Stock Prices of Ssangyong C&E and Others Fall 25-40% in the Past Year

Operating Profit Declines Due to Increased Manufacturing Costs Including Electricity Price Hikes

Despite Price Increases, Housing Market Slump and Recession Concerns Likely Hinder Stock Price Recovery

Over the past year, major domestic cement companies in South Korea, which had experienced sluggish stock performance, have recently announced price increases one after another. While construction sites are in turmoil over the possibility of work stoppages due to rising raw material costs, cement companies are also facing difficulties. Despite having implemented two price hikes last year, their stock prices have continued to decline. Given the ongoing decrease in cement demand due to the housing market downturn, a turnaround is unlikely in the near term.

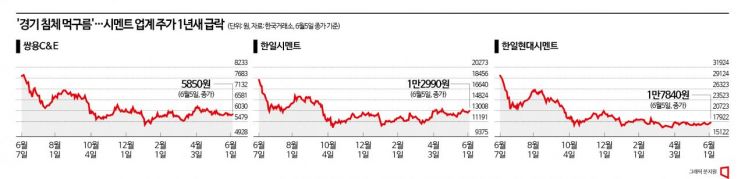

According to the Korea Exchange on the 7th, the stock price of Ssangyong C&E, the country's leading cement manufacturer and seller, has fallen about 25% over the past year. The stock price, which was approaching 8,000 KRW a year ago, stood at 5,850 KRW on the 5th.

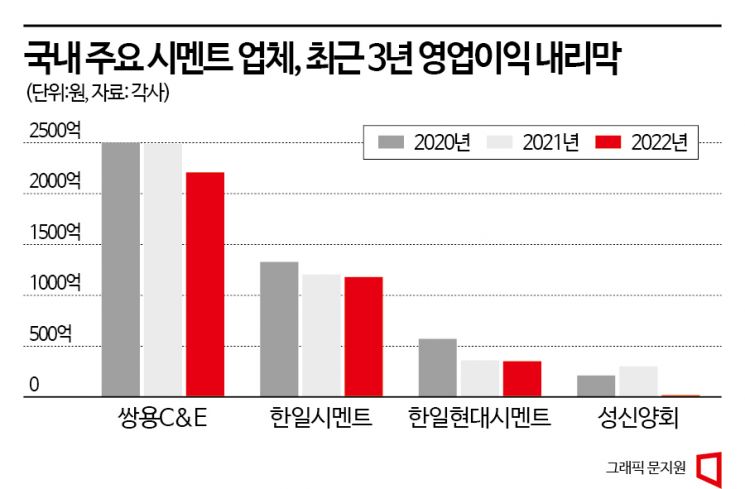

The decline in Ssangyong C&E's stock price is attributed to poor performance. The company's annual operating profit decreased for three consecutive years, from 250.2 billion KRW in 2020 to 248.7 billion KRW in 2021, and 220.9 billion KRW last year. Notably, in the first quarter of this year, it recorded an operating loss of 1.73 billion KRW, turning to a deficit. Despite a more than 30% increase in sales, operating profit was much lower than market expectations. Kyungtae Kang, a researcher at Korea Investment & Securities, pointed out, "Although domestic cement sales, which account for more than half of the company's size, increased, operating profit showed a loss due to the rise in cement manufacturing costs caused by electricity price hikes."

In fact, industrial high-voltage electricity charges account for about 30% of cement manufacturing costs, and after two increases in October last year and January this year, the price per kWh rose by more than 30% compared to the same period last year.

The situation is not much different for other competitors. Over the past year, Hanil Cement's stock price dropped about 31%, from 18,800 KRW to 12,990 KRW, and Hanil Hyundai Cement fell 40%, from 29,750 KRW to 17,840 KRW. Both companies have also seen a downward trend in operating profits over the past three years.

Unable to bear the cost burden including electricity fees, cement companies have pulled out the price increase card again following last year. After Ssangyong C&E announced at the end of last month that it would raise the price of Type 1 bulk cement by about 14%, Seongsin Yanghoe recently sent official letters to ready-mix concrete manufacturers indicating a similar price increase. Following this news, cement-related stocks collectively rose by around 1-2% on the 5th.

However, since the construction industry, which fundamentally determines cement demand, is not doing well and concerns about an economic downturn are emerging for the second half of the year, a stock price rebound seems difficult for the time being. Yurim Song, a researcher at Hanwha Investment & Securities, said, "The area of building starts began to decline last year and has shown double-digit decreases recently," adding, "From the second half of this year through next year, a decrease in domestic cement shipments is expected." Seonil Lee, a researcher at BNK Investment & Securities, also explained, "The increase in cement selling prices and the fact that the price of bituminous coal (a raw material) has peaked and is stabilizing downward are positive," but added, "The housing market downturn could lead to a greater-than-expected decrease in cement demand, which is negative."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)