Government's Service Industry Development TF on the 5th

'Service Export Policy and Support System Innovation Plan'

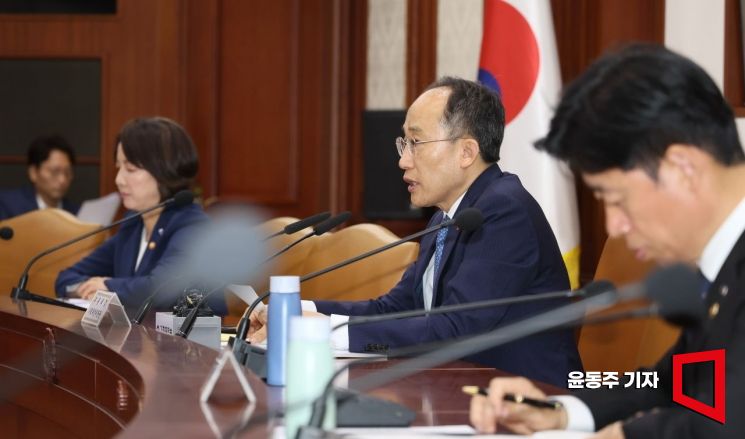

Deputy Prime Minister for Economy Choo Kyung-ho is delivering opening remarks at the Ministerial Meeting on External Economy and the UAE Investment Cooperation Committee held at the Government Seoul Office in Jongno-gu, Seoul on the 2nd. Photo by Yoon Dong-joo doso7@

Deputy Prime Minister for Economy Choo Kyung-ho is delivering opening remarks at the Ministerial Meeting on External Economy and the UAE Investment Cooperation Committee held at the Government Seoul Office in Jongno-gu, Seoul on the 2nd. Photo by Yoon Dong-joo doso7@

The government is launching an all-out effort to foster the service industry, which has been suffering from low productivity, current account deficits, and sluggish exports. It plans to supply export financing totaling 12 trillion won by this year and approximately 64 trillion won over five years until 2027, the largest scale ever, targeting key service sectors such as content, ICT, and healthcare.

On the 5th, the government held a Service Industry Development TF meeting and announced innovative measures for service export policies and support systems. The plan is to concentrate policy capabilities to enable our service industry to secure competitiveness comparable to manufacturing and to transform the export support system, which has been product-centered, into a service-friendly one. The government set a service export target of 200 billion USD (about 261.5 trillion won) by 2027 and 250 billion USD (326.875 trillion won) by 2030, aiming to turn the service trade balance into a surplus.

Transitioning Product-Centered Export Policies and Support Systems to Service-Friendly Ones

The government will supply export financing on an unprecedented scale to major service sectors. It will provide 12 trillion won by this year and about 64 trillion won over five years until 2027 for key service sectors such as content, ICT, and healthcare. In particular, it plans to increase the support scale of major export financing institutions like K-sure and KEXIM by about 8% annually, exceeding the average annual growth rate of service exports (5.9%) over the past five years. The total support amount from seven institutions (KEXIM, K-sure, KDB, IBK, KODIT, Kibo, and KIAT) over the past five years (2018?2022) was 50 trillion won.

Policy financing preferential conditions for service export companies will also be eased. For early-stage service export companies, a new export growth financing system will be established to reduce the burden of export performance certification. Instead of performance-based screening, the plan is to conduct limit screening focusing on financial status and growth potential. For promising service sector SMEs and mid-sized companies, the guarantee ratio will be increased, and special support such as guarantee fee discounts will be expanded.

Significant Expansion of Service Industry Exports... Budget Incentives for Well-Performing Institutions

The proportion of the service industry in existing export support projects will also be significantly expanded. Major export support institutions (KOTRA, KIAT, etc.) will increase their support for the service industry by more than 50% by 2027. For example, in the Ministry of SMEs and Startups’ export consortium project (supporting joint overseas expansion by forming identical or similar consortia), the share of support for exhibitions and consultation meetings for service companies’ overseas expansion will be increased. Each institution supporting service industry exports will raise the target for service industry support performance (based on the number of companies or budget amount) compared to the previous year, evaluate achievement levels, and reflect them in budget allocation, thereby establishing incentive mechanisms.

The export support projects, which have been designed based on manufacturing, will be improved to expand support for the service industry. For instance, the ‘Overseas Branch Sales Support Project’ (Small and Medium Business Corporation), which supports overseas buyer sales promotion costs exclusively for consumer goods, will add service sectors to its support targets. Promising sectors such as edutech may also be added to the BrandK (Ministry of SMEs and Startups) support project, which supports entry and promotion in global shopping malls exclusively for consumer goods. Policies targeting existing service companies will see a significant expansion in support scale. The Ministry of Economy and Finance stated, “We will support the creation of service overseas expansion business models specialized for the service industry and nurture 400 global leading companies by 2027.”

Tax support tailored to the characteristics of services will be prepared. The plan is to review tax support measures that consider the export-import characteristics of service export companies so that service exports can receive support equivalent to goods exports. Also, in the case of taxation on internal transactions, transactions for service export purposes (such as intellectual property royalties) will be excluded from taxation, just like manufacturing.

Supporting Joint Entry of Services Utilizing Manufacturing Competitiveness

A support system for joint entry of services utilizing Korea’s manufacturing competitiveness will also be established. The global partnering project, currently focused on materials, parts, and equipment, will be expanded to the service sector to create a manufacturing-service joint entry system. Global partnering is a project that matches excellent domestic companies based on the cooperation demand of global companies. For example, in the process of discovering demand for automobile parts, support for service demands such as AI solutions used in manufacturing and production processes will be added. Furthermore, companies linked between manufacturing and services will receive preferential treatment when participating in exhibitions and fairs. For small service companies with weak overseas expansion capabilities, risk mitigation support policies will be prepared through consortium formation among similar or related industries.

Utilizing Economic Diplomacy Achievements... Exploring Service Investment Opportunities in ASEAN

Leveraging economic diplomacy achievements, the government will explore investment opportunities for Korean service companies in ASEAN countries such as Indonesia and Saudi Arabia. The government plans to concretize existing achievements at the Korea-Indonesia Economic Joint Committee scheduled for July and promote the discovery of investment opportunities in ICT and healthcare sectors, which are of high interest in ASEAN. Investment opportunities will also be explored at the Korea-ASEAN High-Level Healthcare Meeting (June, Ministry of Health and Welfare), export delegations to Indonesia, Singapore, and Vietnam (June, Ministry of Science and ICT), and the G20 Digital Economy Ministers’ Meeting (August, Ministry of Science and ICT). Additionally, strategic negotiations by country will be pursued in ongoing FTA negotiations to favor the overseas expansion of domestic service companies. The government is currently negotiating the Korea-GCC (Gulf Cooperation Council, six countries) FTA (covering construction, hospital/medical sectors, etc.). Economic cooperation projects in service sectors will also be promoted through newly implemented FTAs such as RCEP (effective February 2022) and Korea-Indonesia CEPA (effective January 2023).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.