The upward trend in the transaction turnover rate, which indicates the vitality of the real estate sales market, has stopped after four months. Recently, as urgent sale properties have been exhausted and asking prices have risen, buyers have shifted to a wait-and-see stance, leading to a decrease in transactions and the real estate market struggling to gain momentum.

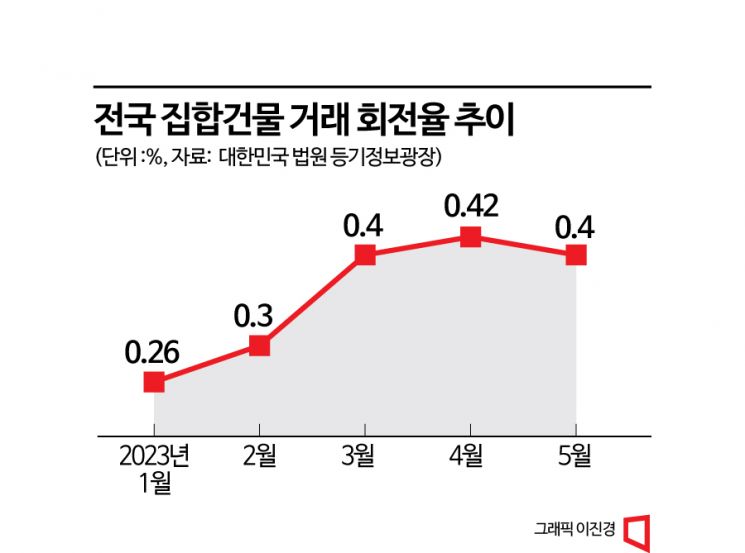

According to the Korea Court Registry Information Plaza on the 13th, the transaction turnover rate for collective buildings (apartments, multi-family/row houses, officetels, etc.) nationwide last month was 0.40%. This is a decrease of 0.02 percentage points from the previous month (0.42%). After rebounding in February, it had steadily increased but the upward trend was broken after four months. Starting from 0.26% in January, it showed a continuous rise in February (0.30%), March (0.40%), and April (0.42%).

The transaction turnover rate is an indicator used to compare the level of activity in the real estate sales market. It is calculated by dividing the number of real estate properties for which ownership transfer (sales) applications have been submitted by the number of real estate properties available for transaction as of the end of the month, then multiplying by 100. A turnover rate of 0.40% means that out of 10,000 collective buildings, 40 were sold.

By region, among the 17 metropolitan cities and provinces nationwide, the transaction turnover rates for collective buildings last month decreased compared to the previous month in Busan (0.41%→0.35%), Daegu (0.47%→0.37%), Incheon (0.78%→0.63%), Gwangju (0.57%→0.32%), Gyeonggi-do (0.48%→0.4%), and Chungnam (0.65%→0.52%).

However, Seoul and Gyeongsangbuk-do have seen a steady increase in the transaction turnover rate for collective buildings since January this year. Seoul hit a low of 0.15% in January and then increased to ▲0.16% in February ▲0.21% in March ▲0.22% in April ▲0.27% in May. Gyeongbuk also steadily rose from 0.23% in January to 0.39% last month.

The market views the pause in the upward trend of the transaction turnover rate as due to the exhaustion of urgent sale properties and rising asking prices, which have led buyers to adopt a wait-and-see attitude. Go Jun-seok, CEO of J.Edu Investment Advisory, said, "It is analyzed that transactions are slowing down due to the combined effect of increased price burdens after the exhaustion of urgent sale properties and the seasonal off-peak period. However, since regulations have been eased by the 1.3 real estate measures and loan interest rates have stabilized, attracting actual demand buyers and revitalizing transactions mainly in Seoul, it is necessary to monitor transaction volumes after May to determine whether the overall market is normalizing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.