. This watch is priced at 44 million yen (404.6 million KRW) including tax. The 20 units released worldwide sold out immediately both domestically and internationally.

Seiko began focusing on premiumization in 2017. At that time, Seiko's popularity spread through social media, as young Americans started buying the brand, calling it a "self-discovered brand." Additionally, a premium watch craze began among young Japanese people. While high-end watches in Japan were traditionally perceived as purchases mainly by middle-aged and older people to commemorate retirement, young people have now emerged as a key customer base.

For this reason, Grand Seiko has also been working to create a luxurious store atmosphere, changing the color scheme of its directly managed stores to white since this spring.

Seiko has also greatly benefited from its "premiumization strategy." According to Chrono24, a specialized high-end watch website, Seiko ranked 7th globally in 2019, rose to 4th in 2020, and climbed to 3rd in 2021. It maintained 3rd place last year, placing it alongside Swiss brands Rolex and Omega.

According to statistics from the Japan Watch & Clock Association, Japanese manufacturers shipped 52.2 million units last year, the same level as the previous year, but shipment value increased by 12% to 255.8 billion yen (2.3289 trillion KRW). This indicates an increase in sales of high-end watches.

Masaharu Nabata, editor-in-chief of the Japanese watch magazine Gracious, commented on this differentiation strategy, saying, "Because wealthy people could not travel abroad due to COVID-19, they shifted their spending to other areas. Wristwatches are small and do not take up space, so high-end watches experienced a boom both domestically and internationally during the pandemic." He added, "Japanese watch brands are praised for their performance, but the key will be whether they can create watches that capture both form and function, embodying a uniquely Japanese sensibility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.