"Much Bigger Shock Than the 2008 Crisis

Invest in Gold and Bitcoin Instead of Real Estate"

Robert Kiyosaki, famous for the global bestseller "Rich Dad, Poor Dad," has warned of the worst real estate crash in history.

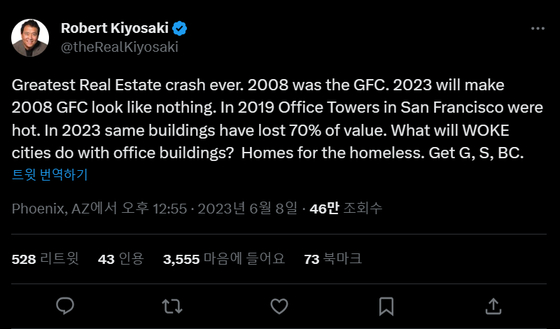

On the 8th (local time), Kiyosaki stated on his Twitter, "The real estate price crash in 2023 will make the 2008 global financial crisis look like nothing."

He cited evidence, saying, "Office tower prices in San Francisco, USA, have plummeted by more than 70% compared to 2019," and claimed, "The 2023 real estate crisis will overshadow the 2008 financial crisis."

He continued, "As office towers lose value, they will turn into shelters for the homeless," emphasizing, "Investors need to buy gold, silver, and Bitcoin to preserve their portfolios."

On the 8th (local time), Robert Kiyosaki posted on his social media (SNS) predicting the worst real estate crash in history.

On the 8th (local time), Robert Kiyosaki posted on his social media (SNS) predicting the worst real estate crash in history. [Photo by Robert Kiyosaki SNS capture]

Since the collapse of Silicon Valley Bank (SVB) in the US last March, warnings surrounding the US commercial real estate market have been nonstop.

Janet Yellen, US Treasury Secretary, said on the 7th (local time), "Some banks are facing profit pressure due to the commercial real estate market downturn, so there is a possibility that small banks will consolidate."

However, she added, "It would not be surprising to see some banks consolidate and for that process to proceed."

Earlier in April, The Wall Street Journal (WSJ) reported that the office vacancy rate in the US rose to 12.9% in the first quarter, setting a new milestone. This is higher than the level during the 2008 financial crisis. According to the Cresa Group, it was the highest vacancy rate since records began in 2000.

Additionally, according to real estate analytics firm Green Street, office building prices have dropped 25% since early 2022. Shopping mall prices fell 19% during the same period, and have decreased by 44% since 2016.

As building values decline, it could affect city governments that rely on real estate tax revenue and impact banks' balance sheets, potentially leading to a reduction in lending across the economy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.