Negative Perceptions of Money Laundering Tools Harm Investors and Industry

Political Affairs Committee Approves Virtual Asset User Protection Act Integrating and Adjusting 19 Bills

Expectations for Image Improvement through Daxar Self-Regulation and National Assembly Legislation

Independent lawmaker Kim Nam-guk is leaving his office at the National Assembly on the afternoon of the 31st of last month. Photo by Yonhap News

Independent lawmaker Kim Nam-guk is leaving his office at the National Assembly on the afternoon of the 31st of last month. Photo by Yonhap News

The coin investment allegations involving Representative Kim Nam-guk (Independent) have inevitably dealt a blow not only to individual investors but also to the domestic virtual asset market. Virtual assets related to P2E (Play to Earn ? earning money while playing games), their issuing companies, and even domestic virtual asset exchanges have been directly hit by this incident. In particular, public perception of coins has worsened. Accordingly, the industry hopes that this incident will serve as an opportunity to establish a regulatory framework for the virtual asset market and that legislation will be enacted to enhance trust.

Legislative Lobbying Claims Cause P2E Coins to Plummet

The domestic P2E-related industry has suffered the greatest damage due to these allegations. Among them, WEMIX, a leading domestic P2E-related virtual asset, and its issuer Wemade have become the center of various suspicions. The fact that Representative Kim held a large amount of WEMIX sparked claims that Wemade might have used virtual assets for legislative lobbying.

Wemade has denied the lobbying allegations. Jang Hyun-guk, CEO of Wemade, met with the People Power Party’s Coingate Investigation Team and stated, "I have never met Representative Kim," and argued, "It is practically impossible to use airdrops (free distributions) as a means to give coins to specific individuals."

According to data submitted by the National Assembly Secretariat to the National Assembly Steering Committee, executives and employees of Wemade and Wemade Entertainment visited the National Assembly 14 times during the 21st National Assembly. However, Representative Kim’s name was not found in the access records. The records included offices of Democratic Party members Kim Sung-joo, Kim Jong-min, Kim Han-gyu, Oh Ki-hyung, Independent Yang Jeong-sook, and People Power Party members Yoon Chang-hyun, Heo Eun-ah, and Jeong Hee-yong. Around November 24 last year, the Digital Asset Exchange Joint Council (DAXA) decided to terminate trading support (delisting) for WEMIX, and it is understood that meetings were requested to explain the circumstances. DAXA decided on delisting due to significant violations of circulation volume, inadequate or incorrect information provision, errors in submitted materials during the explanation period, and damage to credibility.

However, there are criticisms that relying solely on access records to clarify lobbying allegations has limitations. First, it is difficult to view National Assembly access as the only channel for legislative lobbying. Since these are simple access records, it is impossible to know whom they met in the offices, and other offices can be freely visited.

Legal disputes are also ongoing. Woo Jung-hyun, president of the Korea Game Society, targeted Wemade, claiming the essence of the coin incident is legislative lobbying for P2E legalization. He asserted, "Rumors have been rampant for years that P2E companies, associations, and groups have been lobbying the National Assembly." In response, Wemade filed a defamation complaint against Woo with the police on the 17th of last month. The WEMIX investor community 'WeHolder' also filed a complaint with the police against Woo for obstruction of business and requested the Ministry of Culture, Sports and Tourism to audit and supervise the Game Society.

The Seoul Southern District Prosecutors’ Office, investigating the coin holding controversy, raided Wemade’s headquarters and secured Representative Kim’s WEMIX transaction records. They are also looking into a case where about 20 WEMIX investors sued CEO Jang for fraud and fraudulent trading under the Capital Markets Act. These investors claim that Wemade caused significant losses by deliberately deceiving them with false information about circulation volume. They took issue with DAXA’s decision to delist WEMIX, arguing that more coins were circulated in the market than initially disclosed. Wemade filed an injunction against DAXA’s decision, but the court acknowledged the excess circulation. Some have even raised suspicions that the excess issued WEMIX was given to Representative Kim free of charge.

As allegations emerged that Representative Kim also held a large amount of Netmarble’s P2E-related virtual asset Mavrex, Netmarble moved to contain the situation. A Netmarble official stated, "We conducted a thorough internal investigation as requested by the People Power Party’s Investigation Team and confirmed that no internal information was provided."

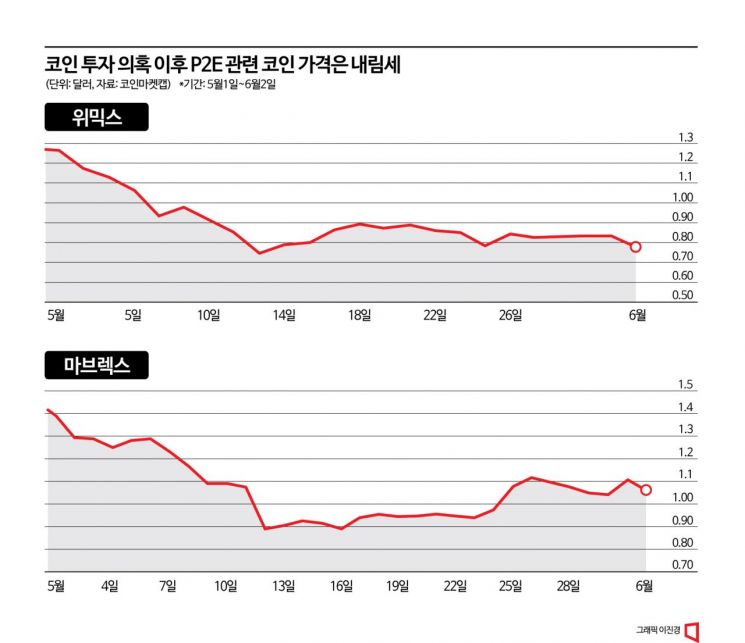

As various allegations surrounding P2E-related coins and issuing companies deepen conflicts, virtual asset prices are also showing weakness. According to CoinMarketCap, a global virtual asset market tracking site, WEMIX was traded at $1.26 (about 1,663 KRW) until early last month before the allegations surfaced, but as of the 2nd of this month, it plunged 38.10% to $0.78 (about 1,030 KRW). Mavrex also fell 23.74%, from $1.39 to $1.06 during the same period.

