Isu Specialty Chemical Gains Attention with 9 Consecutive Trading Days of Rise After Re-listing

Split for Management Efficiency... Growth Potential Highlighted in All-Solid-State Battery Business

Major Shareholder Strengthens Control through OCI Split... Stock Price Shows Weak Trend

Isu Specialty Chemical, which was re-listed after a spin-off from Isu Chemical, has attracted attention as a hot stock by recording nine consecutive trading days of gains. In contrast, OCI, which chose the same spin-off method, has seen its stock price continue to struggle. Opinions are divided over whether the spin-off was a choice to enhance business competitiveness or a trick to strengthen the controlling shareholder's power, with the divergent stock prices reflecting the market's evaluation.

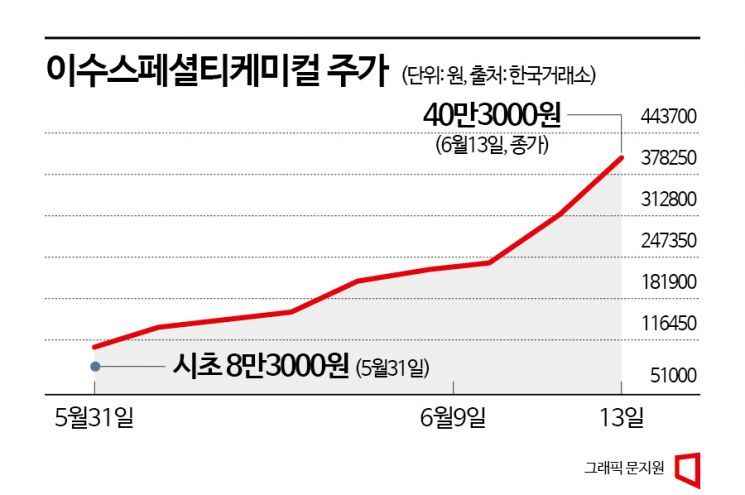

According to the Korea Exchange, Isu Specialty Chemical rose for nine consecutive trading days from its re-listing on May 31 to June 13. On the 13th, Isu Specialty Chemical closed at 403,000 KRW, hitting the daily price limit (30.00%). This is about five times the opening price of 83,000 KRW on May 31 and more than ten times the valuation price of 41,500 KRW. On its first day of re-listing, May 31, Isu Specialty Chemical also hit the price limit, closing at 107,900 KRW. Isu Specialty Chemical is a precision chemical and all-solid-state battery material specialist company spun off from Isu Chemical, an affiliate of the Isu Group. After the spin-off, Isu Chemical (the petrochemical division of the former Isu Chemical), which resumed trading on the 31st of last month, also continued its upward trend for two consecutive trading days, indicating that the market views the spin-off as a positive development.

As Isu Specialty Chemical surged sharply in a short period after re-listing, the Korea Exchange designated it as an investment warning stock on the 9th. Despite this, the stock price continued to rise and was suspended from trading on the 14th.

At a similar time, OCI, which also spun off and listed, has experienced a sluggish stock price trend. After its spin-off, OCI, which was listed on the 30th of last month, closed down 13%. The next day, it showed some strength by rising 17% compared to the listing day but has since declined continuously, showing a weak stock price trend. On the 13th, OCI closed at 129,800 KRW, up 3.43% from the previous trading day. However, this is 18.87% lower than the intraday high of 160,000 KRW on the re-listing day, May 30.

The reason for the divergent stock price trends of the two companies that chose the same spin-off method around the same time is analyzed to be due to different purposes of the spin-offs. The fundamental purpose of a corporate spin-off is to improve management efficiency. However, it can also be used as a ‘trick’ by controlling shareholders to increase their control over the entire group with a small equity stake.

In fact, Isu Specialty Chemical had a solid governance structure even before the spin-off. Looking at the Isu Group's governance, Isu Exachem is the largest shareholder holding 73.44% of the group's shares. Kim Sang-beom, chairman of Isu Exachem, owns 100% of Isu Exachem's shares.

In contrast, OCI's controlling shareholder, Lee Woo-hyun, chairman of OCI Holdings and eldest son of the late Lee Soo-young, holds only 5.04% of OCI shares. OCI Holdings plans to incorporate OCI as a subsidiary through a public tender offer involving in-kind contributions and paid-in capital increases. After the spin-off, if the controlling shareholder transfers the new company's shares to the holding company and participates in the holding company's paid-in capital increase, the controlling shareholder can strengthen control without spending any money. For this reason, the market views OCI's spin-off as a signal that the owner family is trying to strengthen their control.

OCI is not alone. Dongkuk Steel, which completed its spin-off earlier, was split into three companies?Dongkuk Holdings, Dongkuk Steel, and Dongkuk CM?on the 1st of this month. Dongkuk Steel also explained the spin-off decision as a measure to strengthen competitiveness by business segment, but the market evaluates it as a choice to increase the group control of Chairman Jang Se-ju's eldest son, Executive Director Jang Seon-ik. Chairman Jang Se-ju holds 13.94% of shares, and his brother, Vice Chairman Jang Se-wook, holds 9.43%. Executive Director Jang Seon-ik holds only 0.84%. Although he can inherit the chairman's shares, he would have to pay a huge inheritance tax. Dongkuk Steel also announced plans to conduct a public tender offer involving in-kind contributions and paid-in capital increases to secure shares of Dongkuk Steel and Dongkuk CM through Dongkuk Holdings, similar to OCI's method.

The ‘magic of treasury shares’ during the spin-off process also contributes to strengthening the owner family's control. The ‘magic of treasury shares’ refers to a company holding treasury shares that, when converting to a holding company structure through a spin-off, uses the voting rights of treasury shares to increase control over subsidiaries without additional investment. Although treasury shares generally do not have voting rights, when new shares are allocated to the newly established company through the spin-off, treasury shares are also allocated new shares.

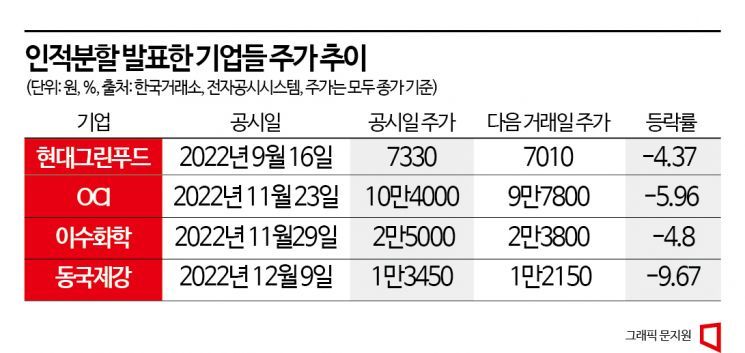

According to the Financial Supervisory Service, the number of companies disclosing spin-offs increased more than twofold from five in 2021 to 13 in 2022. Major companies that disclosed spin-offs include Dongkuk Steel, Hanwha Solutions, Hyundai Green Food, and OCI.

Kim Jun-seok of the Korea Capital Market Institute pointed out, “The ‘magic of treasury shares’ in the spin-off process represents a conflict of interest between controlling shareholders and outside shareholders and infringes on the interests of outside shareholders,” adding, “Although the Fair Trade Commission has recognized the need for institutional improvement, it is still frequently used during the holding company conversion process.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.