Amid recent weakness in the yuan due to concerns over China's economic slowdown, a survey revealed that in 10 years, the yuan is expected to surpass the British pound and Japanese yen in status as a global currency. In particular, there is also a forecast that the use of the yuan will increase among member countries of the Regional Comprehensive Economic Partnership (RCEP), a massive China-led multilateral free trade agreement (FTA).

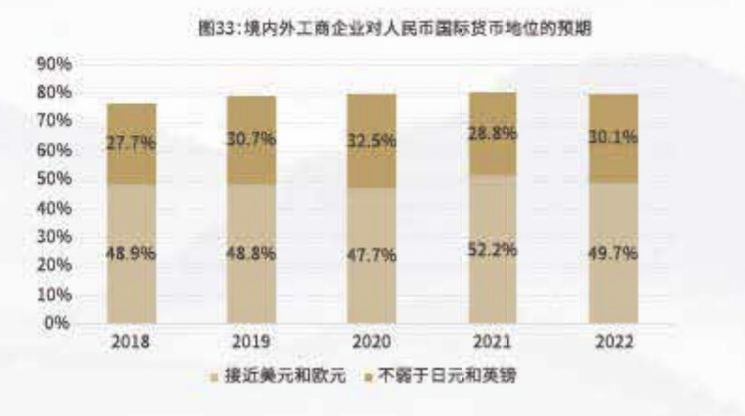

According to the "2022 Yuan Internationalization White Paper" recently published by Bank of China, a Chinese state-owned commercial bank, a survey conducted on 3,600 Chinese and overseas companies and 82 overseas financial institutions showed that 79.89% of respondents believe the yuan's status as an international currency could catch up with the pound and yen in 10 years. Although this forecast is slightly lower compared to 81% a year ago and 80.2% in 2020, it reflects the industry's outlook that the internationalization of the yuan will proceed smoothly despite the intensifying US-China hegemonic rivalry.

Additionally, 78.6% of the surveyed companies responded that they would choose the yuan as a new funding currency when liquidity is insufficient and the supply of dollars and euros is not smooth. This is a 7.4 percentage point increase compared to the previous year. Furthermore, 71.8% of the surveyed companies said they would prioritize using the yuan for trade finance with China, up 3.5 percentage points from the 2021 survey. The white paper stated, "The willingness of overseas companies to use the yuan for trade finance with China has reached its highest level in the past three years," and evaluated that "the US has continued to raise interest rates, dollar liquidity has tightened, and the attractiveness of the yuan to overseas participants has increased."

Respondents anticipated an increase in yuan settlements among RCEP member countries, which include the 10 ASEAN countries, South Korea, China, Japan, New Zealand, and Australia. When asked whether they would increase the use of the yuan in trade within the RCEP region, 58.7% of Chinese companies and 42.2% of overseas companies answered "very positive." In fact, last year, the proportion of cross-border yuan remittances in the RCEP free trade zone reached 18.9%, an increase of 12.8 percentage points compared to 2020. The white paper also mentioned the increase in yuan transactions in Russia last year and predicted that offshore yuan transactions in Africa could increase. It particularly emphasized that Chinese financial institutions in Zambia, South Africa, Angola, Djibouti, and Mauritius could start yuan deposit, loan, and remittance services.

There was also mention of South Korea. South Korea's outstanding yuan deposits decreased by 4.8% year-on-year to $1.78 billion last year, while the total amount of yuan remitted and paid in South Korea increased by 14.4% to 1.6 trillion yuan. The white paper cited SWIFT system data, explaining that "the proportion of yuan settlements in South Korea's import and export trade shows a gradual increase," with the import share at 1.5% and the export share at around 2%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.