Virtual Asset Exchanges Also at the Center of Controversy

The incident has also spread to virtual asset exchanges. The People Power Party’s Coingate Investigation Team investigated Upbit and Bithumb over allegations of money laundering involving Representative Kim’s use of virtual assets. Representative Kim transferred approximately 855,000 WEMIX from Bithumb to Upbit wallets between January and February last year. Upbit reported the suspicious virtual asset movement to the Financial Intelligence Unit (FIU), which then notified the prosecution.

Controversy arose during the exchange investigation. The Coingate Investigation Team said in a media briefing after a status report from Lee Seok-woo, CEO of Dunamu, which operates Upbit, that "Upbit responded that from a general and expert perspective, Representative Kim’s transactions via ClaySwap are highly suspicious for money laundering and appear abnormal." ClaySwap is an exchange service on the Klaytn blockchain by Ground X, a Kakao Group affiliate, allowing the trading of specific virtual assets for others. However, Upbit denied making such statements. Upbit explained, "Dunamu has not explicitly mentioned any specific individual and only explained general cases."

Lee Jae-won, CEO of Bithumb, expressed confusion over why Bithumb was accused of not reporting suspicious transactions to the FIU at the time. However, it is known that Bithumb did not report to the FIU then.

These exchanges are also under prosecution investigation. Prosecutors raided Upbit, Bithumb, and Coinone?which decided to relist WEMIX?securing related materials regarding allegations of manipulating WEMIX circulation volume and causing investor losses.

"Negative Impact on Perception"... Expectations for Improvement through Self-Regulation

Industry insiders acknowledge that this incident clearly harms the perception of the virtual asset market. An industry official said, "With stories about money laundering and other issues, the perception of virtual assets is not good," adding, "Since virtual assets are a key medium in these allegations, it is natural that the negative image grows."

However, they believe that perception improvement is possible only if the industry itself shows changed behavior. DAXA has released standard internal control guidelines and a code of ethical conduct for virtual asset service providers. This is the first case reflecting the characteristics of the virtual asset industry and has undergone review by member companies and advisory committees.

The standard internal control guidelines consist of 68 articles covering governance, internal control organizations and standards, and compliance requirements during business operations for virtual asset service providers. The code of ethical conduct includes 24 articles on ethics toward customers, employee work ethics, corporate management ethics, and social ethics.

Acceleration of Virtual Asset-Related Legislation

Moreover, the allegations have accelerated the pace of virtual asset-related legislation enacted or planned by the National Assembly, which is expected to help improve public perception. The National Assembly’s Political Affairs Committee has passed the first phase of legislation, the "Act on the Protection of Virtual Asset Users." This law consolidates and coordinates 19 related bills previously proposed.

The bill regulates matters to protect virtual asset users’ assets, including ▲deposit and trust of customer deposits ▲separate custody of users’ virtual assets ▲custody of the same type and quantity of customer virtual assets ▲insurance, mutual aid subscription, or reserve fund accumulation to prepare for hacking or system failures ▲creation and storage of virtual asset transaction records.

It defines insider trading, market manipulation, and unfair trading as unfair trade practices and imposes criminal penalties and liability for damages for violations. It also prohibits arbitrary blocking of virtual asset deposits and withdrawals and mandates monitoring of suspicious transactions. Class action lawsuits are allowed. For supervision and sanctions, the Financial Services Commission can impose fines and delegate all or part of its duties to the Financial Supervisory Service president by presidential decree.

Political Affairs Committee Plans Second Phase Legislation Following First Phase

The Political Affairs Committee plans to proceed with second-phase legislation to supplement market order regulations such as virtual asset issuance and disclosure in line with international standards. Lee Jung-doo, senior researcher at the Korea Institute of Finance, emphasized in a report, "A systematic unfair trade monitoring plan is needed for cases where the same virtual asset is traded on multiple exchanges," and "Legal grounds for information sharing and mutual cooperation to establish an international cooperation system for regulating market manipulation and insider trading should be supplemented, and soft norms such as memorandums of understanding (MOUs) between countries should also be considered."

He further noted the need to set reasonable regulatory levels regarding issuer requirements, disclosure obligations, and responsibility scope through white papers, and to build a regulatory system that can actively utilize private sector expertise and resources with flexible regulatory design and operation. Professor Hwang Seok-jin of Dongguk University’s Graduate School of International Information Security suggested, "If the Act on the Protection of Virtual Asset Users and DAXA’s self-regulation improve soundness and transparency, the virtual asset market can establish itself as a place for investment rather than speculation," adding, "The most important aspect within legislation and self-regulation is investor protection policy, and it is desirable to include ESG (environment, social, governance) issues demanded by society."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)