89% of Total Foreign Net Purchases from January to May Belong to Samsung Electronics

KOSPI Also Rises 17.5% in Same Period, Surpassing 2600 Points

Negative Factors Include Recession Concerns and Potential Additional Tightening

Although foreigners have increased their net purchases in the Korean stock market and the KOSPI has surpassed the 2600 mark, it is still considered premature to adopt an optimistic outlook. This is because foreigners have concentrated their net buying solely on Samsung Electronics. Considering concerns about an economic recession and the possibility of interest rate hikes, the possibility of a market correction cannot be ruled out.

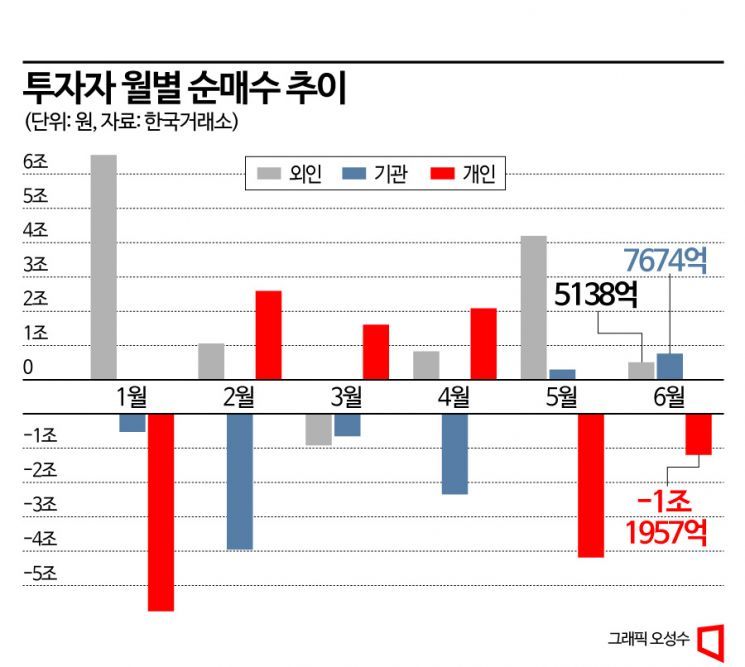

According to the Korea Exchange, foreigners made net purchases worth 4.1925 trillion KRW last month (May). Foreigners bought stocks worth 6.5494 trillion KRW in January and 1.0596 trillion KRW in February. In March, they turned to net selling with 917.5 billion KRW, but after net buying 833 billion KRW in April, they increased their buying scale in May.

However, looking at the top stocks in foreigners' net purchases, a concentration in semiconductors, especially Samsung Electronics, was prominent. From January to this month (up to the 7th), the top net purchase stock was Samsung Electronics every month. Notably, out of the total net purchase amount of 11.717 trillion KRW from January to May, 89%, or 10.4062 trillion KRW, was attributed to Samsung Electronics.

Samsung Electronics' market capitalization accounts for 20.08% of the KOSPI. The market capitalization shares of the second and third largest companies, LG Energy Solution and SK Hynix, are only about 6.69% and 3.72%, respectively. This means that even if foreigners or institutions buy only Samsung Electronics, they can drive the index upward. Thanks to foreigners' net buying of Samsung Electronics, the KOSPI rose 17.5% from 2225.67 at the beginning of the year to 2615.60.

The market believes that for the stock market to show a sustained upward trend, overall investor sentiment must improve. The main variables related to this are concerns about an economic recession and the possibility of additional interest rate hikes in the United States. The consensus is that these two variables have not yet been reflected in the stock market. Until last week, the biggest issue in the market was the US debt ceiling negotiations.

The World Bank (WB) on the 6th (local time) slightly raised its global economic growth forecast for this year to 2.1%, up from the projection in January. However, it expects weakness to continue until next year due to the impact of the Ukraine war and tightening monetary policies. In contrast, the Bank of Korea lowered its economic growth forecast for South Korea this year from 1.6% to 1.4%, slightly revising it downward considering the slowdown in exports. When the economy slows, investor sentiment toward risk assets also weakens. This means that foreigners' net buying concentrated on Samsung Electronics may also falter.

The possibility of additional interest rate hikes by the US Federal Reserve (Fed) this year is also a variable. It is widely expected that the Federal Open Market Committee (FOMC) will keep rates unchanged in June. The FedWatch tool reflects a 75% probability of a rate hold in June. This is because recent Fed officials have made statements suggesting a pause. Even if rates are held steady, hawkish comments reduce the likelihood of rate cuts. The market is paying attention to the possibility of rate cuts within the year. However, Fed Chair Jerome Powell's firm stance that 'there will be no rate cuts this year' is a negative factor for the stock market.

Yang Hae-jung, a researcher at DS Investment & Securities, explained, "In the second half of the year, as debates over the economy and rate cuts intensify, the stock market is expected to show a 'high start and low finish' pattern." He added, "However, the 'low finish' does not mean a sharp market crash. The second half will require rotation from large-cap and cyclical sectors (IT, automobiles, shipbuilding) to growth and defensive sectors (healthcare, food and beverages)."

The US bond market can also affect the domestic stock market. Typically, the US Treasury issues one-year bonds after concluding debt ceiling negotiations. Seo Sang-young, head of Future Asset Securities, expressed concern, saying, "The issuance of one-year US Treasury bonds is a factor that absorbs market liquidity amid a tightening stance, which is unfavorable for the Korean stock market," and warned, "There is a possibility of a meaningful market correction in June to July." He further analyzed, "Even if a correction occurs, there is a high possibility of a rebound from the end of the year due to expectations of an economic bottom and semiconductor industry recovery. If no correction occurs, profit-taking selling may emerge due to KOSPI valuation pressures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)