This month, the Seoul apartment pre-sale outlook index surpassed the baseline of 100 for the first time in 13 months. This appears to be due to the revival of real estate buying sentiment amid government deregulation and stable market interest rates.

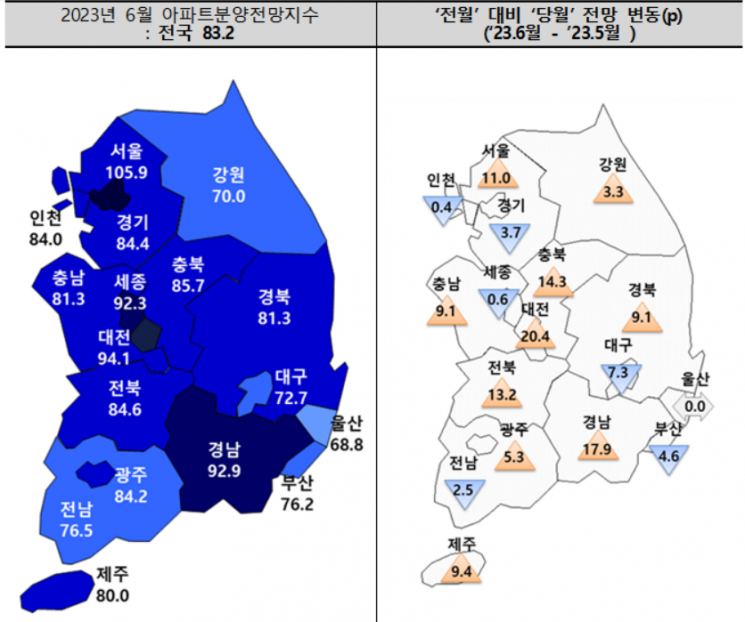

On the 8th, the Korea Housing Industry Association (KHIA) conducted a survey among housing developers, revealing that the nationwide average apartment pre-sale outlook index for June rose by 5.5 points from May to 83.2. The Seoul metropolitan area is expected to increase by 2.3 points, metropolitan cities by 2.2 points, and other provinces by 9.2 points.

In particular, Seoul's apartment pre-sale outlook index this month recorded 105.9, up 11.0 points from the previous month. This is the first time in 13 months since May last year (105.0) that Seoul's pre-sale outlook has exceeded 100. An index above 100 indicates a positive pre-sale outlook, while below 100 indicates a negative one.

By region, most provinces are expected to see increases: Daejeon by 20.4 points (73.7→94.1), Gyeongnam by 17.9 points (75.0→92.9), Chungbuk by 14.3 points (71.4→85.7), Jeonbuk by 13.2 points (71.4→84.6), Jeju by 9.4 points (70.6→80.0), Gyeongbuk by 9.1 points (72.2→81.3), Chungnam by 9.1 points (72.2→81.3), Gwangju by 5.3 points (78.9→84.2), and Gangwon by 3.3 points (66.7→70.0).

Conversely, Daegu is expected to decline by 7.3 points (80.0→72.7), Busan by 4.6 points (80.8→76.2), Gyeonggi by 3.7 points (88.1→84.4), Jeonnam by 2.4 points (78.9→76.5), Sejong by 0.6 points (92.9→92.3), and Incheon by 0.4 points (84.4→84.0).

A KHIA official stated, “With the government's deregulation policy, the sales prices in some areas of Seoul have turned upward, increasing positive expectations for the pre-sale market.” However, they added, “Except for certain complexes in Seoul, the success of pre-sale projects remains uncertain, and polarization and localization in the pre-sale market are expected to intensify.”

This month’s pre-sale price outlook index rose 3.1 points from the previous month to 103.1, surpassing 100 for the first time since October last year. Due to consecutive increases in raw material costs, labor costs, and financial expenses, along with the mandatory implementation of zero-energy buildings starting next year, government regulations are expected to further pressure construction costs, leading to higher pre-sale prices. The continuous rise in construction costs and stricter building standards make an increase in apartment costs inevitable.

The apartment pre-sale volume index is expected to rise by 2.5 points. However, it remains below the baseline because many projects have postponed their pre-sales, resulting in supply not meeting the original pre-sale plans.

Conversely, the unsold inventory outlook fell by 7.5 points from the previous month to 98.5, dropping below 100. The easing of real estate regulations and the freeze on the base interest rate have slightly revived housing buying sentiment, which appears to have slowed the increase in unsold inventory.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.