OECD 'Sovereign Debt Outlook 2023'

South Korea's Net Borrowing Requirement at -0.7% of GDP

Sharp Decline from 5.9% in 2021 over Two Years

Debt Pressure Ranks 4th Lowest Among Member Countries

This year, there is a forecast that the South Korean government will not need to borrow money to cover its budget shortfall. This is attributed to the lesser impact of the Russia-Ukraine war compared to European countries, as well as the debt pressure reduction due to the Yoon Seok-yeol administration's sound fiscal policy.

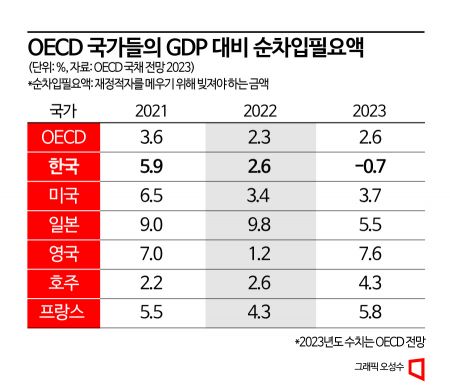

According to the OECD's 'Government Debt Outlook 2023' released on the 30th, South Korea's Net Borrowing Requirement (NBR) relative to its Gross Domestic Product (GDP) is projected to be -0.7%. The Net Borrowing Requirement refers to the amount of money a country needs to borrow to cover its budget deficit. If the NBR is 10% of GDP, it means the country must borrow an amount equivalent to 10% of its GDP to finance the budget. A negative figure indicates that the government either has lower expenditures or the annual budget is not significantly short, meaning the government does not need to incur debt.

South Korea's NBR-to-GDP ratio is decreasing at the steepest rate. In 2021, this indicator was close to 5.9%, meaning South Korea borrowed an amount equivalent to 5.9% of its GDP to cover its budget shortfall that year. This was higher than the OECD average of 3.6% and ranked seventh highest among member countries. However, last year, South Korea's ratio dropped to 2.6%, a reduction of more than half, and this year it is expected to turn negative.

-0.7% is the fourth lowest among the 38 OECD countries. The country projected to have the lowest NBR-to-GDP ratio was Sweden at -1.6%, followed by Denmark (-1.5%) and Costa Rica (-1.2%). However, all these countries are expected to experience a slight increase in debt pressure compared to the previous year. Among countries expected to see a decrease in debt pressure from the previous year, South Korea showed the largest reduction.

Impact of Yoon Administration's Sound Fiscal Policy... Uncertain Tax Revenue Conditions Pose Challenges

OECD countries, on average, used debt equivalent to 3.6% of their GDP to finance budgets in 2021, but this decreased by 1.3 percentage points to 2.3% last year. This decline is due to the pandemic phase entering a recovery stage as new COVID-19 cases decreased, reducing government spending on epidemic support. The faster-than-expected recovery in tax revenue conditions also contributed. However, this year, energy prices have risen due to the Russia-Ukraine war, and major countries have expanded fiscal support to protect households and businesses, causing the ratio to rise again to 2.6%.

The OECD explained, "Among the 12 countries expected to see an increase of more than 0.5 percentage points in NBR-to-GDP over the past two years, 10 are European countries," adding, "This reflects fiscal support measures implemented to protect households and businesses from food inflation and rising energy prices." It further analyzed that "the NBR-to-GDP ratios of these 12 countries will be more than twice as high as before the COVID-19 pandemic."

The positive evaluation of South Korea's situation by the OECD is grounded in the Yoon administration's sound fiscal policy. According to the OECD, changes in the NBR are mostly related to each country's fiscal support policies. In 2021, under former President Moon Jae-in, the government injected massive budgets to overcome COVID-19 and implemented various support policies. However, under the Yoon administration, efforts are underway to reduce the excessive spending that increased during the pandemic, including pushing for the legislation of fiscal rules.

However, uncertain tax revenue conditions remain a hurdle for South Korea. The government collected 87.1 trillion won in national taxes in the first quarter, which is 24 trillion won less than the previous year. There are concerns that tax revenue could fall short by as much as 30 trillion won by the end of the year. Consequently, some speculate that the Ministry of Economy and Finance may engage in 'budget non-use' or carry over already allocated budgets to the next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.