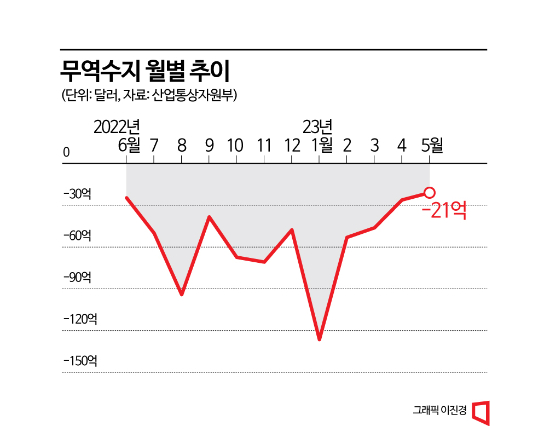

The trade deficit continued for the 15th consecutive month due to the prolonged slump in the semiconductor industry. However, the deficit narrowed for the fourth consecutive month since January as imports of the three major energy sources significantly decreased. Exports to China also recovered to $10 billion after two months, marking the highest average daily export level since October last year. However, with the likelihood of a prolonged global economic downturn until the second half of this year increasing, there are concerns that export recovery may be delayed due to a slowdown in trade volume.

According to the 'May Export-Import Trends' released by the Ministry of Trade, Industry and Energy on the 1st, the trade deficit last month was $2.1 billion. This was influenced by exports (provisional customs clearance basis) of $52.24 billion, down 15.2% year-on-year, and imports of $54.34 billion, down 14.0%. During this period, the number of working days was 21.5, 1.5 days fewer than the 23 days in the same period last year. Considering the number of working days, the average daily export amount was $2.43 billion, a decrease of 9.3%.

Semiconductor Drag Despite Automobile Resilience... Exports Decline for 8 Consecutive Months

Exports declined for the eighth consecutive month as the recovery of the semiconductor industry, Korea's largest export item, was delayed. Prices of major products such as DRAM and NAND fell sharply, causing semiconductor exports in May to decrease by 36.2%. In fact, the fixed price of DRAM dropped from $3.35 in June last year to $1.40 in May this year, and the fixed price of NAND fell from $4.81 to $3.82 during the same period. Additionally, the high base effect from last year's record-high May exports ($11.54 billion) also contributed to the decline.

The outlook is that a quick turnaround in the semiconductor industry is unlikely. The government expects the industry to improve in the second half of the year due to effects such as memory semiconductor production cuts and inventory depletion. However, experts analyze that considering the lag between wafer input and production, it will take at least three more months for the full effect of production cuts to materialize. Although Samsung Electronics and SK Hynix are currently cutting production, the demand slump is causing inventories to increase further, creating a vicious cycle that makes it difficult to guarantee the effect of production cuts in the second half. The growing inventory burden leads to further price declines.

During the same period, exports of petroleum products (-33.2%) and petrochemicals (-26.3%), including semiconductors, also decreased. Although items such as automobiles (49.4%), general machinery (1.6%), and cathode materials (17.3%) somewhat supported exports, it was insufficient. Notably, total computer exports fell by 57.5% due to weakened demand for consumer products (PCs and laptops), sluggish server investment, and poor SSD (solid-state drive) exports.

Fortunately, imports of the three major energy sources decreased by 20.6%, reducing the trade deficit. Due to the continuous decline in oil prices, imports of crude oil (-16.2%), gas (-20.2%), and coal (-35.1%) all decreased in May. Consequently, Korea's import volume also dropped from -2.8% in January to -14.0% in May. Although the scale of energy imports has been gradually decreasing monthly since December last year, the problem remains that it is still $2.7 billion higher than the average of the past 10 years, making it premature to be optimistic about a trade surplus turnaround.

Export Conditions Worsen for ASEAN Following China

Export declines in major ASEAN regions, including China, are also negative factors. Although exports to China recovered to the $10 billion level in May after March ($10.4 billion), exports to China decreased by 20.8% due to continued declines in major items such as semiconductors, petrochemicals, and wireless communications. China's global imports and exports are also deteriorating. According to China's General Administration of Customs, from the 1st to the 25th of this month, China's semiconductor exports fell by 34.0%, petrochemicals by 23.6%, wireless communications by 20.7%, and steel by 13.9%, showing a downward trend in major items.

The trade outlook with Vietnam, the largest trade partner within ASEAN, is also not bright. Although major items such as automobiles (27.5%), general machinery (20.8%), and steel (49.5%) increased due to demand for Korean cars and expanded infrastructure investment, total exports decreased by 2.6% due to fewer working days. Furthermore, Vietnam's global exports have also been gradually declining this year. According to the World Trade Organization (WTO), Vietnam's exports decreased from -15.8% in December last year to -16.2% in April this year, and imports shrank from -14.0% to -23.1% during the same period, indicating a contracting economy.

With increasing downward pressure on the global economic recovery, South Korea's economic growth forecast for the second half of the year is also being revised downward. The Korea Institute for Industrial Economics and Trade, a government research institute, lowered South Korea's economic growth forecast from 1.9% to 1.4%. This represents a 0.5 percentage point reduction in just six months. The delay in export recovery due to the global economic downturn and trade volume slowdown is the main cause. Although exports are increasing in areas such as electric vehicles and secondary batteries, exports are expected to decline by 9.1% this year due to last year's base effect, semiconductor recession, and decreased exports to China. China's sluggish economic recovery is also a drag. The effect of China's reopening has been less than expected, and the impact of semiconductor export declines on the Korean economy is greater than anticipated, suggesting that export and manufacturing recovery may be further delayed.

Nevertheless, the government expects the trade balance to turn positive as early as September this year. Jang Young-jin, the first vice minister of the Ministry of Trade, Industry and Energy, said at a meeting with reporters last month, "The size of the trade deficit has been continuously decreasing monthly this year," adding, "We expect to ease public concerns in the second half of the year." In fact, the trade deficit has been shrinking for four consecutive months, from $12.51 billion in January to $5.27 billion in February, $4.62 billion in March, $2.62 billion in April, and $2.1 billion in May. The cumulative trade deficit through May this year is $27.346 billion. The government stated, "To overcome the export crisis and improve the trade balance, we have been implementing the 'National Advanced Industry Development Strategy,' increasing tax credit rates for national strategic technology investments, and conducting sales diplomacy." It added, "We plan to hold the third inter-ministerial export status inspection meeting and digital trade roundtable in June to achieve a trade surplus turnaround as soon as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.