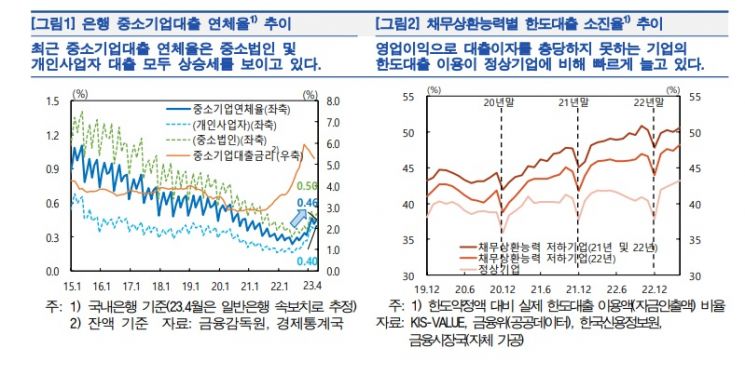

As the delinquency rate on bank loans to small and medium-sized enterprises (SMEs) has continued to rise since the second half of last year, concerns have been raised that financial conditions could rapidly deteriorate, particularly among vulnerable sectors such as non-audited SMEs with high debt ratios, regional real estate-related companies, and self-employed individuals and small business owners.

On the 4th, the Bank of Korea stated in its report titled "Financial and Economic Issue Analysis: Recent Assessment of SME Financial Conditions" that delinquency rates in regional areas are increasing at a faster pace than in the metropolitan area.

By industry, while delinquency rates have risen across most sectors, the increase has been more pronounced in certain service industries such as food, accommodation, retail and wholesale, as well as in construction, compared to manufacturing.

Reviewing SME business performance based on last year's financial statements, sales growth has continued, but the operating profit margin relative to sales remained at the same level as the previous year, and the net profit margin slightly declined. By industry, the operating profit margin improved in manufacturing but deteriorated somewhat in construction and some service sectors.

The Bank of Korea assessed that SMEs' debt repayment capacity has weakened, especially in vulnerable industries, due to increased interest repayment burdens from rising interest rates. It is estimated that the proportion of companies whose debt repayment capacity has declined to the point where operating profits cannot cover loan interest has increased, and as liquidity buffers have shrunk, the utilization rate of credit lines among these companies has steadily risen.

The Bank of Korea noted, "There does not appear to be a major problem with the overall financial conditions of SMEs at present. However, there is a possibility that difficulties may increase in the future, particularly in industries where delinquency rates are rapidly rising." It further analyzed that financial conditions could deteriorate faster than expected, especially among vulnerable sectors such as non-audited SMEs with high debt ratios, regional real estate-related companies, and self-employed individuals and small business owners.

The Bank of Korea emphasized, "Banks need to strengthen risk and asset quality management for these vulnerable industries. While continuing to provide funding to SMEs experiencing temporary liquidity shortages, proactive corporate restructuring efforts should be undertaken for companies with high risk of insolvency."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)