ADC Developer Synapix Acquired for 160 Million Euros

Lonza, Global No.1 CDMO Company

Also Holds 50% ADC Market Share

Concerns Raised Over Need for Early-Stage Development Investment

Will Acquisition of Synapix Resolve This?

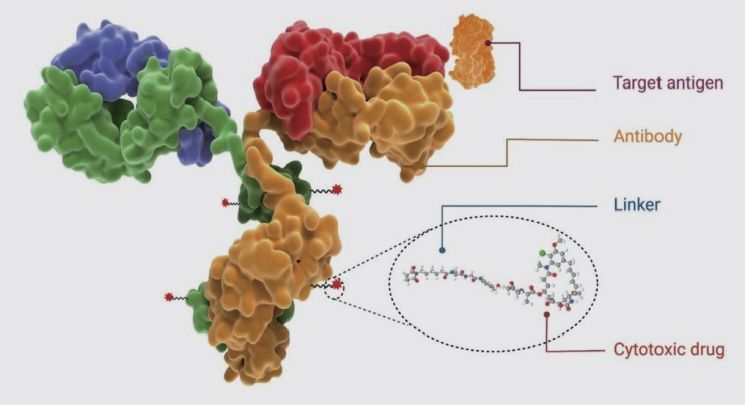

The technology called 'antibody-drug conjugate (ADC)', which injects poison only into cancer cells like a guided missile to eliminate them, is heating up the global pharmaceutical and bio industries day by day. Especially since considerable technological capability is required for contract development and manufacturing organization (CDMO) as well, competition is intensifying in the CDMO industry, with companies directly acquiring ADC developers.

Lonza announced on the 1st (local time) that it has acquired Synaffix, a Dutch biotechnology company, to strengthen its ADC product portfolio. The acquisition amount is a total of 160 million euros (approximately 226.3 billion KRW), including milestones. It will initially pay 100 million euros (approximately 141.5 billion KRW) in cash and an additional 60 million euros (approximately 84.9 billion KRW) depending on future performance.

Lonza, a CDMO company that recorded the highest global sales last year with a 20.7% global market share, will further enhance its ADC-related capabilities through this acquisition. Lonza has already entered the ADC CDMO market since the late 2000s and produced about half of the global ADC production as of last year, but it was also evaluated that it needs to secure promising ADC candidates from an earlier stage and prepare for production. Ji-Hyun Park, partner of EY Consulting’s Health Sector, pointed out in a lecture at Bio Korea last month, "Lonza faces competition from companies like WuXi Biologics, which provide end-to-end services, due to limited investment in the early development stages of ADCs," adding, "To build a future market position, it must focus on both clinical and commercial capabilities."

However, this acquisition has enabled Lonza to resolve such challenges at once. Synaffix is a company gaining attention by recently signing contracts related to ADC platforms with major global pharmaceutical companies. Since the beginning of the year, it signed a contract worth up to 2 billion dollars (approximately 2.642 trillion KRW), including milestones, with Amgen, a big pharma company that had not properly established an ADC pipeline. It also secured a contract worth 150 million dollars (approximately 198.2 billion KRW) with Singapore-based biotech Hummingbird Bio, raising its profile recently. Additionally, Chong Kun Dang signed a contract worth 132 million dollars (approximately 174.4 billion KRW) with Synaffix for ADC technology adoption in February.

Synaffix possesses a platform composed of proprietary technologies such as GlycoConnect, HydraSpace, and toxSYN, which can enhance the efficacy of ADCs. It implements a site-specific conjugation method that attaches an exact number of drugs to precise locations on antibodies, allowing ADC application without antibody modification, unlike other technologies that require antibody alteration. Through this acquisition, Lonza plans to combine its development and manufacturing capabilities with Synaffix’s ADC technology platform to provide comprehensive services for ADCs.

Ulrich Osswald, Vice President of Licensing at Lonza, said, "Synaffix’s ADC technology is the gold standard for designing potential therapies at the clinical stage in areas with high unmet needs," adding, "This acquisition equips us with capabilities to support both clinical and commercial demands." Peter van de Sande, CEO of Synaffix, also stated, "By leveraging Lonza’s potential, we can accelerate technological innovation beyond cytotoxic ADCs to bio-conjugates," and "We look forward to closely collaborating with Lonza colleagues to continuously develop promising medicines for patients."

As the name suggests, ADCs are drugs that conjugate antibodies and drugs. By linking antibodies that bind to cancer antigens with cytotoxic drugs (payloads) that can kill cancer cells via linkers, they can effectively deliver toxins only to cancer cells like a missile, earning the nickname 'cruise missile' for cancer drug bombing and attracting attention as next-generation anticancer technology. As of last year, there are as many as 426 ADC pipelines under development, and the global ADC market is expected to grow rapidly at an average annual rate of 13%. Alongside this, competition among bio CDMO companies to dominate the contract development and manufacturing organization (CDMO) market, which is expected to grow in tandem, is intensifying. Especially since production capabilities for all parts including antibody, payload, and linker production must be secured, this industry requires top-level technological skills, and it is expected that 70-80% of production will be outsourced.

Domestic CDMO companies are also continuing attempts to secure ADC-related technologies. Samsung Biologics acquired shares in ADC developer Araris through the 'Samsung Life Science Fund' worth 150 billion KRW, jointly established with Samsung C&T last month. It also plans to operate its own ADC production facility by the first quarter of next year. Lotte Biologics plans to complete an ADC CDMO production facility at its Syracuse plant in the U.S. by 2025 and start production. Michael Hausleiden, head of Lotte Biologics’ U.S. branch, explained, "We are adding related capabilities," and "We have already started related investments worth 80 million dollars (approximately 105.6 billion KRW)." To secure technological capabilities, it also made an equity investment in ADC developer Pinobio in April.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)